The Top Dividend King Stock to Own in August 2025 – Time to Buy?

Dividend kings are the blue-chips that never quit—but which one’s primed to dominate your portfolio now?

Yield Hunters, Take Note

Forget meme stocks and crypto hype trains. These cash-flow titans have paid—and raised—dividends for 50+ years straight. The real question: Which one’s trading at a steal?

The Contenders

We’re talking bulletproof balance sheets, recession-proof demand, and management teams that treat shareholders like… well, kings. No NFT fluff here—just cold, hard compounding.

The Verdict

One stands out with a juicy yield and a P/E ratio that won’t make value investors vomit. (Take that, overpriced tech ‘moonshots’.) Time to rotate out of speculative garbage?

Image source: Getty Images.

Choosing the best Dividend King

If I had to choose one Dividend King to buy right now, there's no doubt that it's(KO 0.55%). The dominant brand in soft drinks has 30 separate brands worth at least $1 billion. While it's best-known for Coca-Cola and Sprite, the Atlanta-based company also sells bottled water, teas, coffees, juices, sports drinks, and alcoholic beverages.

Today, Coca-Cola products are sold in more than 200 countries and territories. But the company believes it has a tremendous opportunity in front of it. Coca-Cola estimates that 80% of the global population resides in developing and emerging markets -- and in those markets, Coca-Cola only enjoys a 7% market share.

The company reported $12.5 billion in revenue in the second quarter, up 1% from a year ago. Its earnings per share were $0.88, up 58% and restrained somewhat by an 11-point currency headwind.

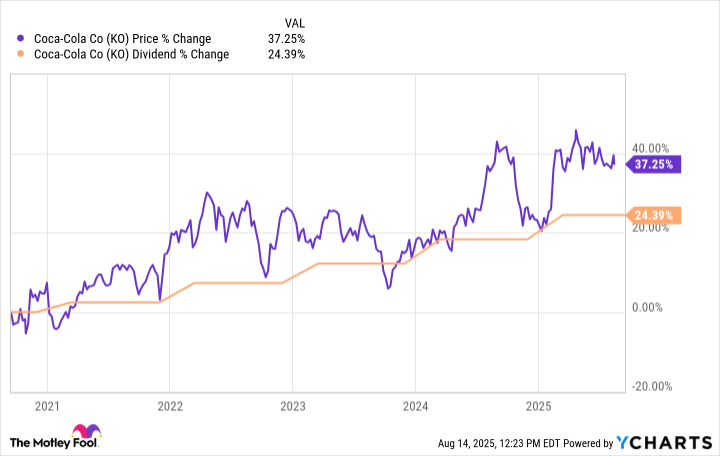

So far in 2025, Coca-Cola stock is up 12%, and it gained 37% in the last five years. While that's not as explosive as a tech stock, I also appreciate the fact that Coca-Cola's dividend has also increased more than 24% in the last five years. That kind of consistent dividend growth offsets the softer stock return, making this Dividend King even more appealing. Coca-Cola has increased its dividend for 63 consecutive years, and its dividend yield of 2.9% is a full percentage point higher than the yield of the average consumer staples stock.

Data by YCharts.

Coca-Cola is the dividend stock to own in a tariff-centric world

There are a lot of really good Dividend Kings that I considered --,,,,, and others. While these are solid companies, I'm also very aware that many of them have to confront the reality of tariffs. It makes importing goods more expensive and forces companies into the difficult decision to either absorb the cost (which eats into profit margins) or pass along the costs to customers (which means higher prices).

Coca-Cola isn't immune from tariffs, but its primary costs for commodities such as sugar, aluminum, and corn syrup can be more easily managed. Coca-Cola's reported gross margin of 62.4% was 133 basis points higher than a year ago, showing that the company is doing a solid job in managing its costs despite higher commodity prices. The company didn't even discuss tariff costs in its second-quarter earnings call, but it previously said that it expected the effect of trade tensions to be "manageable."

The bottom line

There's nothing guaranteed in investing, but when you put your money into a Dividend King, you are nearly assured of consistent returns. Coca-Cola has been raising its dividend for generations now, and it has a dominant position in its field with a huge opportunity for continued growth.

There's no question in my mind that it's the best Dividend King to own today.