Lululemon Stock Plunged 60%—Is the Bleeding Stopping? Buckle Up for the Truth

Lululemon’s stock got shredded—down 60% from its peak. Now investors are asking: Is this the bottom, or just a pit stop on the way to painville?

Let’s cut through the yoga-mat-thick analyst fog.

The Bear Case: Stretched Valuations & Consumer Fatigue

Lululemon rode the athleisure wave straight into a valuation wall. Even after the drop, it’s still priced like a growth darling—but can it deliver?

The Bull Argument: Brand Power & Global Expansion

Loyal customers still swear by those $120 leggings. International growth could be the next catalyst… if macro headwinds don’t wreck discretionary spending first.

The Cynic’s Take

Wall Street’s ‘buy the dip’ chorus sounds suspiciously like bagholders trying to recruit fresh capital. Remember: stocks don’t owe you a rebound.

One thing’s clear—this isn’t just a ‘healthy correction.’ Either Lululemon reinvents itself, or investors will need more than deep breathing exercises.

Temporary headwinds in athleisure

Multiple headwinds hit Lululemon over the last two years. Some self-inflicted, others from a broader athleisure spending cycle. In 2024, Lululemon's new styles did not impress its Core customer base, with management admitting recently it needed to be more nimble to adapt to changing customer trends. Competition has grown in athleisure with upstarts such as Vuori and Alo Yoga, which is a strong narrative among investors worried about Lululemon losing its customers. From a broad economic perspective, spending on athleisure and casual clothing as a whole has waned in recent years after a COVID-19 pandemic boost.

Despite all this pain, Lululemon's revenue grew more than 7% year-over-year last quarter, with impressive 22% growth in China. Competitors may be trying to step on Lululemon's toes, but it has been able to defend its turf with its omnichannel retail strategy.

Profit margins remain high, at over 23% over the last 12 months. What's more, Lululemon is steadily expanding outside of just gym, yoga, and workout clothing. It now sells running shoes, which is a lucrative market (albeit highly competitive), as well has handbags, backpacks, and even polo and collared shirts for men.

Image source: Getty Images.

A valuation that gets more and more appealing

Lululemon's stock price trajectory WOULD make you think the business is collapsing, but as we can see, that is not happening. The brand has a lot of room to keep growing in China and wiggle its way into new geographies in the coming years. A new storefront in Milan's flagship shopping district is a big investment and shows how eager Lululemon is to expand into Europe.

With this international expansion, Lululemon should be able to grow its revenue at a 5%-10% annual rate for the rest of the decade. The stock's current valuation seems to assume that the company will never grow its revenue again.

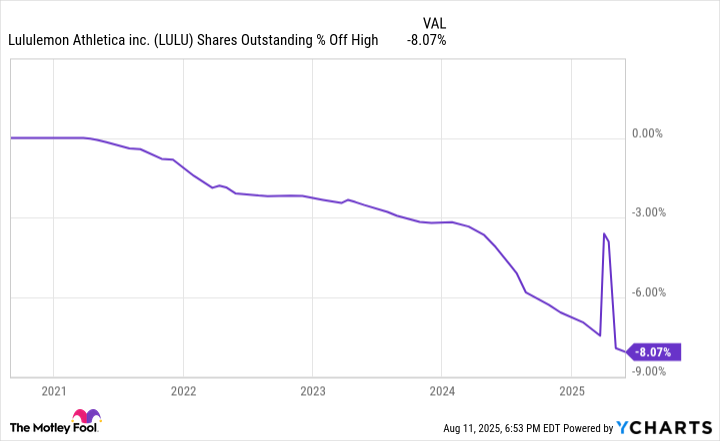

To take advantage of this cheap valuation, Lululemon is greatly increasing its stock buyback program. Last quarter, it spent $430 million on share buybacks to reduce its shares outstanding by 1.4 million. As the number of shares come down, Lululemon's earnings per share (EPS) will rise, which will help the stock performance over the long haul.

LULU Shares Outstanding data by YCharts

Is the worst over for Lululemon?

Timing the bottom for a stock on its way to a turnaround is close to impossible. You could try to predict when revenue growth will stabilize, but that may be missing the forest for the trees. It is extremely difficult to predict short-term moves in the stock market. Lululemon's stock could fall another 20% from here, or it may be about to rise 20%.

What should be easier to understand is the fact that Lululemon's stock is cheap relative to its past history of growth. It trades at a cheap P/E ratio around 12 and has a long runway to grow internationally. Management is buying back stock like it's about to go out of style. This combination should help investors stay confident that buying shares today will lead to strong performance over the next five to 10 years. The worst may or may not be over for Lululemon stock, but it remains a good buy and hold for the long term.