D-Wave Quantum vs. IonQ: The High-Stakes Battle for Quantum Supremacy in 2025

Quantum computing isn't just the future—it's the billion-dollar arms race heating up Wall Street's speculative engines. Here's how two industry titans stack up.

The Hardware Showdown: Qubits vs. Trapped Ions

D-Wave's annealing approach slashes through optimization problems like a machete—while IonQ's trapped-ion precision cuts cleaner than a laser scalpel. Neither's claiming full fault-tolerance yet, but both are sprinting toward the finish line.

Wall Street's Quantum Gambit

Analysts froth over both stocks despite neither company turning a profit—because when has that ever stopped tech investors? (Remember the crypto bubble? Exactly.)

The Verdict: Schrödinger's Investment

Until someone demonstrates commercial-scale quantum advantage, buying either stock remains equal parts brilliance and madness—just like quantum superposition itself.

Taking a look at IonQ's business

IonQ is taking a rather interesting approach to developing quantum computing applications. Instead of allocating its financial horsepower toward traditional supercomputers, IonQ offers quantum computing as a service that is accessed through cloud infrastructure.

This quantum-as-a-service (QaaS) approach is both unique and flexible, as companies leveragingAzure,Web Services (AWS), or's Google Cloud Platform (GCP) can access IonQ's quantum services directly through cloud-based integrations.

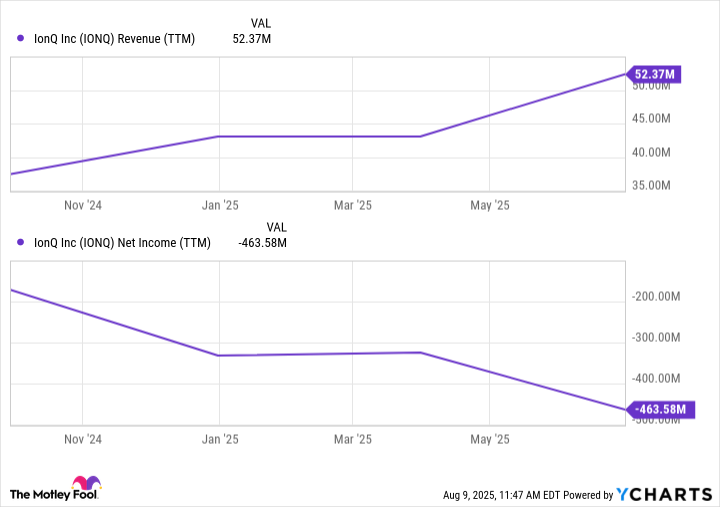

IONQ Revenue (TTM) data by YCharts

While IonQ's revenue has steadily risen over the last few years, the company's profitability has moved in the opposite direction. On the surface, investors might want to give IonQ some leniency here. Developing quantum computing requires hefty sums allocated toward research and development (R&D) and capital expenditures (capex).

At the end of the second quarter, IonQ boasted just $140 million on its balance sheet. When accounting for short-term investments in U.S. bonds, the company's cash and equivalents rises to $547 million. Furthermore, even after layering long-term bond investments on top of this sum, IonQ's total liquidity of $656 million is barely enough to cover another year's worth of operations under the current burn profile. With this position, the company may resort to further stock issuances to raise capital.

Given these dynamics, I think it's fair to question whether or not IonQ truly offers a viable solution that will yield improved unit economics in the long run.

Image source: Getty Images.

How does D-Wave compare to the competition?

D-Wave's approach to quantum computing is through the development of annealing services -- tools that are oriented for niche problem solving at fast speeds.

The table below summarizes D-Wave's revenue and profitability over the last 12 months:

| Revenue | $1.9 million | $2.3 million | $15.0 million | $3.1 million |

| Net Income | ($22.7 million) | ($86.1 million) | ($5.4 million) | ($167.3 million) |

| Cash and equivalents | $29.3 million | $177.9 million | $304.3 million | $819.3 million |

Data Source: D-Wave Investor Relations

There is a lot to unpack from the financial profile above. The first anomaly that sticks out is the lumpiness of D-Wave's revenue -- with roughly 68% of trailing-12-months sales occurring in just one quarter. To me, the inconsistency of D-Wave's revenue generation suggests that its annealing tools are not yet fetching robust demand.

In addition, the company's liquidity continues to rise despite having barely any sales coming through the door and losses mounting each quarter. How is that possible?

Just like IonQ is doing, D-Wave is tapping the capital markets to raise cash through multiple series of at-the-money (ATM) offerings.

IonQ vs. D-Wave Quantum: Which is the better stock?

If I had to choose a winner between IonQ and D-Wave Quantum, my preference WOULD lean toward IonQ as the superior choice. With that said, I see both stocks as highly speculative opportunities.

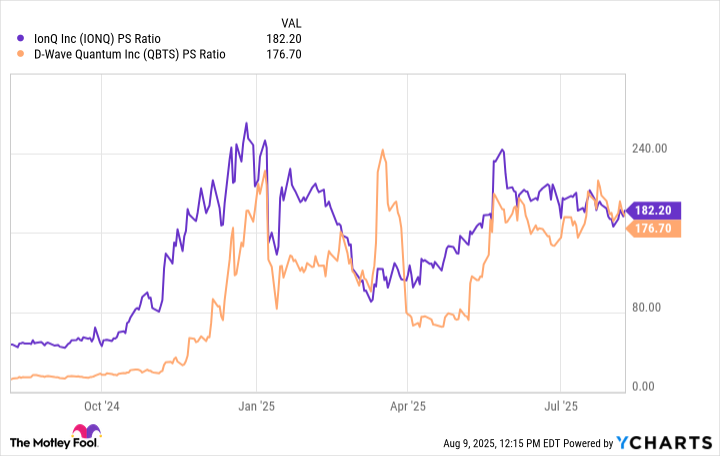

IONQ PS Ratio data by YCharts

Right now, both IonQ and D-Wave have limited business traction in the grand scheme of things. Nevertheless, each company trades at market capitalizations well into the billions and boasts valuation multiples that echo what investors witnessed during previous stock market bubbles. Management at both companies seem to recognize this frothiness -- continuing to raise capital at these inflated stock prices.

While this may be acceptable in the short-term, it is not a sustainable capital allocation strategy. It raises doubts about their ability to achieve critical scale, generate accelerating revenue, and transition to positive unit economics.

For that reason, I'd steer clear of both stocks unless you are prepared to assume outsized levels of risk and volatility.