2 Dividend Stocks to Double Up on Right Now: Your Portfolio’s Lifeline in 2025’s Chaos

Forget chasing memes—real wealth gets built on cold, hard cash flow. While crypto swings 40% before breakfast, dividend aristocrats keep printing checks. Two names stand out not just for yield, but for survival DNA in this economic circus.

Cash Machines Beating Inflation

These picks don’t just pay—they grow payouts faster than the Fed prints. We’re talking 5%+ yields with hike histories that shame bond markets. They’re boring. They’re beautiful. And they’re crushing it while tech burns.

Defensive Plays That Actually Defend

One dominates infrastructure nobody quits using—ever. The other owns real assets that appreciate during monetary debasement. Their financials? Fortresses. Debt? Managed like a Swiss watch. Unlike some *cough* crypto projects that vanish with your funds.

Execution Over Hype

No NFT partnerships. No metaverse pivots. Just operational excellence that fuels dividend growth for decades. They’re the anti-thesis to finance bros chasing shiny objects—and they’ll retire you while those guys bag-hop.

Because sometimes the smartest trade is ignoring the circus and owning the tent.

Image source: Getty Images.

1. PepsiCo stock is bubbly

's (PEP -0.47%) dividend yield looks tempting at above 3.5% today. Sure, that high yield is partly thanks to the stock underperforming the market over the past two years. Wall Street pros are disappointed with the consumer staples giant's 1.7% organic sales growth so far in 2025, compared to 2024's 2% uptick. Management is expecting earnings to be flat this year, too, as the company works to pass along higher costs in an era of slow demand growth.

Yet there's plenty to like about this investing story. Pepsi is highly profitable with an operating margin sitting at 18% of sales. The company is on track to return nearly $9 billion to shareholders this year, mainly through dividend payments. And the 5% dividend hike the company announced for 2025 was its 53rd consecutive annual raise, meaning it's a Dividend King. As for speeding growth back up, Pepsi is busy reshaping its portfolio to capitalize on demand for more health-focused drinks and snacks. It recently closed a $2 billion purchase of the Poppi prebiotic soda brand.

You can own the stock for 2.2 times sales, compared to the 3 times sales (price-to sales valuation) that investors were paying for Pepsi in 2023. That discount should pave the way for better returns from here, even if it takes time for the company to accelerate organic sales gains back up toward the 10% spike that shareholders enjoyed in 2023.

2. McDonald's looks tasty

In early August,(MCD -0.13%) had some good news for investors to celebrate in its Q2 earnings report. The restaurant company returned to comparable-store sales growth as gains hit 4% compared to the prior quarter's slight decline. Management credited its focus on value along with aggressive spending in areas like mobile ordering and delivery. "Our technology investments and ability to scale digital solutions at speed will continue to elevate the McDonald's experience," CEO Chris Kempczinski said .

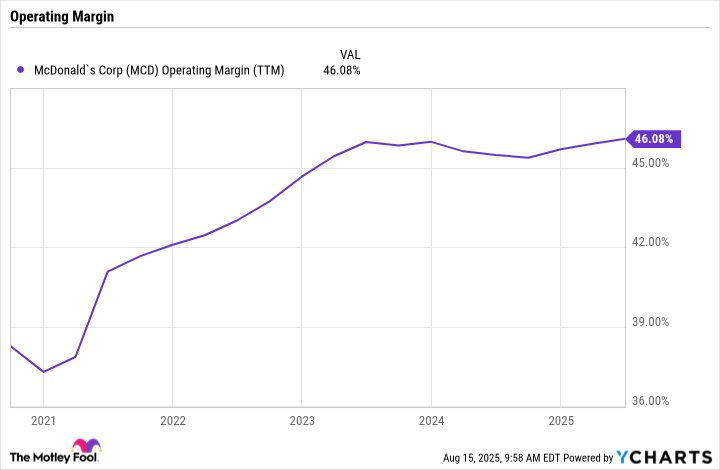

Those investments aren't harming profitability, either. McDonald's posted 5% higher Q2 earnings and ample free cash flow. The chain's operating margin continues to climb toward 50% of sales.

MCD Operating Margin (TTM) data by YCharts

Shareholders will want to see more improvements in growth trends in the second half of 2025. I'll be watching for McDonald's to return to customer traffic gains, too, so it doesn't have to rely so much on higher average spending in its restaurants or on the digital selling channel.

In any case, this 2.6%-yielding dividend stock has a good shot at boosting your portfolio returns from here, given its sluggish performance so far in 2025. Investors are clearly more interested in tech stocks right now, and that's creating an opportunity for income investors to pick up shares of high-performing companies like McDonald's and PepsiCo, securing many years of rising dividend payments in the process.