Cathie Wood Doubles Down on This Sleeper Defense Stock (Spoiler: It’s Still Not Palantir)

Cathie Wood's ARK just made a bullish move—and no, it's not another Palantir play. Here's the under-the-radar defense stock soaking up her fund's cash.

Why this pick shocks Wall Street

While analysts obsess over AI spy-tech darling Palantir, Wood's loading up on a legacy contractor with classified government contracts. The move defies her typical disruptive-tech thesis—unless you count disrupting short-seller portfolios.

Defense sector's dirty little secret

Turns out old-school ballistic systems still get more Pentagon funding than blockchain-based surveillance. Who knew? (Besides every military budget analyst since Eisenhower.)

Closing thought: In a world where 'defense stocks' now mean AI pattern-recognition, sometimes the smart money bets on the company still making actual bullets. How very 20th century.

Understanding how AI fits into the defense equation

While AI has become the dominant megatrend driving the technology sector, most conversations still center on chips, data centers, cloud infrastructure, or workplace productivity tools. Behind the scenes, however, AI is rapidly emerging as a transformative tailwind reshaping modern military strategy.

AI's applications in national security range from satellite imagery analysis and equipment maintenance to cybersecurity threat detection and autonomous navigation for unmanned systems like drones.

Among established defense contractors, the usual names include,,,,,, and L3Harris.

Palantir stands apart from these incumbents thanks to its versatile AI platforms, including Foundry and Gotham. This integrated ecosystem has positioned Palantir as the operating system supporting a wide range of military operations, securing billion-dollar contracts with the Army and Navy, and extending its reach overseas through collaborations with U.S. allies in NATO.

Image source: Getty Images.

Why might Cathie Wood like L3Harris stock?

Like many of its peers mentioned above, L3Harris manufactures mission-critical systems poised to benefit from deeper integration of AI-enhanced capabilities. This makes it plausible that Wood is targeting stealth opportunities to complement Ark's more pure play AI holdings, such as Palantir.

That same logic helps explain why several defense-adjacent companies such as electric vertical take-off and landing aircraft (eVTOL)and, Kratos,, and Lockheed found a place in Ark's portfolio. When it comes to L3Harris however, I think there is a more specific catalyst behind Wood's recent buying.

While Palantir often commands the spotlight in the DOD's high-profile technology awards, many other contractors secure portions of these deals. L3Harris is one of them, partnering with Palantir to develop the Army's next-generation ground transportation systems under the Titan program.

During the company's second-quarter earnings call, L3Harris CEO Christopher Kubasik even highlighted the collaboration, noting, "our ongoing partnership with Palantir on the U.S. Army's Titan program continues to mature".

Is L3 Harris stock a buy?

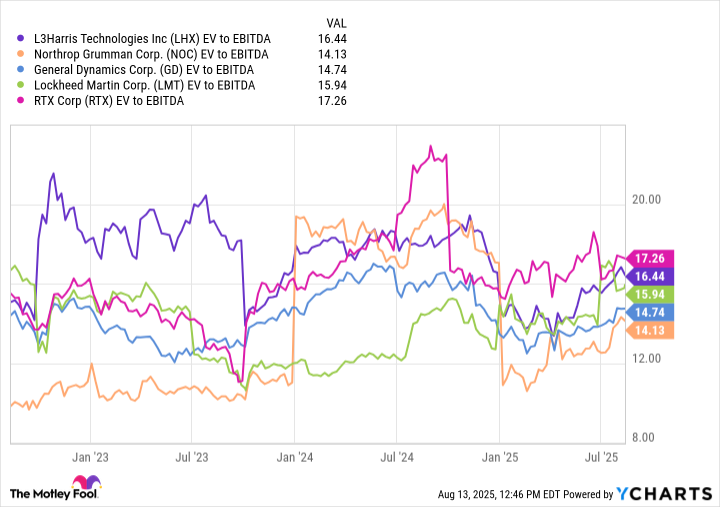

The comparable company analysis benchmarks L3Harris against a peer set of leading defense contractors on an enterprise value-to-EBITDA (EV/EBITDA) basis.

LHX EV to EBITDA data by YCharts.

From a valuation standpoint, L3Harris trades at an EV/EBITDA multiple of 16.4 -- a discount to historical peaks but still on the higher end of this cohort. Despite this relative premium, analysts largely view L3Harris through the lens of a conventional defense contractor, valuing the company based on its current contracts and pipeline.

I think that the upside from AI integration is not yet fully reflected in L3Harris's share price. As AI-enabled services become a greater priority at the Pentagon, the narrative around traditional contractors could shift especially as they FORM deeper ties with leading technology platforms like Palantir -- as L3Harris is already doing.

For this reason, I see L3Harris as well positioned for long-term valuation expansion and consider it a savvy buy at current levels.