BigBear.ai Stock Plunge: Genius Buying Opportunity or AI Hype Trap?

Another day, another tech stock getting mauled by the bears—this time, literally. BigBear.ai's shares just took a nosedive, and Wall Street's vultures are circling. But is this a fire sale or a flaming dumpster?

Decoding the AI bloodbath

The market's chewing up AI plays like they're yesterday's NFT projects. BigBear got caught in the crossfire despite its military contracts and supply chain tech. Typical market overreaction—or a sign the AI bubble's leaking air?

To dip or not to dip?

Fundamentals whisper 'maybe' while the chart screams 'danger.' Retail traders are piling in like it's a meme stock revival, but smart money's hedging bets. Remember: in tech, 'buying the dip' often means catching falling knives—just ask the metaverse bagholders.

Bottom line: This ain't your grandpa's value play. Either you believe in AI's battlefield dominance and supply chain sorcery, or you're just gambling with extra steps. Either way, maybe keep some dry powder for when the Fed stops playing whack-a-mole with inflation.

Image source: Getty Images.

BigBear.ai isn't growing revenue

BigBear.ai is focused on providing AI-powered solutions, primarily to the government, although it has other endeavors (like partnering with the United Arab Emirates) as well. If you look at, another government-focused AI company, you'll see its revenue is growing fast from both commercial and government clients, with commercial revenue rising 47% year over year and government revenue increasing even faster at 49%.

BigBear.ai is not seeing the same success. In Q1, revenue fell 18% year over year to $32.5 million. With the massive demand for AI products and several companies rapidly growing their revenue, this is an obvious red flag.

Perhaps even bigger news is that there was a disruption in its U.S. Army contract, which accounts for a large chunk of its revenue. This caused management to decrease its full-year revenue outlook, raising another red flag.

BigBear.ai is not looking like a true winner in the AI space right now, and the struggles it's experiencing make it fairly obvious that competitors are providing much better products. It's not too late for BigBear.ai to turn it around, but there are other issues investors should be aware of.

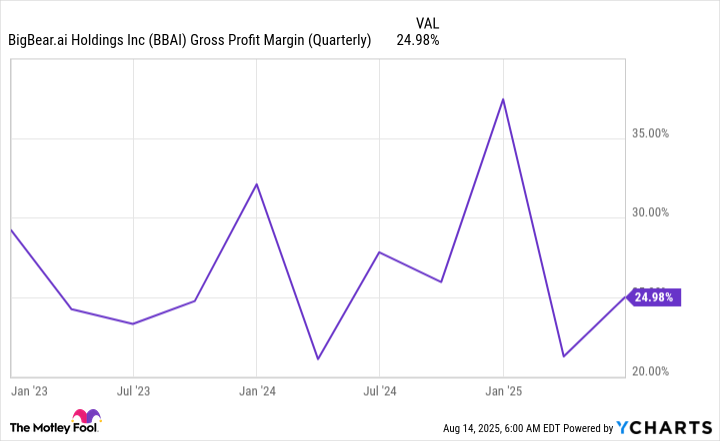

BigBear.ai's margins are low compared to its peers'

Most software companies produce gross margins in the 70% to 80% range, with the best even getting to 90%. However, despite being a software company, BigBear.ai is nowhere NEAR that level.

BBAI Gross Profit Margin (Quarterly) data by YCharts

The company has low gross profits because BigBear.ai isn't offering a standardized software; it's tailoring each product it delivers to its customers. This is quite expensive, and limits the potential net income it could generate someday if it turns profitable.

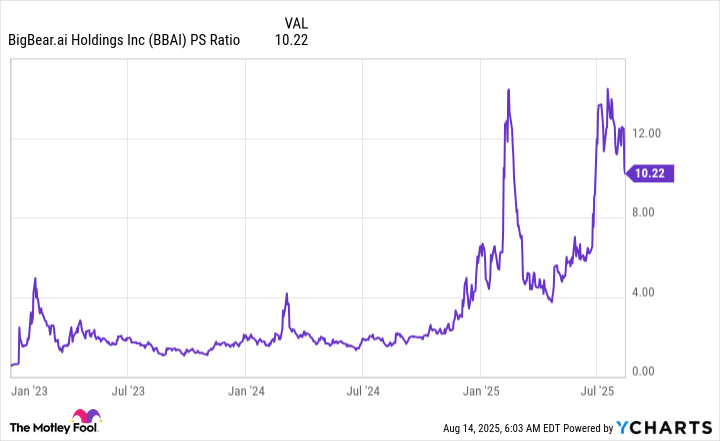

Additionally, due to its low gross margin, the rule of thumb that most software companies trade between 10 and 20 times sales is useless. That rule of thumb assumes that higher gross margins will lead to higher profit margins, thus the increased valuation levels. At 10 times sales, BigBear.ai can be considered a very expensive stock, even after the fall following earnings.

BBAI PS Ratio data by YCharts

BigBear.ai isn't a stock I'd recommend anyone invest in. It has falling revenue at a time when business is unlikely to improve, and it's seeing problems with its primary contract. The company's margin structure is poor, and the stock is already expensive. The bull case for BigBear.ai's stock is essentially that AI is a rising tide that will lift all ships. However, that's not happening with BigBear.ai, and there are far too many impressive AI companies to invest in right now for anyone to waste time with an underperformer.