Roku Stock Too Pricey? This One Chart Will Shock You.

Wall Street's sleeping on Roku—again. The streaming giant's metrics tell a different story than the naysayers screaming 'overvalued.' Here's why the bears might be blindsided.

The Growth Engine Wall Street Ignores

Active accounts? Up. Streaming hours? Rocketing. Ad revenue? Please—this isn't 2020's cord-cutting narrative anymore. Roku's playing chess while cable TV burns monopoly money.

The Cynic's Corner

Sure, analysts will downgrade it at $500 and upgrade at $50—classic buy-high-sell-low genius. Meanwhile, the platform keeps eating linear TV's lunch. Stay emotional, Wall Street.

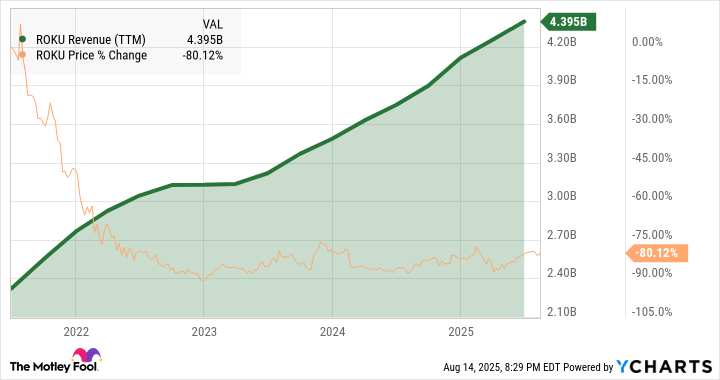

ROKU Revenue (TTM) data by YCharts

Roku's price slipped, but the growth engine didn't

Roku's stock fell 81% over the last four years. At the same time, the company's top-line sales surged 89% higher. That's an average annual revenue increase of 17.3%, while the stock fell 34% per year.

I'll admit that Roku started that period at an unsustainably high plateau, riding high on the streaming-friendly effects of COVID-19 lockdowns. The stock was overdue for a correction in the summer of 2021.

Image source: Getty Images.

The price drop went too far, though. If you separate Roku from the ups and downs of the 2020 pandemic and the 2022 inflation crisis, you see a healthy company with robust growth in all the right places.

You've seen the revenue surge already. Here, Roku's growth is faster than market darlings such as(NFLX 0.70%) and(META 0.38%). Yet, Netflix stock trades at 12.6 times sales, and Meta sports a price-to-sales ratio of 11. Roku is stuck with a meager 2.9 multiple in the same metric.

You should still measure Roku by its sales growth

I'm not saying that Roku should have a larger market value than Netflix or Meta. That's not the point. However, Roku's stock deserves a sales multiple in the same class, if not higher.

I have explored Roku's profit strategy and long-term market prospects in depth elsewhere, and this is not the place for another DEEP dive. Long story short, Roku's profit-based valuation doesn't tell the whole story. The stock looks deeply undervalued when you include its fundamental business growth in your analysis.