Why I’m Still Loading Up on These 2 High-Yield ETFs for Passive Income in 2025

Wall Street's dividend darlings are getting a crypto-era makeover.

Forget grandma's bonds—these ETFs are printing yield while traditional finance snoozes.

The Contenders

Two funds quietly compounding returns as banks still charge 0.5% 'high-yield' savings accounts (with three asterisks).

Yield or Die

Passive income strategies aren't passive when you're fighting 6% inflation. These picks actually keep pace—unlike your financial advisor's 60/40 portfolio.

The Bottom Line

While hedge funds chase AI hype, smart money's collecting real cash flow. Just don't tell the suits—they might realize ETFs are eating their lunch.

Image source: Getty Images.

The top 100 dividend stocks in one fund

Investing in high-quality, high-yielding dividend stocks is a central component of my passive income strategy. I seek companies with steadily growing dividends and above-average yields backed by strong financials. These provide me with sustainable and steadily rising passive dividend income.

The Schwab U.S. Dividend Equity ETF helps complement my portfolio by passively providing me with greater access to the top high-yielding dividend stocks. The fund tracks the, which measures the returns of 100 top dividend stocks. The index screens for companies based on four dividend quality characteristics:

- Cash flow to total debt.

- Return on equity.

- Dividend yield.

- Five-year dividend growth rate.

As of the index's annual reconstitution last March, its holdings averaged a 3.8% yield and 8.4% annualized dividend growth over five years. Strong financials support their growing payouts, positioning these companies to continue raising their dividend payments.

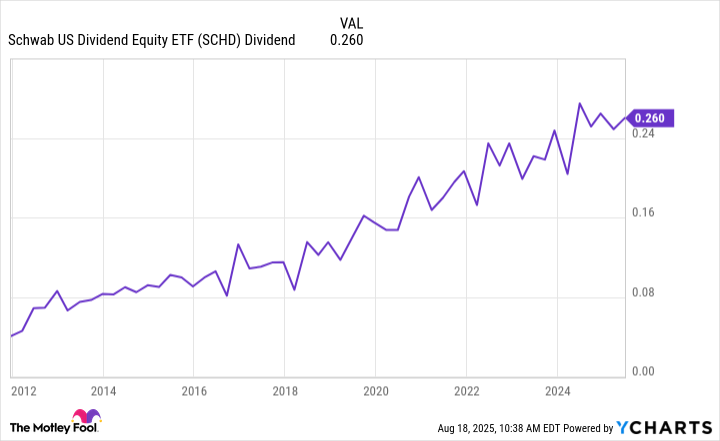

This fund's commitment to high-quality, high-yielding dividend growth stocks has consistently rewarded investors. Year after year, it has distributed increasing amounts of cash, demonstrating its ability to generate growing passive income.

SCHD Dividend data by YCharts.

Today, the fund offers a compelling 3.9% yield -- significantly higher than the's current 1.2% yield. This attractive starting yield, coupled with its reliable growth potential, gives me every reason to continue buying more shares of this top ETF.

A nice income option

I also utilize options to generate income, such as selling covered calls on stocks I own or cash-secured puts to possibly buy at a lower price. Options trading can be lucrative, but it is an active strategy. That's why I also hold ETFs, such as the JP Morgan Equity Premium Income ETF, to generate additional passive income from options. Over the last 12 months, it has had an income yield of 8.1%.

The JPMorgan Equity Premium Income ETF has a simple strategy for generating options income. It writes out-of-the-money (i.e., above the current market price) call options on the. As an options writer, the fund receives the options premium (the value of the option). It distributes these net payments to fund investors each month as the options expire. While this income fluctuates from month to month, it tends to be higher following periods of market volatility.

The fund also holds a defensive stock portfolio, providing it with upside exposure to the stock market. This has added to its total return. Since its inception in May 2020, the fund has delivered an average annualized return of 11.5%.

With this ETF's powerful income stream and additional return potential from capital appreciation, it perfectly aligns with my strategy for building lasting wealth while generating passive income.

Piling into these ETFs to pump up my passive income

The Schwab U.S. Dividend Equity ETF and JPMorgan Equity Premium Income ETF work well together as part of my income strategy. SCHD provides me with a passive stream of growing dividend income from leading U.S. companies, while JEPI generates lucrative income through its options strategy. This combination enables me to easily boost my income and diversify the ways I earn it, which motivates me to continue piling into these high-yielding ETFs as I have more cash to invest.