Elon’s Latest Tesla Bombshell Sparks Fury—Even by His Standards

Tesla's CEO drops another grenade in the EV arena—this one might actually burn bridges.

Why Wall Street's rolling its eyes (again)

Another day, another headline-grabbing stunt from the tech provocateur. This time? A move so divisive it makes Cybertruck pricing look unanimous.

The fine print hiding in plain sight

Buried beneath the hype cycle: implications that could rattle supply chains, irk regulators, and—let’s be real—pad Elon’s net worth while retail investors pick up the tab. Classic disruptive innovation—if disruption means rewriting rulebooks mid-game.

Love him or loathe him, the man’s a masterclass in volatility—both in stocks and sound bites.

A Tesla take for the ages

Cramer is the host of a CNBC program called Mad Money in which he covers the economy, individual stocks, and broader market themes. On his show, he hosts a segment called "Lightning Round," taking rapid-fire calls from retail investors who ask for advice about their portfolios.

In the clip below, you'll hear Cramer's response to a caller who asked if Tesla stock might rebound back to her original purchase price.

Jim Cramer last night on $TSLA: "Tesla is morphing right now. It's in transition from being a car company to being a technology company. You wanna be in there because the tech is worth a lot more than what it's selling for right now. Don't care where you bought it, care where... pic.twitter.com/WzlPdQD7gq

-- Sawyer Merritt (@SawyerMerritt) August 5, 2025Although the video is brief, Cramer managed to share several important insights.

Investing in Tesla stock requires a genuine belief that the company is not a traditional automaker. While the biggest money Maker for the company is the electric vehicle (EV) business, Musk has been sharing a vision of transitioning Tesla to a technology platform for years.

While Cramer did not offer specifics to the caller, he suggests that Tesla's technology stack is the real reason to own the stock. More specifically, Tesla is pursuing artificial intelligence (AI) products across two primary end markets: robotics and self-driving vehicles.

Tesla's autonomous vehicle fleet, dubbed the robotaxi, has officially launched and has its sights on rival platforms from's Waymo and.

In addition, Musk has proclaimed that Tesla's humanoid robot, Optimus, could wind up being the largest segment of the company's ecosystem in the long run. While that might sound overzealous, which is quite apropos for Musk,CEO Jensen Huang has shared a similar sentiment, calling robotics a multi-trillion dollar opportunity.

I believe that many investors view Tesla purely as a vehicle manufacturer and either discount or completely overlook the company's AI ambitions. Cramer lost me with his final thought to the caller, though.

Image source: Getty Images.

Here is where Cramer lost me

Investors should not try to time the market. Instead, you're better off adding to high-conviction positions for a long time -- buying the stock at various price points. This is an investment strategy commonly referred to as dollar-cost averaging.

One interpretation of Cramer's advice is that the caller shouldn't worry about the specific price she paid for Tesla stock because this could be just one entry point in a series of buys over the course of several years. The thing is, he didn't really say that.

Instead, Cramer seems confident -- perhaps overly so -- that Tesla stock will rise from its current levels. This is where he (sort of) lost me.

Where is Tesla stock headed from here?

Over the last five years, Tesla stock has risen by 222% as of this writing (Aug. 7). This absolutely trounces the returns of theand, both of which gained roughly 90% over the same period.

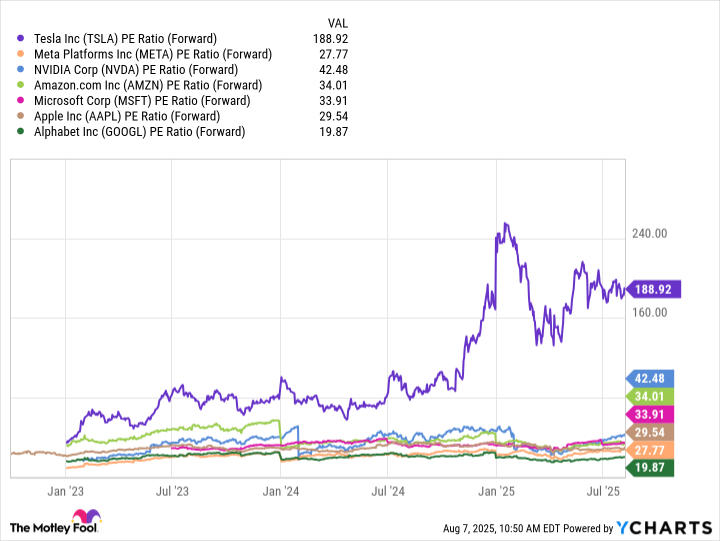

TSLA PE Ratio (Forward) data by YCharts

The chart above benchmarks Tesla against its "Magnificent Seven" peers on the basis of forward price to earnings (P/E) over the past three years. Throughout the AI boom, Tesla's valuation multiples have consistently outpaced its peers' -- despite the company having little to actually show for its AI ambitions so far.

Many of Tesla's peers have already launched, commercialized, and monetized AI-powered products and services. Meanwhile, Tesla is in the early innings of monetizing robotaxi and launching Optimus. For now, both of these projects remain fairly unproven revenue sources.

This is an important contrast because investors could argue that much of the upside from Tesla's AI pursuits is already priced into the stock.

Taking this one step further, the analysis above features future earnings estimates. Even though Tesla has yet to generate meaningful profits from its most ambitious bets, the company still fetches a premium valuation multiple over its peers who already have strong footholds in AI.

While trying to time the market is a mistake, I do think that price and valuation should matter to investors. If Musk successfully pulls off his AI vision, then Tesla stock could experience a parabolic run for the ages. The big variable here is that no one really knows when robotaxi and Optimus will reach a critical mass.

While Tesla stock may rise in the long run, there's no knowing when. Ignoring valuation might work for a swing trade, but for long-term investors, understanding what is priced in -- and what's not -- is crucial. This is what makes Cramer's statement about price a little flawed, in my view.