🚀 This 7-Bagger Stock Could Skyrocket 500%+ in 5 Years – Here’s Why

Wall Street's latest obsession just got a turbocharged upgrade—and the numbers don't lie.

The 7X factor: Forget 'growth potential'—this equity already delivered sevenfold returns while analysts were busy downgrading crypto. Now institutional money's flooding in like it's 2021 all over again.

Catalyst cocktail: A perfect storm of supply chain AI integration, regulatory tailwinds (thank you, FSA overhaul), and that sweet $2B buyback program even the bears can't ignore.

The cynical take: Sure, the CFO sold shares last quarter—but what do you expect from someone who still uses a Blackberry? Meanwhile, the algos keep stacking.

One thing's certain: In a market where most 'moon shots' crash land, this rocket's still got fuel.

Image source: Getty Images.

Palantir's current valuation could limit its explosive upside

Anytime I've talked about Palantir's stock recently, I've pointed out just how expensive the stock is by virtually any standard. It's important to know at any time, but especially if you're wondering about its chances for explosive growth.

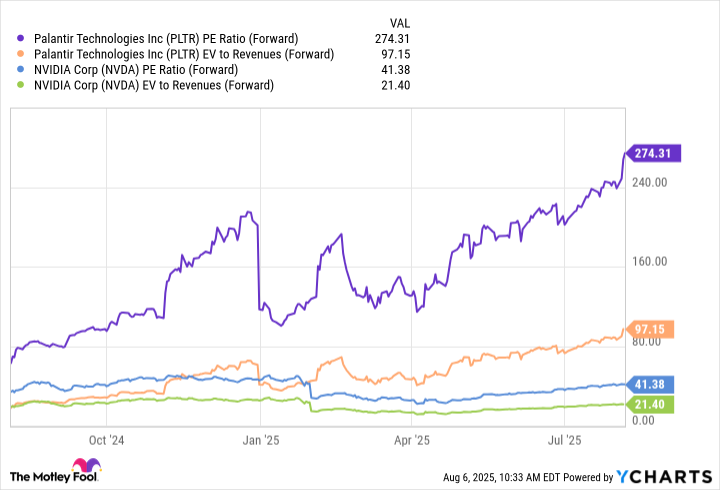

At the time of this writing, it's trading at 274 times its expected earnings for next year and 98.5 times its expected revenue. Its enterprise value (market cap + debt – cash) is currently trading around 97 times its forward expected revenue. For perspective, those are more than 6.5 and 4.5 times higher than, respectively, which is also considered very expensive by most standards.

PLTR PE Ratio (Forward) data by YCharts

In this case, Palantir's forward P/E ratio is what's important because it shows that investors have already priced in a lot of future growth. There's really no way to justify the levels Palantir is trading at, but if you're approaching the stock expecting explosive growth in the next five years, know that it WOULD take years of unprecedented and flawless execution to pull it off.

Can it happen? Sure. But that largely depends on your definition of "explosive growth." If you're expecting more short-term 600% gains, it's probably not a realistic outlook from this point.

Palantir impressed with its second-quarter financials

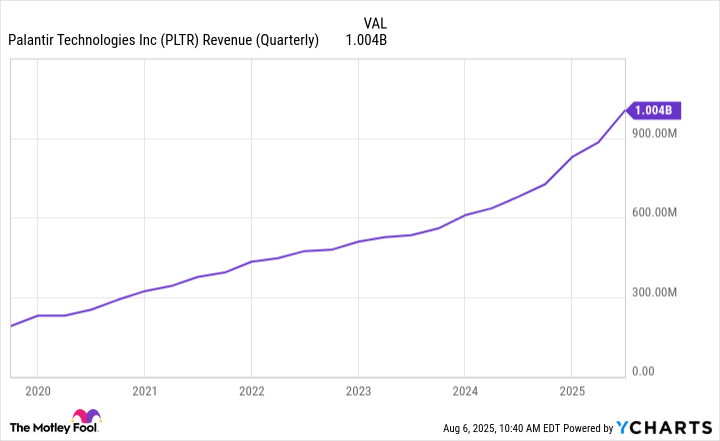

Palantir's impressive financial growth over the past year is part of the reason for its stock price growth. (Emphasis on "part" because it hasn't necessarily justified this much of a surge.)

In the second quarter (Q2), its revenue hit $1 billion for the first time in company history. Its U.S. government revenue made up the bulk of it, growing 53% year over year (YOY) to $426 million. However, the growth of its U.S. commercial segment was the most impressive, growing 93% to $306 million.

PLTR Revenue (Quarterly) data by YCharts

Palantir's U.S. commercial segment will likely be its fastest-growing segment for the NEAR future, and its CEO, Alex Karp, predicts that the company can increase its U.S. revenue tenfold in the next five years. Even if it's able to accomplish this, its current valuation with that future revenue would still be awfully expensive.

Approach Palantir with a long-term mindset

The stock market behaves irrationally all the time; that's just what it does. So, strictly looking at financials and saying Palantir's stock can't experience more explosive growth in the next five years isn't a guarantee of how things will play out.

That said, I would caution against approaching the stock with those expectations. If anything, I would invest in Palantir, planning to hold onto the stock for quite some time because high volatility seems inevitable.

A great approach would be to dollar-cost average instead of investing a lump sum at its current price. By dollar-cost averaging, you can gradually acquire shares, while protecting yourself against sharp pullbacks or buying in at overinflated levels.