Future Titans: 2 Stocks Set to Eclipse Tesla by 2028

Move over, Musk—these underdogs are gearing up to leave Tesla in the dust.

Forget 'quietly bullish'—we're calling it now: two disruptors are primed to outpace the EV giant within three years. No crystal balls, just cold-hard momentum.

First contender: The AI infrastructure play Wall Street keeps lowballing. Second: A space-tech dark horse burning cash like a meme trader at a bull market peak.

Neither needs hype trains or cult followings—their tech stacks do the talking. Meanwhile, Tesla's 'growth stock' aura? Looking more like blue-chip nostalgia by the day.

Final thought: When the 'next big thing' arrives, legacy giants rarely see it coming. Just ask the guys still waiting for Bitcoin to zero out.

The hand of a Tesla Optimus robot. Image source: Tesla.

Tesla's ambitious plans will likely take time, and that could spell near-term trouble

The narrative around Tesla is shifting from its legacy electric vehicle business to Robotaxi and humanoid robotics, which CEO Elon Musk and an increasing number of investors expect to carry the company's value moving forward.

Tesla's electric vehicle sales have started to decline, which could be at least partially due to Elon Musk's sometimes controversial, politicized persona. The issue here is that Tesla has only just begun launching its Robotaxi business, which is limited to a small number of vehicles with multiple safety measures in place. Tesla wants to expand its fleet rapidly, but that may take longer than most want to believe due to local and state-level regulations. Remember, Tesla's self-driving technology has still only obtained Level 2 capability, which mandates a human driver be present in the vehicle while it is autonomously operating.

Optimus, Tesla's humanoid robot, is also still in early stages. While the company aims to build 5,000 Optimus units this year, reports indicate that Tesla is behind on that. Perhaps Optimus will someday generate the trillions of dollars in revenue Elon Musk believes it can, but Tesla has infamously established numerous timetables before that have failed to execute as promised.

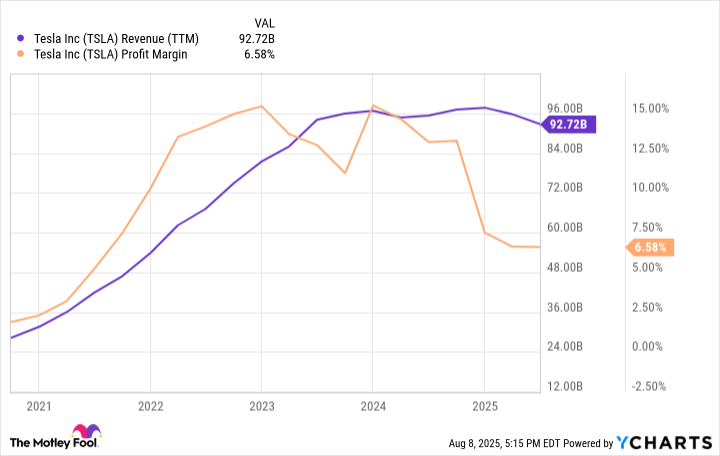

Unless Tesla can ramp Robotaxi and Optimus very quickly over the next year or so, the company's recent sales struggles could weigh significantly on the stock:

Data by YCharts.

Over the past few years, revenue growth ceased and then turned negative. Profit margins have cratered. If investors make Tesla a "prove it" story, the stock, trading at over 12 times revenue, could reasonably see at least 50% downside as its valuation shifts to more closely resemble that of an automotive manufacturer than a technology company.

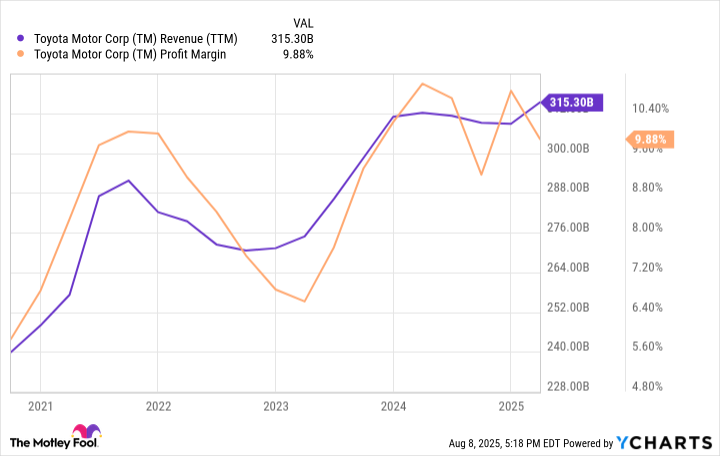

Investors may not appreciate Toyota enough

Take Toyota, for example, which is the world's most valuable legacy automotive company. Its revenue continues to grow to new highs, and its profit margin is far higher, clearing Tesla by over 3 percentage points. Ironically, Toyota has a market cap of just $246 billion, valuing the stock at a price-to-sales (P/S) ratio of less than 1.0, and a fraction of Tesla's.

Data by YCharts.

To be fair to Tesla, I don't think it's likely that the stock's valuation drops all the way down to Toyota's level. The upside is too high if it delivers on Robotaxi and Optimus as investors hope -- even if it takes longer than expected.

But Toyota could surpass Tesla's value if the two meet somewhere in the middle. Using each's trailing-12-month revenue, Toyota's valuation WOULD overtake Tesla's at a P/S ratio of 1, if Tesla's fell to about 3. This comparison is more about Tesla's downside than Toyota's upside, but it highlights Tesla's potential risks if the company doesn't follow through on some very ambitious goals.

Alphabet is the true market leader in self-driving vehicles

It seems SAFE to say that Waymo is currently the leading autonomous ride-hailing company. That puts parent company Alphabet in the driver's seat.

Alphabet, valued at over $2.3 trillion, is already worth more than Tesla, but some may not feel it will remain that way. Ark Invest's Cathie Wood believes that Tesla's value will skyrocket on Robotaxi growth. But I'm skeptical, at least of such a short time frame, for the reasons I walked through above. Additionally, Alphabet is a central player in artificial intelligence, with a blossoming cloud-computing business and digital advertising business that generates cash flow.

Some might not associate Alphabet with self-driving vehicles. Yet Alphabet is arguably the perfect company to go after that market because it has such strong existing businesses that can fund the investments to develop a self-driving fleet and expand it across the United States. Waymo continues to announce new markets, and until Tesla and Robotaxi close the gap, it's hard not to like Alphabet's prospects better than Tesla's moving forward.