Quantum Showdown: IonQ vs. Quantum Computing Inc. – Which Stock Holds the Future?

The quantum race heats up as two tech titans battle for supremacy. Forget Schrödinger's cat—these stocks are either alive with potential or dead money. Here's the breakdown.

Hardware vs. Software: The Quantum Divide

IonQ bets big on trapped-ion systems, while Quantum Computing Inc. plays the middleware game. Both promise revolution—but only one can dominate the coming quantum gold rush.

Wall Street's Quantum Fever

Analysts can't decide if these are trillion-dollar opportunities or hype-fueled bubble plays. Meanwhile, hedge funds place their bets like drunk gamblers at a roulette table.

The Verdict: Watch the qubits, ignore the noise. Early leaders often stumble—just ask anyone who bought IBM in the 1960s thinking mainframes were the endgame.

Image source: Getty Images.

Where Quantum Computing Inc. is at today

Current quantum computers are prone to calculation errors due to the delicate nature of atomic particles, preventing these machines from scaling up, and limiting their widespread use. Many quantum companies try to minimize errors by subjecting particles to freezing temperatures in expensive, bulky cryogenic equipment.

Quantum Computing Inc. takes a different approach. It embraces the inherent chaos of harnessing these particles in a technique called entropy quantum computing. This method allows QCi's machines to operate at room temperature, use less power, and integrate with ordinary computer servers.

Despite these advantages, its technology hasn't taken off. In the first quarter, QCi produced revenue of just $39,000. However, its Q1 operating expenses totaled $8.3 million. This chasm between income and expenses eventually will become a death knell for the business if sales don't pick up.

But perhaps the company is turning a corner. In April, it sold one of its computers to a large automotive manufacturer, and in July, it secured a purchase valued at $332,000 from a major U.S. bank. The bank's sale is significant considering QCi produced revenue of $373,000 in all of 2024.

IonQ's financial ups and downs

IonQ's technology also operates at room temperature by using lasers to carefully control ions. It's been winning customers and growing revenue, a sign that its approach shows promise in surmounting quantum computing's shortcomings. In 2024, sales reached $43.1 million, up from the prior year's $22 million.

But in Q1, the company's revenue of $7.6 million was flat year over year. This underwhelming result was not a good sign for a business with a Q1 operating loss of $75.7 million.

Then in Q2, IonQ's sales trajectory changed once again. This time, revenue came in at an impressive $20.7 million, nearly double the prior year's $11.4 million. Part of this massive increase came from the company's recent acquisitions, as it works toward building a quantum computer network akin to the infrastructure underpinning today's internet.

However, the acquisitions resulted in additional expenses, which catapulted IonQ's Q2 operating costs to $181.3 million, a huge increase over 2024's $60.3 million. Consequently, its Q2 operating loss ballooned to $160.6 million versus a loss of $48.9 million in the previous year.

To bolster its finances, IonQ executed a $1 billion equity offering in July. This adds to the $1.3 billion in total assets the company exited Q2 with, while total liabilities stood at $168.2 million.

Choosing between IonQ and Quantum Computing Inc.

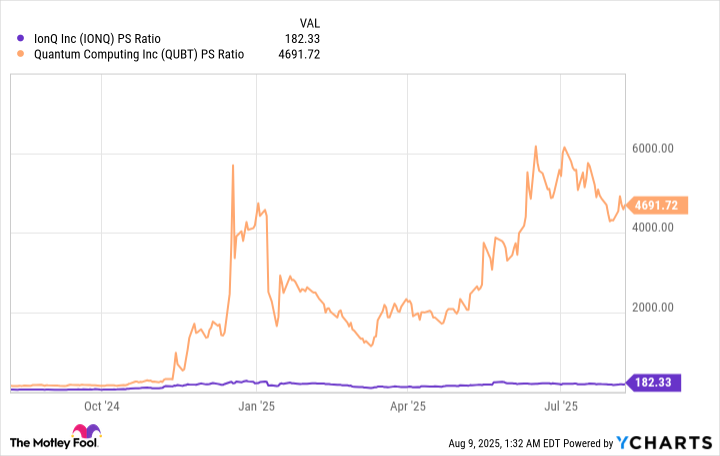

In deciding between these two quantum computing companies, one factor to weigh is share price valuation. This can be assessed through the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

IonQ's P/S multiple is substantially lower than QCi's, indicating it's a better value. In fact, QCi's P/S ratio is so high, its stock looks overpriced.

IonQ's superior sales growth and share price valuation make it a better investment over QCi in the emerging field of quantum computing. That said, buying IonQ stock carries risks, especially in the current macroeconomic climate, which could see inflation rise as a result of the TRUMP administration's aggressive tariff policies.

IonQ's operating expenses are already accelerating, and the economic environment could drive those costs higher. While its balance sheet sports the funds to maintain operations in the short term, the longer-term picture remains murky.

Whether IonQ's tech can achieve the quantum computing dominance it seeks is far from certain, and both it and QCi face large competitors with DEEP pockets, such as, which is developing its own quantum computing solution. So only investors with a high risk tolerance should consider IonQ stock.