Dogecoin’s 5-Year Forecast: Meme Coin Evolution or Speculative Implosion?

From internet joke to billion-dollar asset—Dogecoin defies conventional wisdom while testing crypto's outer limits.

Market Trajectory: Beyond the Hype Cycle

Dogecoin's five-year outlook hinges on adoption catalysts versus meme fatigue. Mainstream payment integration could propel DOGE past current resistance levels, while regulatory headwinds might trigger consolidation phases. The coin's inflationary supply model creates perpetual sell pressure that even Elon Musk's tweets struggle to overcome.

Technology Stack: More Than Just a Shiba Inu

Layer-2 solutions and cross-chain bridges are quietly upgrading Dogecoin's utility beyond tip-jar status. Development activity—though often overshadowed by price speculation—focuses on transaction speed improvements and smart contract compatibility. These upgrades position DOGE as potential middleware in the social token ecosystem.

Investor Sentiment: Retail Army Versus Institutional Skepticism

Retail traders continue treating Dogecoin as a lottery ticket while traditional finance dismisses it as unserious—proving once again that Wall Street's arrogance blinds them to grassroots momentum. The community's persistence suggests either cult-like devotion or brilliant collective delusion.

Five years out, Dogecoin either becomes PayPal's quirky sidekick or serves as another cautionary tale about investing based on memes—because nothing says financial sophistication like betting your retirement on a cryptocurrency named after misspelled dog.

Image source: Getty Images.

The fundamentals (or lack thereof)

Launched in 2013, dogecoin is one of the oldest cryptocurrencies, and it's notable for being the first meme coin. Software engineers Billy Markus and Jackson Palmer wanted to poke fun at the lofty ambitions of other cryptocurrencies and decided to make their own. The doge meme was popular at the time, so they used that as the name and the logo.

There's nothing remarkable about Dogecoin as a cryptocurrency. Transactions are affordable, with fees normally costing less than $0.10, but plenty of other cryptocurrencies have sub-$0.01 transaction fees. Transaction processing times are about five to 10 minutes, and Dogecoin's blockchain can manage about 30 transactions per second. Not bad for its time, but newer cryptocurrencies handle much higher workloads and settle transactions in a matter of seconds.

Dogecoin's purpose was never to be the fastest cryptocurrency or find new uses for blockchain technology. Its aim was to be amusing. There's nothing wrong with that, but it means Dogecoin doesn't have any competitive advantages that make it stand out in a crowded crypto market.

To its credit, Dogecoin has done well at building a following. One of its backers, in particular, has been instrumental in its rise up the crypto charts.

Elon Musk's impact on Dogecoin

(TSLA 1.42%) Chief Executive Officer Elon Musk is a longtime fan of Dogecoin. He first talked about it in 2019, writing on X (formerly Twitter) that Dogecoin might be his favorite cryptocurrency.

Musk has also played a role in the meme coin's biggest moments. The price went up several times in 2020 and 2021 after tweets by Musk, and Dogecoin's all-time high coincided with Musk's appearance on Saturday Night Live. Dogecoin's bull run last year happened right after Donald TRUMP won the presidential election, and made Musk the head of the new Department of Government Efficiency (DOGE), although there was no connection between the crypto and the agency.

It's not a good sign that a single person has such an outsized impact on Dogecoin's price. It reinforces that there's no fundamental basis for this crypto's previous price appreciation.

Also worth mentioning is that those previous moments of success have been brief. After reaching its all-time high of $0.74 on May 8, 2021, Dogecoin lost 70% of its value in less than two weeks. It hit a peak of $0.48 last year on Dec. 8, and while it held on longer this time, it still declined by more than 60% during the next three months.

Dogecoin's best days may be behind it

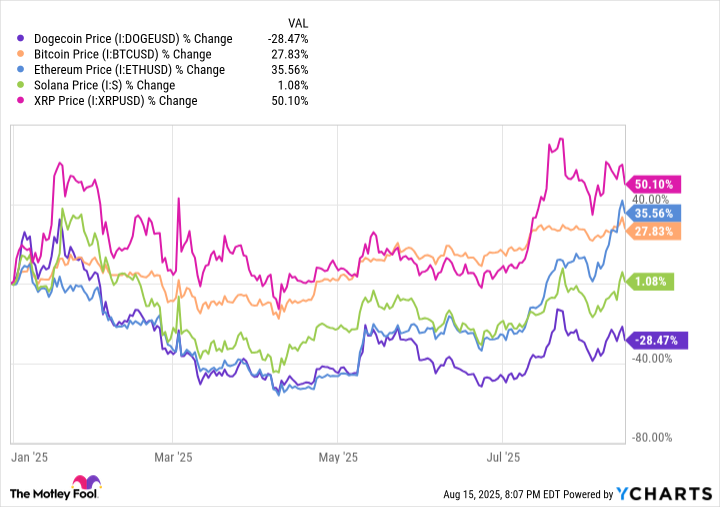

Dogecoin has underperformed lately, losing more than 28% of its value on the year (as of Aug. 16). That's even more concerning when you consider that many cryptocurrencies have been on a tear.

The chart shows how Dogecoin's performance compares to four other top cryptocurrencies:,,, and.

Dogecoin Price data by YCharts

It hasn't been all bad. Dogecoin is still worth more than twice as much as it was a year ago. In addition, most economists are expecting the Federal Reserve to cut interest rates multiple times before the end of the year. Lower interest rates normally drive more investment in cryptocurrency, which could be beneficial for Dogecoin.

But there's nothing to suggest Dogecoin is a good long-term investment. It's only worth buying if you like the idea of owning a meme coin, and only with money you can afford to lose. My personal prediction is that Dogecoin loses about 50% of its value during the next five years as investors flock to more useful crypto investments.