🚀 Forget Nvidia: This Under-the-Radar AI Semiconductor Stock Is Primed for a September Surge

The AI chip race has a dark horse—and Wall Street hasn’t priced it in yet.

### Why This Stock Could Outperform the 'Magnificent Seven'

While Nvidia soaks up headlines, an overlooked semiconductor play is quietly building an AI moat. Supply chain whispers suggest production ramps that could shock analysts next quarter.

### The Numbers Don’t Lie (Unlike Some Earnings Calls)

Margins are expanding faster than a crypto influencer’s follower count during a bull run. With tape-breaking volume patterns emerging, this could be the last chance to buy before institutional FOMO kicks in.

### Cynical Take: Of Course It’ll Rally—The Fed Needs Another Bubble to Pop Later

Get positioned now. By the time CNBC runs their 'AI Chip Boom 2.0' special, the easy money will be made.

What does Micron do?

Nvidia and AMD design advanced chipsets called GPUs, which serve as the Core architectures on which AI models are trained and inferenced. Micron enters the equation through its high-bandwidth memory (HBM) solutions, which essentially help keep GPUs running at optimal speeds and help prevent bottlenecks during data workload processing.

Outside of data centers, Micron's DRAM and NAND products power applications across Internet of Things (IoT) devices such as smartphones and gaming PCs, as well as cloud infrastructure and more industrial applications such as autonomous automotive systems and robotics.

Image source: Getty Images.

How large of an opportunity is high-bandwidth memory?

According to data compiled by Bloomberg Intelligence, the total addressable market for HBM was estimated to be worth $4 billion in 2023. This figure is expected to grow at a 42% compound annual growth rate through 2033, reaching approximately $130 billion by the early 2030s.

Despite this rapid acceleration, the HBM market remains highly concentrated. Only a few companies such as Micron,, andare producing HBM solutions at global scale. While competition is intense, I see this industry concentration as the foundation of Micron's high strategic market value.

As hyperscalers expand AI capacity, many will seek to diversify their supply chains for different chip components. This makes sense, as big tech does not want to rely solely on a singular vendor in order to ensure steady access to chip supply, lock in favorable pricing, and access broader manufacturing footprints. With its growing HBM capabilities, Micron is well positioned to acquire additional market share in this environment.

Is Micron stock a buy right now?

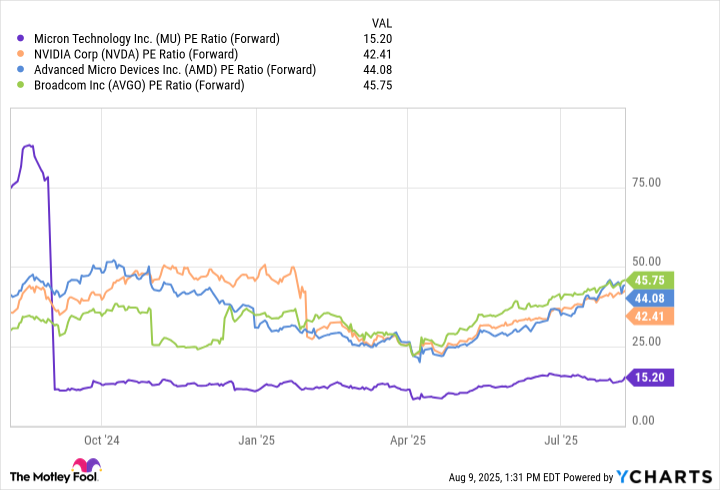

The chart below benchmarks Micron against a small cohort of leading chip stocks on a forward price-to-earnings (P/E) basis.

Data by YCharts.

The obvious thing that sticks out is that Micron's forward P/E experienced notable compression during late 2024. This is due, in part, to the lumpiness in Micron's financial guidance since accurately forecasting demand trends for a still-developing market such as HBM is challenging. Investors tend to shy away from uncertainty, which appears to be weighing on sentiment around Micron at the moment.

The valuation disparity between between Micron and its peers could suggest that investors do not fully understand or appreciate just how important the company's products are to overall AI infrastructure.

Micron's HBM solutions and edge computing products are essential for AI development at scale. As the market begins to connect the dots between Micron's leadership in memory and storage chips to the broader AI narrative, there is significant room for Micron's valuation to expand.

With earnings scheduled for next month and the stock still trading for a steep discount to its peers, Micron looks like a compelling buy right now.