This Stealthy Dividend Juggernaut Raked in 30% Gains in 2025 — And Still Yields a Juicy 6%+ Payout

Wall Street's sleeping giant just woke up—and it's handing investors a rare double win.

The Contrarian Cash Machine

While crypto bros were laser-eyeing meme coins, this old-school income play quietly delivered total returns that'd make most DeFi protocols blush. Thirty percent price appreciation. Six percent dividend yield. Zero vaporware.

Yield Meets Growth (No, Really)

In a market where 'high yield' usually means 'impending disaster,' this outlier proves mature companies can still print money—then actually share it with shareholders. The kicker? It's plowing cash back into growth like a startup with actual revenue.

The Ironic Truth About 'Boring' Stocks

Turns out you don't need blockchain buzzwords when you've got fundamentals. But good luck explaining that to the NFT crowd.

Defying industry headwinds

Cigarette consumption in the United States has been falling for decades and recently worsened in the age of nicotine pouches and electronic vaping devices. This has been a major headwind for tobacco companies, with volumes for Altria's flagship Marlboro brand slipping 10% year over year last quarter.

Despite this, Altria's smokeable products segment grew its operating earnings 4.4% year over year to $2.9 billion. How? Price increases, along with volume growth for the cigars segment.

The company consistently raises the price of its cigarettes sold to retailers, which counteracts volume declines and increases profit margins. These operating earnings are the key driver of consistent free cash FLOW generation. Even though smoking is on the outs in the U.S., there is plenty of room for the company to raise prices in the face of these volume declines to maintain cash flows.

Using a vaping device. Image source: Getty Images.

Buybacks and dividend optimization

When buying a low-growth stock such as Altria, investors care about dividend income and dividend growth. Today, investors who buy it get a yield of 6.25%, meaning every $10,000 in the stock generates $625 in annual income. Not bad.

Altria is optimizing its capital returns for increasing its dividend per share over the long haul. It is using cash Flow not going to dividends to repurchase stock, which has brought its shares outstanding down by 14% in the last five years.

Recently, the pace of share repurchases has accelerated, which should further help to increase the dividend per share. With fewer shares outstanding, Altria will be able to maintain a nominal dividend payout while increasing the per-share paid out to remaining shareholders.

With free cash flow per share of $5.156 versus $4.08 in dividends per share, Altria has plenty of room to keep growing its dividend despite its high 6.25% yield today.

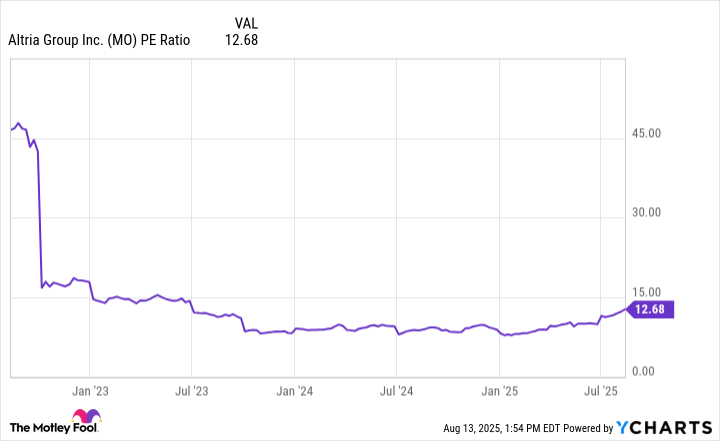

MO PE Ratio data by YCharts; PE = price to earnings.

What's next for Altria?

Cigarette smoking is slowly going away in the U.S. Cigars remain a strong profit driver for Altria, but they cannot replace all of the cash flows from cigarettes. So the company is turning to alternative nicotine categories to help drive growth over the long term.

It has acquired the NJOY electronic vaping brand, which has decent market share in the United States but is suffering due to illicit sales of illegal nicotine vaping devices around the country. The On! nicotine pouch brand is growing volumes by 26.5% year over year but remains a tiny part of the overall business.

Management has many years to invest in these new categories before the cash flow from cigarettes runs dry. At a price-to-earnings ratio (P/E) of 13, future expectations still remain low for this business. However, eventually Altria will need to show significant growth from these adjacent products in order to keep this business relevant in the future. Investors should watch volume growth for On! and NJOY as signs of success for these new investments.

Buy Altria Group for its current dividend yield and growth, but keep a close eye on its new nicotine products.