Like Joby Aviation? You’ll Love This eVTOL Growth Stock and ETF - The Next Crypto-Level Breakout?

Forget traditional aerospace—the real vertical lift action's happening in digital assets. While eVTOL stocks grab headlines, crypto's delivering the kind of parabolic moves that make aviation gains look like taxiway traffic.

Sky-High Returns Without the Regulatory Turbulence

Crypto's bypassing years of FAA paperwork and delivering 3x returns while traditional aerospace still waits for clearance. Blockchain protocols are cutting out middlemen faster than eVTOLs bypass traffic.

The Infrastructure Play Wall Street Missed

Smart money's not betting on flying cars—it's betting on the digital infrastructure that'll power everything from drone payments to AI trading algorithms. Crypto's building the financial stack while legacy finance still debates runway lengths.

Because sometimes the best way to escape gridlock isn't going vertical—it's going digital. Just don't tell the SEC we're moving faster than their approval process.

Image source: Getty Images.

Things have heated up this summer for Joby Aviation

While Joby Aviation is still waiting for the final certifications from the FAA to start ferrying passengers back and forth with its electric air taxi service, it doesn't mean the company is sitting idle. Over the past couple of months, Joby has reported some notable news indicating that the company is working hard to hit the ground running when it receives the requisite FAA certification, making it an eVTOL stock that demands to be on the radar of any investor interested in gaining exposure to the nascent industry.

Most recently, Joby notched an aviation industry first when it completed an eVTOL flight between two U.S. public airports: Marina and Monterey, both of which are in California. Management lauded the accomplishment "a major step as part of Joby's commercial market readiness, highlighting key capabilities across safety, operations, air traffic control, and certification progress."

But there are even bigger developments that the upstart eVTOL company reported this summer. For one, Joby announced its plan to acquire the urban air mobility business of. When the transaction closes (presumably in the next few weeks), Joby will gain immediate market access to infrastructure assets, as well as urban corridors in New York City and Southern Europe.

Diversifying beyond the civilian market, Joby announced a partnership withto collaborate on developing hybrid eVTOL aircraft suited for defense applications. Should the partnership with L3Harris, a leading defense contractor, bring a defense aircraft to fruition, it will help Joby diversify its revenue base and mitigate the risk associated with the company's air taxi business.

For investors looking to land an eVTOL stock in their portfolios, Joby is a consideration they can't afford to ignore.

An interesting eVTOL stock you probably haven't heard of

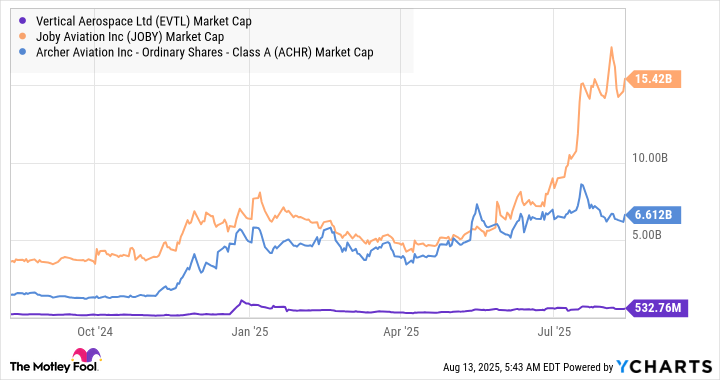

As you can see in the chart, the British eVTOL company's market cap is a mere fraction of its U.S. peers' market cap.

EVTL Market Cap data by YCharts

Part of it comes down to Vertical Aerospace's short financial runway. According to CEO Stuart Simpson, "Our cash runway takes us into the middle of 2026 with our cash and cash equivalents as of today, approximately $139 million."

Another part of it is possibly the different regulatory path followed by Vertical Aerospace. The company is seeking certification for its aircraft with the U.K.'s Civil Aviation Authority and the European Union Aviation Safety Agency. After this, it will work on certification with the FAA and other regulators worldwide.

However, the good news is that the current capital position will enable the company to "begin the assembly of our next aircraft, our pre-production or certification aircraft, and continue to expand our certification aircraft supply chain." Vertical recently completed the first public-to-airport eVTOL flight by a commercially planned vehicle. It also has 1,500 preorders in place for its aircraft, including fromand.

Vertical Aerospace will require capital to complete its aims, and there are no guarantees it will. Still, it offers an interesting option for investors looking to diversify eVTOL holdings, and potentially more upside due to its low valuation.

Shoot for the stars with this high-octane ETF

The Ark Space Exploration & Innovation ETF has been on a tear -- up 36.2% year to date and 78% over the last year. According to Ark Invest's overview of the ETF: "The advisor defines 'Space Exploration' as leading, enabling, or benefiting from technologically enabled products and/or services that occur beyond the surface of the Earth, including autonomous mobility, intelligent devices, advanced battery technologies, 3D printing, reusable rockets, adaptive robotics, and neural networks."

The fund addresses the space theme across industries -- through growth-focused companies as well as legacy industrial companies like L3Harris,, and. And like other Ark funds, the ETF is not remotely market-cap-weighted -- meaning that the highest-weighted holdings will be the fund managers' top picks rather than the most valuable companies. The fund's largest holding ---- only has a market cap of $11.5 billion compared to $420.3 billion for fifth-place.

Vertical take-off and landing plays into the "space theme," withJoby Aviation, and Blade Air Mobility combining for 11.2% of the ETF. The ETF has many recognizable names, but also some companies you may have never heard of -- like unmanned aircraft system makerand satellite giant-- the third- and fourth-largest holdings by weighting. Again, since the fund isn't market-cap weighted, it can put more conviction in these companies and still have small pieces of megacap growth companies. The fund holdsand, but they only make up 2.7% and 1.7% of the fund, respectively.

The Ark Space Exploration & Innovation ETF sports a relatively high expense ratio at 0.75% -- which is far higher than the expense ratios investors may be used to from passive funds. The key difference is that the Ark Space Exploration & Innovation ETF is actively managed and very nuanced. The higher expense ratio is the fee for the active management, but it has certainly been worth it, given the fund's epic gains.

All told, the Ark Space Exploration & Innovation ETF could be a good pick for investors who are interested in "space" outside just eVTOL.