Nvidia Dumped SoundHound AI Stock—Was It a Billion-Dollar Blunder?

Nvidia just made a move that’s got Wall Street buzzing—and not in a good way. The chip giant slashed its stake in SoundHound AI, leaving investors scrambling for answers. Was it a strategic masterstroke… or a faceplant?

Here’s why the market’s freaking out.

SoundHound’s stock tanked 15% post-sale—never a good look when the ‘smart money’ bolts. But Nvidia’s sitting on enough cash to buy small countries, so maybe they know something we don’t? (Or maybe their CFO just wanted a new yacht.)

The real question: Is AI voice recognition the next big thing… or yesterday’s news? Nvidia’s betting chips over chat. Again.

Image source: Getty Images.

A leader in conversational AI

SoundHound's conversational AI applications are popular in a variety of industries, but they are experiencing particularly high demand in quick-service restaurant chains and with automotive brands that want to include a powerful AI assistant in their new vehicles.

In the restaurant space, SoundHound's Voice AI technology can accept customer orders autonomously in-store, over the phone, and in the drive-thru. It can also answer queries from employees, whether they need help making menu items or need clarity on a particular store policy. Chains like,, andare just a few of SoundHound's customers.

In the automotive industry, companies like Hyundai and(Chrysler, Jeep, and Dodge) are using SoundHound's Chat AI software in their latest vehicles. It can give drivers information about the weather, stocks, and everything in between with a simple voice command, and manufacturers can customize its personality to suit their brand.

Last August, SoundHound acquired another conversational AI specialist called Amelia. The joint companies recently launched a new platform called Amelia 7, which allows businesses to create custom AI agents that can assist customers with their inquiries or even help employees troubleshoot technical issues. Of course, these agents can be controlled entirely with voice commands.

SoundHound's revenue is absolutely skyrocketing

SoundHound generated a record $42.6 million in total revenue during the second quarter of 2025 (ended June 30), which was a blistering 217% increase from the year-ago period.

The strong result gave management the confidence to increase its full-year revenue guidance for 2025 from $167 million to $169 million (at the midpoint of the forecast range), which WOULD be a 99% increase compared to 2024. That would mark an acceleration from the 85% growth SoundHound generated last year, highlighting the significant momentum in its business.

But that growth is coming at a significant cost, because SoundHound continues to burn truckloads of cash. It lost $74.7 million on a generally accepted accounting principles (GAAP) basis during the second quarter, which was twice as much as it lost in the year-ago period.

SoundHound did suffer a one-off, $31 million hit to its bottom line from a liability associated with one of its acquisitions during the quarter, but even after stripping it out -- along with every other one-off and non-cash expense -- the company still lost $11.8 million.

SoundHound has a solid balance sheet with $230 million in cash on hand and no debt, so it can sustain losses of that size for the foreseeable future. However, the company will eventually have to prioritize profitability, or else it might need to raise capital, which could dilute existing shareholders. Cost cuts would almost certainly dent SoundHound's revenue growth, which is something for investors to keep in mind.

Here's why Nvidia didn't make a mistake by selling SoundHound stock

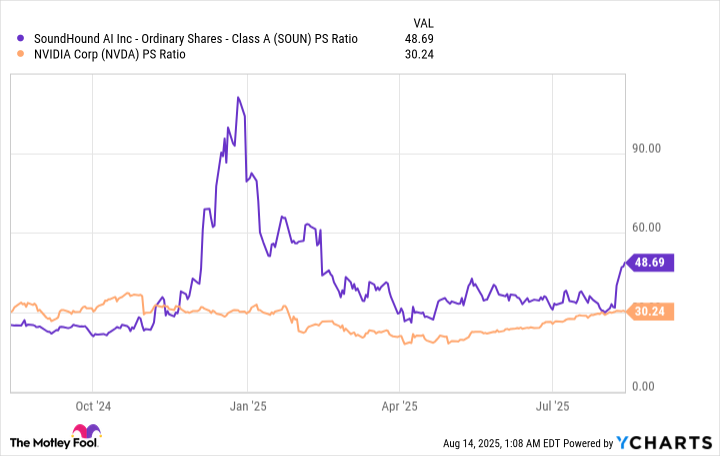

Nvidia never told investors why it sold SoundHound stock, but if I had to speculate, I think its valuation likely had something to do with the decision. Its price-to-sales (P/S) ratio is trading at an eye-popping level of 48.6, which is more than a 50% premium to Nvidia's P/S ratio of 29.9.

It was even more expensive when Nvidia sold it toward the end of 2024, because its P/S ratio was hovering NEAR 100.

SOUN PS Ratio data by YCharts

SoundHound will quickly grow into its current valuation if its revenue continues to increase at such a blistering pace, but the financial results of companies in the early stages of commercialization are notoriously unpredictable, so there's no guarantee it will. Moreover, Nvidia is one of the highest quality companies in the world with a track record of success that spans decades, a rock-solid balance sheet, and surging profits, so I don't think SoundHound deserves to trade at a premium to the chip giant.

Nvidia held 1.73 million SoundHound shares, which would've been worth around $27.7 million at the current price of $16. Given the chip giant's market cap of $4.4 trillion, a total loss would've been a mere rounding error. However, holding a stock with such a steep valuation opens the door to substantial downside if the underlying company falters, so I don't think Nvidia made a mistake by closing its position.