Nvidia Stock Before Aug. 27: What History Says About This Make-or-Break Moment

Nvidia’s stock is flashing a big signal—again. Will history repeat itself before August 27?

The AI Chipmaker’s Rollercoaster

Nvidia’s shares have been a battleground for bulls and bears all year. With August 27 looming, traders are scrambling for clues. Past performance isn’t a crystal ball, but it’s the only one Wall Street’s got.

The Date That Moves Markets

Key earnings? Product launch? Nvidia’s calendar has a habit of turning mundane dates into market earthquakes. August 27 is the next line in the sand.

Greed, Fear, and Silicon

When Nvidia sneezes, the tech sector catches a cold. This time? The stakes are higher—AI dominance hangs in the balance. Short-term traders see volatility; long-term holders see another dip to buy.

The Bottom Line

History suggests fireworks. Your broker ‘forgets’ to mention 90% of retail traders lose money on these setups. Will you be the exception?

How does Nvidia stock generally perform after earnings?

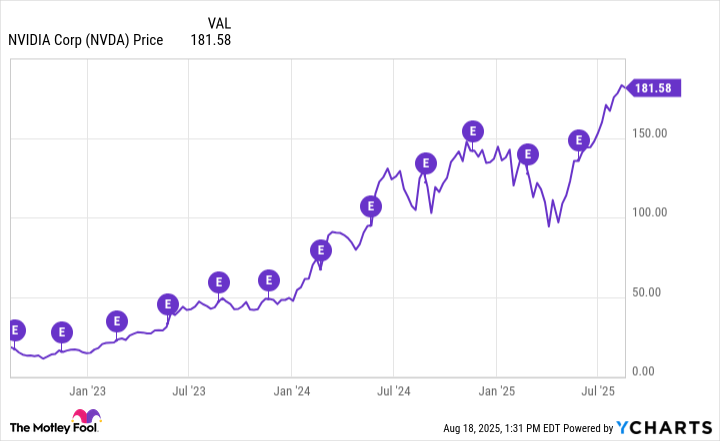

The chart below illustrates Nvidia's price action over the past three years, with purple "E" markers indicating earnings dates.

NVDA data by YCharts

With just one exception, every earnings release has been followed by a surge in buying activity, underscoring the market's unrelenting appetite for Nvidia stock.

The lone outlier came earlier this year, when concerns about competition from Chinese models -- namely DeepSeek -- combined with uncertainty over President Donald Trump's new tariff agenda cast doubt on Nvidia's outlook. These worries fueled a narrative of caution that briefly interrupted the company's otherwise robust momentum.

As recent trends make clear, however, those fears have largely faded -- replaced by new investor enthusiasm. The broader takeaway is undeniable: Nvidia has been a standout winner over the last few years, with its share price climbing in lockstep with the rise of AI.

Image source: Getty Images.

What should investors be listening for on Nvidia's earnings call?

During the AI boom, Nvidia's business has primarily been fueled by unprecedented demand for its graphics processing units (GPUs) and CUDA software system. Despite rising competition in the GPU landscape fromand the upcoming release of custom ASICs from, I still see a number of compelling catalysts that could fuel long-term growth for Nvidia.

Chip demand from hyperscalers

Earlier this year, investors learned thatandplan to significantly expand their AI capital expenditure (capex) budgets. Meta made a $14.3 billion investment in Scale AI, while also launching a new initiative, dubbed Meta Superintelligence Labs (MSL). Meanwhile, Alphabet continues to ramp up spending on servers and data center buildouts -- clear accelerating tailwinds for AI infrastructure. They are not alone, however.andalso maintain massive capex commitments, bringing the combined total among the four hyperscalers to an estimated $340 billion on AI infrastructure spending this year alone.

Sovereign AI

Shortly after President Trump's inauguration in January, leaders from, OpenAI, andgathered in the Oval Office to unveil Project Stargate -- a landmark $500 billion initiative to build out AI infrastructure in the United States. Countries across the Middle East -- such as the United Arab Emirates and Kingdom of Saudi Arabia -- have launched their own Stargate-style projects, each with massive funding commitments. Nvidia's industry-leading chipsets and data center expertise serve as the AI backbone to bring these efforts to life.

New life in China

For much of 2025, China has been Nvidia's biggest obstacle. A newly structured agreement with the U.S. government now allows Nvidia to reenter this critical market, with the company remitting 15% of its Chinese sales back to Washington. While the arrangement may appear costly upon first glance, Nvidia's superior pricing power in the chip market positions the company to absorb this expense with minimal impact on profit margins. Nvidia's ability to offset these fees ensures that doing business in China remains a net positive for shareholders.

Emerging applications

Beyond infrastructure, a new wave of opportunities is emerging as more advanced AI use cases take shape. For example,'s push to scale its robotaxi business -- and its decision to replace the in-house Dojo system with one powered by Nvidia -- underscores the company's critical role in more sophisticated applications such as autonomous vehicles. Meanwhile, Tesla and other developers are racing to commercialize AI-powered robotics applications -- a market that Nvidia CEO Jensen Huang thinks could be worth multiple trillions in the long run. Looking even further ahead, the rising momentum around quantum computing points to the need for next-generation hardware and software -- inspiring Nvidia to continue innovating in order to remain at the forefront of the next chapter of the AI story.

Is Nvidia stock a buy before Aug. 27?

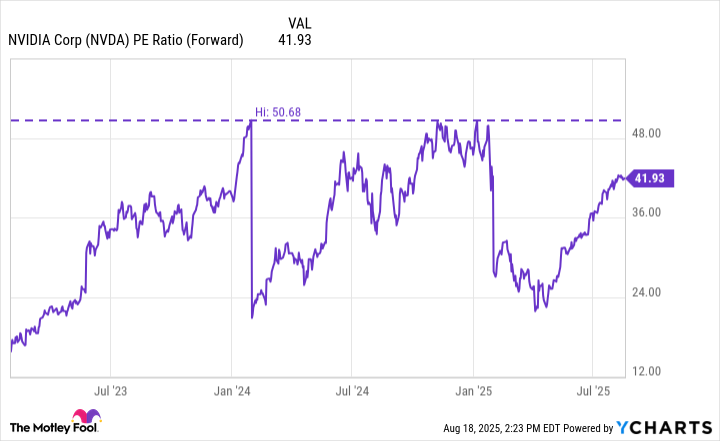

The chart below tracks Nvidia's forward price-to-earnings (P/E) multiple throughout the AI revolution. While the company's valuation has expanded recently, shares still trade at a discount compared to prior forward earnings peaks.

NVDA PE Ratio (Forward) data by YCharts

This suggests that much of the growth from the catalysts discussed above is not yet fully priced into Nvidia's stock price. In other words, there could be meaningful valuation upside ahead as these opportunities scale and contribute to Nvidia's growth.

While Nvidia's surge over the last three years has been generational, the company's long-term tailwinds give reason to believe that the rally is far from over.

For investors, the focus should not be on trying to time the perfect entry point. Instead, buying the stock at different price points over time -- a strategy known as dollar-cost averaging (DCA) -- remains an effective approach to building a position in one of the defining winners of the AI era.