Can the Vanguard Dividend Appreciation ETF Make You Rich by 2025? Here’s the Brutal Truth

Dividend ETFs are the slow-and-steady darlings of traditional finance—but can they really compete in today’s crypto-powered markets?

Vanguard’s Dividend Appreciation ETF (VIG) promises steady payouts from companies with a history of raising dividends. Sounds safe, right? Maybe too safe.

While boomers cling to yield like a life raft, decentralized finance (DeFi) protocols are offering double—even triple—digit APYs. Sure, those come with smart contract risks, but let’s be real: in a world where Bitcoin just notched another ATH, is a 2% dividend yield really ‘setting you up for life’?

Here’s the kicker: VIG’s top holdings—Microsoft, Walmart, Johnson & Johnson—are the same old giants propping up every pension fund. Meanwhile, crypto natives are stacking SOL and BNB like there’s no tomorrow.

Final thought: If ‘for life’ means retiring on a yacht versus surviving inflation, your ETF pick matters. Choose wisely—or wake up in 2030 wondering why your ‘safe’ investments got wrecked by the next bull run.

What does the Vanguard Dividend Appreciation ETF do?

As far as exchange-traded funds go, the Vanguard Dividend Appreciation ETF is fairly simple to understand. It tracks the. That index starts by only looking at the companies that have increased their dividends for at least 10 years. It then eliminates the highest-yielding 25% of the stocks and buys the rest using a market cap weighting methodology.

Image source: Getty Images.

Thinking the selection process through highlights a few key factors. First, this is not an income-focused ETF, since it specifically removes the highest-yielding choices from the mix. But that makes sense, too, since the highest-yielding stocks are also likely to be the ones facing financial difficulty or the ones that tend to be slow-growing.

Second, by biasing the ETF toward the lowest-yielding stocks, the Vanguard Dividend Appreciation ETF is likely going to be focused on companies with more of a growth flare. Indeed, the fastest-growing companies often have the lowest yields, even though they may also have the fastest-growing dividends.

Third, the Vanguard Dividend Appreciation ETF is a growth ETF that uses dividends to screen for stocks. After all, getting to a decade of dividend hikes is a pretty impressive feat. This simple bar likely eliminates a lot of lower-quality investment options even before the highest-yielding 25% of the eventual candidates gets tossed out.

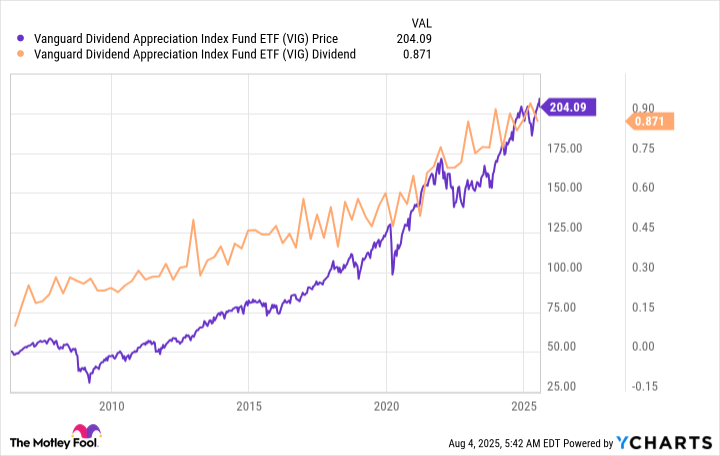

VIG data by YCharts

What are you really getting with the Vanguard Dividend Appreciation ETF?

As the chart above highlights, the Vanguard Dividend Appreciation ETF is delivering a generally growing dividend over time. And it is delivering a generally rising share price. So it offers income growth and capital appreciation. That's not a bad combination, especially if you are still fairly young and have a long time before you will need to tap your nest egg. Indeed, if you start early enough and hold on long enough, the dividend growth here could actually end up providing you with a fairly substantial income stream in the future.

You are also getting an easy-to-understand investment, since the index the Vanguard Dividend Appreciation ETF tracks is far from being complex. The cost is also easy to appreciate, given the expense ratio is a modest 0.05%. Essentially, the ETF isn't doing a lot of heavy lifting in the stock selection process, but you aren't paying a lot, either.

What you definitely aren't getting here, however, is a huge income stream today. The ETF's dividend yield is around 1.7%. That's higher than the 1.2% you'd collect from anindex (^GSPC 0.78%) clone. But if you are looking to maximize the income you generate from your portfolio right now, well, there are far better choices out there. This highlights that the word "appreciation" is far more important with this ETF than the word "dividend."

The Vanguard Dividend Appreciation ETF does what it sets out to do

All in, if you are looking to maximize the income you generate today, buying the Vanguard Dividend Appreciation ETF will set you up to be disappointed. However, if you have a long time horizon, the mix of capital appreciation and dividend growth here could set you up for a solid outcome when you eventually retire.