Microsoft Stock Hits ATH Again—Time to Buy or Bail?

Microsoft just shattered its all-time high—again. The tech titan's shares are defying gravity while legacy investors scramble to justify valuations. But here's the real question: is this a rocket ship or a bubble waiting to pop?

Let's cut through the hype.

The Bull Case: Cloud Still Has Room to Run

Azure's growth remains a cash cannon, and AI integrations are layering on premium pricing. No slowdown in sight—unless you count Wall Street's chronic undervaluing of tech moats.

The Bear Trap: Priced for Perfection

At these levels, Microsoft needs flawless execution. One missed quarter could trigger the algo-traders to pile on the sell orders. Remember: even blue chips bleed when momentum flips.

Bottom line? This isn't your grandfather's 'safe' stock anymore. Microsoft's playing with the big boys in hypergrowth territory—complete with gut-churning volatility. But hey, at least it's not another 'disruptive' crypto token burning VC cash.

Image source: Getty Images.

Microsoft's upside could hinge on the success of Copilot and its AI strategy

For Microsoft to continue surging in value, I think it needs to show investors that Copilot is the real deal that can be a huge growth catalyst for its business. While AI has been boosting its sales, the company achieved revenue growth of 18% in its most recent quarter (which ended on June 30), and it may need to do better than that for it to continue to be a hot buy among growth investors, given its not-so-cheap valuation; Microsoft's stock currently trades at a price-to-earnings multiple of just under 39.

While Microsoft is bullish on Copilot,CEO Marc Benioff believes the company has simply repackaged ChatGPT, disappointing its customers. Salesforce is a rival of Microsoft, so criticisms from its management need to be taken with a grain of salt. But there are other worrying signs, such as lackluster personal computer sales despite the launch of new AI-powered computers from Microsoft. Plus, Microsoft delayed the launch of its AI chip, Maia, by at least six months, offering further proof that its AI strategy isn't going exactly according to plan.

The stock is trading at a big premium

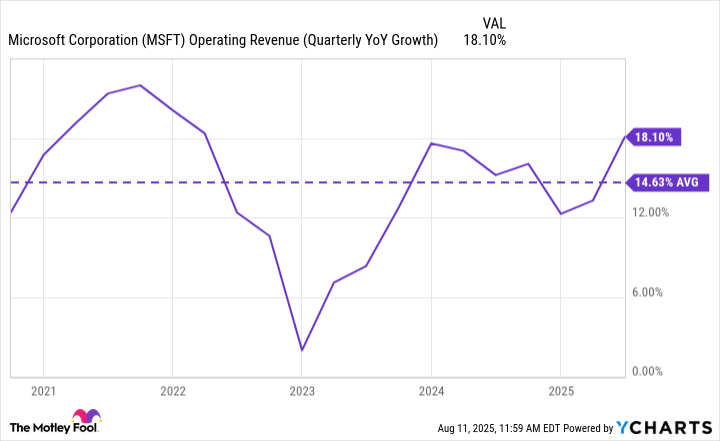

A stock trading at a high valuation means that investors will have high expectations for future growth. And if that doesn't end up being the case, it could lead to a correction. For now, investors appear to be content with the stock's growth rate of around 18%, but it wasn't all that long ago that it was in the low-single digits.

MSFT Operating Revenue (Quarterly YoY Growth) data by YCharts.

If there is a slowdown in the economy, AI spending could come down, and so could the excitement and demand for AI products and services. The big test will be what happens next quarter for Microsoft and whether its growth rate can accelerate or even remain stable. If it can, the stock may continue to do well and rise higher. If it doesn't, however, that could put downward pressure on Microsoft's valuation.

Should you buy Microsoft stock right now?

Microsoft is a quality business to invest in for the long term. I love its diversification and the vast opportunities it possesses. But for me, the company hasn't shown enough to suggest that it's a big innovator these days and that it can keep up with other businesses. While it's undoubtedly one of the biggest names in tech, that doesn't mean it'll be one of the best growth stocks or among the largest benefactors from the growth opportunities related to AI.

And if that's not the case, then I don't see this being a good stock to buy at nearly 40 times earnings. Microsoft is a blue-chip stock that's trading like a fast-growing AI stock. I think it's mispriced and due for a correction. Until that happens, or until it proves that Copilot will indeed be a big catalyst for its business, I'd put the stock on a watchlist as it may have gotten too expensive to buy right now.