🚀 Torm Stock Soars: Here’s Why Traders Are FOMOing Today (August 14, 2025)

Torm stock just got a rocket-fueled boost—and Wall Street's scrambling to catch up. Here's the breakdown.

Fueling the Fire: Market whales are piling into shipping plays as global trade volumes defy recession fears. Torm’s tanker fleet? Suddenly looking like golden geese.

Short Squeeze Alert: Bears got steamrolled after Q2 earnings whispers hit the tape. Nothing burns hedge funds faster than a surprise liquidity wave.

Bonus Finance Jab: Meanwhile, traditional asset managers are still trying to short crypto from their golf carts. Priorities.

One thing’s clear: When the tides turn, shipping stocks don’t ask for permission to rally. Will the momentum hold? Grab your binoculars—this chart’s writing its own headlines.

Image source: Getty Images.

Management sees calm seas through the rest of 2025

Reporting revenue of $315.2 million, Torm beat analysts' profit estimates. Whereas the consensus was that the company WOULD report earnings per share (EPS) of $0.57, Torm posted $0.60 EPS for Q2 2025.

But investors are likely more focused on what management had to say about the remainder of the year than its report on the recent quarter. For 2025, management projects time charter equivalent (TCE) earnings -- an industry metric that measures the vessels' profitability -- of $800 million to $950 million, an upward revision from the earlier 2025 TCE guidance of $700 million to $900 million. In addition, the company projects earnings before interest, taxes, depreciation, and amortization (EBITDA) of $475 million to $625 million, instead of the previous guidance of $400 million to $600 million.

Is now a good time to dock Torm stock in your portfolio?

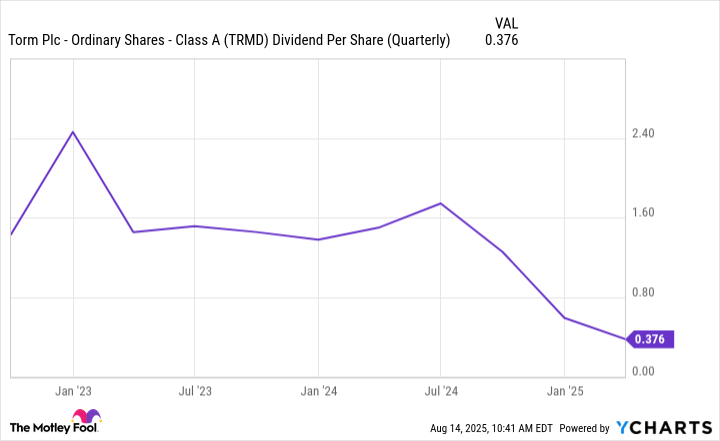

For those who have Torm stock on their radars, the likelihood is that it's there due to the company's generous dividend. Currently, the distribution represents an ultra-high forward yield of 8.4%. But before investors rush to pick up shares of Torm, it's important to note that the quarterly dividend varies considerably, and over the past three years, it has steadily declined.

TRMD Dividend Per Share (Quarterly) data by YCharts.

For those seeking a reliable passive income stream, Torm stock doesn't fit the bill, but for those with a higher risk tolerance and who are comfortable with the lack of certainty in the quarterly payout -- though it has the potential to be generous -- Torm stock may warrant a closer look.