Broadcom: The Next Nvidia? Why This Chip Giant Could Dominate the AI Boom

Move over, Nvidia—Broadcom’s gunning for the AI crown.

With hyperscalers scrambling for custom silicon and VMware now under its belt, Broadcom’s quietly building an empire. Their ASIC game? Strong enough to make even Jensen Huang glance over his shoulder.

The AI Infrastructure Play

While Nvidia rides the H100 wave, Broadcom’s chips power the plumbing—networking switches, data center interconnects, and those juicy custom AI accelerators Google and Meta can’t get enough of.

The VMware Wildcard

That $61B acquisition wasn’t just for show. Broadcom’s squeezing VMware’s software stack into an AI orchestration beast—because what’s hardware dominance without a lock on the management layer?

Wall Street’s Late Epiphany

Analysts finally noticed when Broadcom’s stock doubled in 12 months. Now trading at 30x earnings—because nothing screams ‘rational valuation’ like FOMO on anything with ‘AI’ in the earnings call.

Bottom line: In the race to build AI’s backbone, Broadcom’s holding both the blueprint and the wrench. Nvidia better hope their moat’s deeper than it looks.

Image source: Getty Images.

Broadcom's XPUs could have a massive market opportunity

Broadcom hasn't become a household name like Nvidia, although it's still a giant. Broadcom's market capitalization is around $1.4 trillion, making it the seventh-largest company listed on a U.S. exchange. That's about one-third the size of Nvidia, showcasing that it's already a tech giant.

The chipmaker has multiple product offerings ranging from cybersecurity to mainframe hardware to VIRTUAL desktop software via its VMware acquisition. Still, the most important part of the Broadcom investment thesis centers around custom AI accelerators and connectivity switches.

Starting with connectivity switches, these devices connect GPUs and XPUs (Broadcom's typical acronym when referring to custom AI accelerators) in a data center. These switches are critical and allow workloads to be distributed across different computing clusters and then stitched back together to form an answer. Without these switches, AI data centers with hundreds of thousands of GPUs WOULD be significantly less effective.

Moving to its custom AI accelerators or XPUs, Broadcom believes that there is a serviceable addressable market between $60 billion and $90 billion that will emerge by 2027 from just three customers. Broadcom also has four other customers working on their XPU designs with the company, so this potential market could dramatically expand.

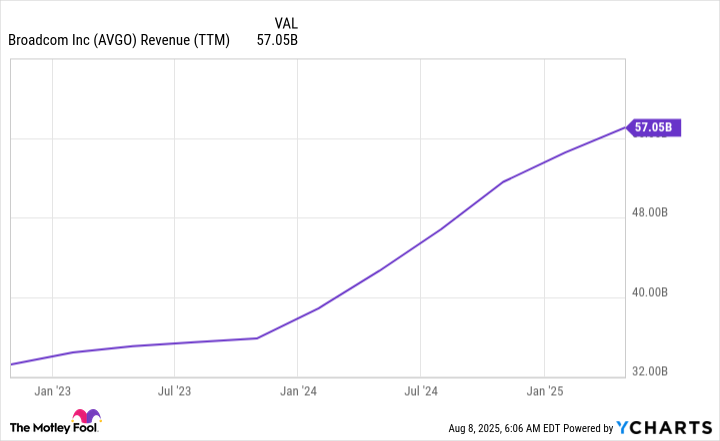

Considering Broadcom's trailing-12-month revenue was just shy of $60 billion, and its AI revenue was $4.1 billion in Q1, this could be a huge growth factor in the coming years.

AVGO Revenue (TTM) data by YCharts

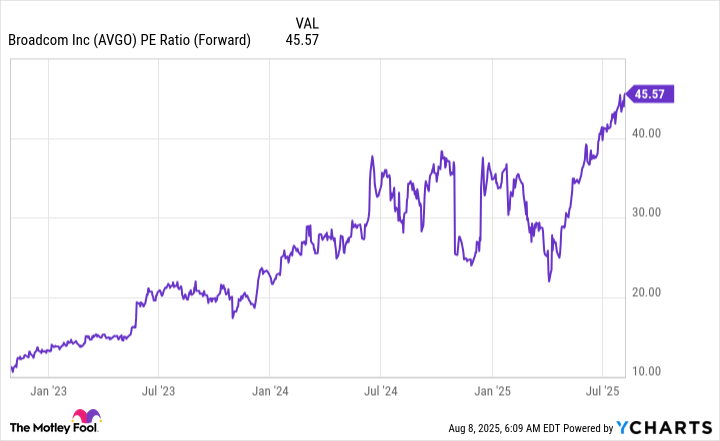

The stock's valuation has dramatically risen in the past few years

But does all this make Broadcom a buy right now? The market isn't blind to the fact that Broadcom's growth opportunity over the next few years is massive. It's well aware of its potential, which is why the stock has a premium valuation attached to it. Broadcom's stock trades for more than 45 times forward earnings, which is more expensive than Nvidia's 42 times forward earnings valuation.

AVGO PE Ratio (Forward) data by YCharts

While Broadcom may have projections of rapid growth, Nvidia is currently outperforming it in this department, with its revenue rising 69% in its latest quarter versus Broadcom's 20%. So, Broadcom's premium valuation over Nvidia doesn't make a TON of sense right now.

It will need to deliver some serious growth numbers to justify its current price tag, especially if it wants to outperform Nvidia over the long run. While I believe that Broadcom will have immense success with its custom AI accelerators, the price tag is too expensive to justify buying shares over Nvidia.

I want Broadcom to show me that this AI accelerator growth is real and following along the trajectory management laid out. If it can do that, then Broadcom could be a compelling investment. But right now, it's just a bit too expensive to purchase shares versus Nvidia.