Pepsi vs. Coke: Which Soda Stock Pops With Real Value in 2025?

The soda wars rage on—but which beverage giant is actually worth your hard-mined crypto profits?

The Fizz Factor: Fundamentals or FOMO?

Pepsi and Coke aren't just sugar-water peddlers—they're cash-flow machines with dividends that could make a DeFi yield farmer blush. But in an era where 'value' gets tossed around like a meme coin, which one survives the inflation squeeze?

Portfolio Carbonation: Bubbling Up or Flattening Out?

Both stocks have been shaken by supply chain volatility—because apparently even soda giants can't escape the 'just-in-time' logistics hangover. Yet one's quietly acquiring niche brands like a whale accumulating altcoins.

The Bitter Aftertaste: Regulatory Sugar Crashes Ahead

With health regulators circling like bear-market vultures, that 65% profit margin on liquid diabetes starts looking... speculative. But hey—at least they're not as volatile as your favorite shitcoin.

Verdict? One's a blue-chip with bite, the other's repackaging nostalgia. Choose wisely—or stick to drinking your gains instead.

Comparing and contrasting Coca-Cola and PepsiCo

They may both be in the beverage business, but they're not the same.

Coca-Cola, for instance, is only in the drinks market. Its brands include Gold Peak tea, Minute Maid juices, Dasani water, Costa coffee, and of course, its powerhouse namesake cola, just to name a few. But it's still only drinks. Not so for PepsiCo. While it's also the name behind Mountain Dew, Tropicana, and Gatorade, the company also owns snack chip company Frito-Lay, which makes Doritos, Cheetos, and a range of Frito and Lay's branded products. Moreover, PepsiCo owns Quaker Oats.

These aren't the only differences, though. Whereas PepsiCo owns the majority of its bottling and chip production facilities, Coca-Cola has made a point of getting out of the bottling business so it can focus on what it does best. That's marketing. Third-party bottlers NEAR the geographical markets they serve now handle the majority of Coke's production work, taking on the cost-based risk of doing so.

This nuanced difference is the chief reason for the decidedly different performances of these two companies' stocks. In an inflation-riddled environment like the one we've been stuck in since 2023, Coke's margins remain relatively high since the bulk of the cost in this business is borne by bottling itself. PepsiCo is its own bottler, though, and as such is forced to absorb higher materials, facility, and logistics costs even if it does enjoy more direct control of its production.

The company's exposure to the snack chip market has proven particularly problematic. Although PepsiCo is mostly able to manage its costs and pricing for its beverages, that's not the case for its potato chips and similar snacks. The necessary price increases on these goods have not been well received by consumers. North America's food business slipped 2% year over year during the second quarter of this year, for example, leading to a 13% decline on a constant-currency operating basis. Those results extend a long streak of weakness for PepsiCo's business, too, going all the way back to the last half of 2023. It was only a matter of time before this headwind finally started being priced into the stock.

These sellers, however, have arguably overshot their target.

Plenty of bullish argument

There's plenty of evidence to support that argument, too, like PepsiCo stock's price-to-earnings (P/E) ratio. Its trailing-12-month P/E currently stands at 18 times this year's projected earnings of $8.01 per share. That's cheap for this stock, particularly in comparison to Coke stock's 2025 P/E ratio of more than 23.

However, the biggest value disparity lies in these two stocks' differing dividends. Coca-Cola's forward-looking yield of 2.9% is respectable, but markedly less than PepsiCo's projected dividend yield of 4%. There's little risk of PepsiCo's dividend not being paid in the future, or, for that matter, its 53-year streak of annual dividend growth being broken anytime soon. The $5.56 worth of per-share dividends it's dished out over the course of the past 12 months is considerably less than the $8.16 per share it earned last year, despite all the aforementioned challenges, as well as the similar bottom-line figure it expects to report for this year.

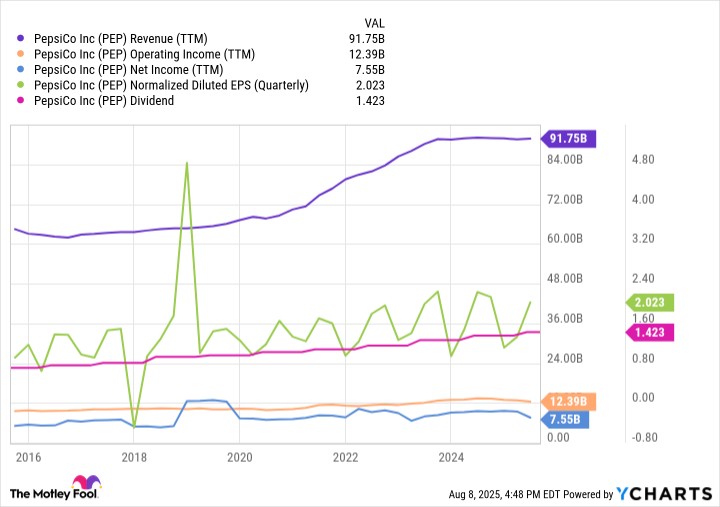

PEP Revenue (TTM) data by YCharts

Perhaps the chief reason PepsiCo stock is fizzing with underappreciated value at this time, however, is the fact that it's performed so poorly even though the company is finally figuring out -- and fixing -- what's been holding it back the most lately.

One of these initiatives is a rethinking of its products. As an example, its recent acquisitions of Siete Foods and Sabra offer instant access to authentic brands in the Mexican and Middle Eastern segments (respectively) of the food market at a time when that authenticity is in demand. The company's also responding to the ongoing consumer shift away from sugary soft drinks and salty snacks and toward healthier options. It's putting more focus on its Simply line of snack chips, for instance, which have no artificial colors or flavors. At the same time, following its recent acquisition of health-minded soda brand Poppi, PepsiCo has unveiled a new prebiotic cola.

Image source: Getty Images.

It's not just an overhaul of its product lineup, though. PepsiCo is also embracing technology as a means of improving the efficiency and cost-effectiveness of its supply chain, where it needs help the most. Although this part of the turnaround journey began over a year ago, its AI-powered warehouse robotics are now starting to demonstrate their intended efficiency, while its partnership withto create tailor-made AI customer service agents is showing promise as a time-saving and cost-lowering service solution.

The top is popped

There's still work to be done, to be sure. However, the company is moving in the right direction, especially on the cost-cutting front, but also in terms of product relevancy. We're only seeing slight upside from these initiatives so far, but a slow start is to be expected within the consumer goods industry, which requires lots of tedious production steps and suffers from a slow-moving sales pipeline anyway.

Just because the business is a slow one doesn't necessarily mean investors have plenty of time to think things over, though. Once the majority of investors recognize that PepsiCo's revamp is exactly what the company needs, the undervalued stock could start moving pretty quickly to a richer valuation.

In fact, it's starting to look like this is happening anyway. While still well below their mid-2023 peak, PepsiCo shares are also still up 12% from their June low. That's the biggest uninterrupted gain this ticker's seen in a few years, suggesting that at least some investors are starting to become believers in the turnaround effort.

In other words, if you're interested, you might not want to linger on the sidelines much longer just waiting to see what happens. This stock could run away from you pretty quickly, in light of everything that's changed for the better in just the past few months.