Nvidia and Microsoft Just Hit $4 Trillion—Will Apple Be the Next Tech Titan to Join Them?

The AI gold rush catapults Nvidia and Microsoft past $4 trillion—leaving Apple scrambling to keep pace.

Silicon Valley's trillion-dollar club just got more exclusive. As of August 2025, only two companies have breached the $4 trillion valuation mark: Nvidia (riding the AI chip wave) and Microsoft (dominating cloud infrastructure). Both stocks defied gravity this year—while Apple's growth flatlined.

Wall Street's new math: AI = $$$. Forget iPhones—the real money's in data centers and GPU clusters now. Nvidia's H100 chips became the new oil, Microsoft's Azure swallowed the cloud, while Apple... well, at least Vision Pro looks cool.

Can Cook & Co. pivot fast enough? With wearables stagnating and car projects imploding, analysts whisper Apple might need an AI miracle—or risk becoming the next 'beleaguered tech giant.'

Bonus cynicism: Meanwhile, hedge funds are placing side bets on which megacap will be first to fake an AI demo video.

Image source: Getty Images.

Riding the AI train

Nvidia has had a mind-blowing ascent as the premier designer of the graphics processing units (GPU) that are necessary for generative artificial intelligence (AI). It has evolved from a somewhat obscure chipmaker for the gaming industry into a household name that's associated with the AI revolution.

Of course, it's much more than a name. It's an excellent company, reporting massive growth and a wide operating margin, and it's not surprising that investors are noticing its incredible opportunity. In the fiscal 2026 first quarter (ended April 27), revenue increased 69% year over year, which is outstanding for a company of its size. At the current price, it trades at a forward, 1-year P/E ratio of 31. It's debatable how expensive that is, but it's not astronomical, giving it even further room to run. It could easily reach a $5 trillion market cap before the year is out.

Microsoft is a Nvidia client, and it's also a leader in software and increasingly, cloud services. It's also investing in AI throughout its business, especially in creating large language models (LLMs) and offering LLM services to developers and clients in its cloud business. Total revenue increased 18% year over year in the 2025 fiscal fourth quarter (ended June 30), and revenue from its Azure cloud segment was up 34% in the quarter. Microsoft stock trades at a forward, 1-year P/E ratio of 29.

Both of these stocks are reporting tremendous growth, but more importantly, they have incredible opportunities. According to United Nations Trade and Development (UNCTAD), the AI market is expected to increase from $183 billion in 2023 to $4.8 trillion in 2033, or more than 25-fold over 10 years.

Falling far from the tree

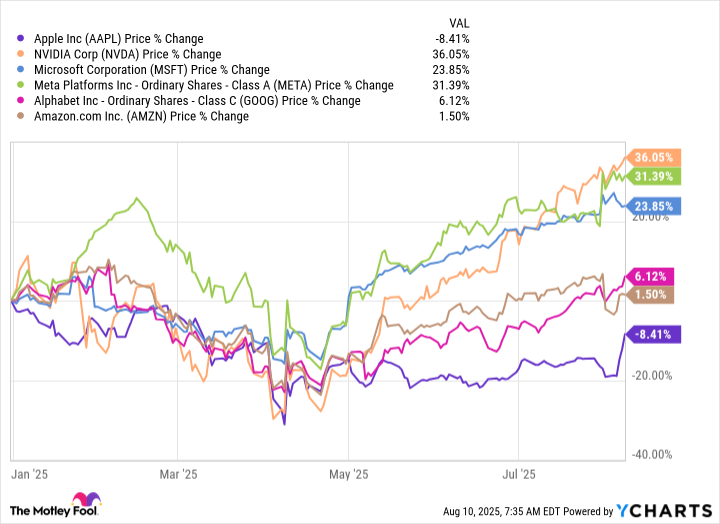

Where's Apple in all of this? It's still the third-highest-valued company in the world, but it hasn't grown as fast as its large peers recently. In fact, it's the only one of the six largest stocks, with the other three being,, and, that's down this year.

AAPL data by YCharts

There are a number of factors that are creating pessimism. One is its reliance on iPhones, which account for almost half of total revenue. As technology improves, there are reasons to suspect that users will gravitate toward new kinds of devices. Alphabet CEO Sundar Pichai caused a commotion when he said, "I think it'll be an exciting new emerging category, but I still expect phones to be at the center of the experience for the next two to three years, at least," on Alphabet's second-quarter conference call.

While that implies iPhones will be important for a while, it also implies that they may not be in the coming years. You don't have to look too far back in history to see leading companies that became obsolete when they didn't keep up with changing trends, and that's a worry for the market. And at the current price, it's not cheap at all, trading at 29 times forward, 1-year earnings, just like Microsoft.

On top of that, investors haven't been impressed with Apple Intelligence. While the other tech giants have been launching exciting and revolutionary AI-based features and tools, Apple's AI hasn't excited users. However, CEO Tim Cook stressed on the third-quarter earnings call two weeks ago that Apple is going to significantly increase its investments in AI.

Apple tends to do things differently, and that has brought it great success in the past. Apple stock has tumbled several times in the past as well, and it has always bounced back to new heights, bypassing the has-been lane. It's well-positioned right now to leverage its massive user base with improved technology, and there's a good chance that a rebound is just around the corner. I wouldn't count it out from joining the $4 trillion club soon.