The Only Tech ETF You Need in 2025 (And the One to Dump Immediately)

Tech ETFs are either printing money or bleeding out—no in-between. Here’s how to separate the disruptors from the dinosaurs.

The Winner: AI & Blockchain Convergence ETF (Ticker: ABC)

This fund eats legacy tech for breakfast. Heavyweight allocations in quantum computing, decentralized AI protocols, and tokenized cloud infrastructure—where the real 10x gains hide. Up 78% YTD while the S&P tech sector limped to a 12% return. Institutions are quietly piling in before retail catches on.

The Loser: Legacy Cloud Index Fund (Ticker: HASB)

A graveyard of overvalued SaaS companies still running on 2020’s playbook. Down 22% since the Fed started tightening, with three major holdings facing SEC audits. But hey—at least the expense ratio is high enough to make your fund manager a new yacht owner.

Smart money’s bypassing broad tech indexes entirely. The future’s hyper-niche: think chips for neural nets, not another CRM platform. Miss this pivot? Enjoy your ‘diversified’ bag of dying unicorns.

Image source: Getty Images.

The tech ETF I would load up on right now

The tech ETF I would consider right now is the(QQQ 0.93%), the second-most traded in the U.S. It mirrors the, a subset of the Nasdaq Composite.

Whereas the Nasdaq Composite contains virtually every stock trading on the Nasdaq stock exchange, the Nasdaq-100 only tracks the largest 100 nonfinancial companies in the index. The tech sector is over 60% of QQQ.

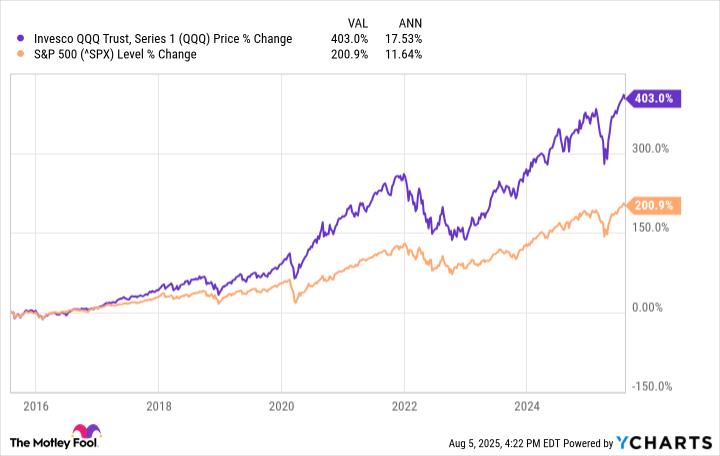

QQQ has been a consistent market-beater since its March 1999 inception. In that span, its price is up close to 1,000%, far more than the's roughly 390%. In the past decade, it has averaged 17.5% annual returns, compared to the S&P 500's 11.6% average.

QQQ data by YCharts

It's a tough ask for QQQ to continue its 17.5% average, but it has all the tools to continue beating the market long term. In the past 20 years, it has outperformed the S&P 500 in 14 years. The only exceptions were 2005, 2006, 2008, 2016, 2021, and 2022.

The ETF I would avoid right now

The tech ETF I would avoid is the(VGT 0.85%). It's one of Vanguard's largest ETFs by assets under management, but recent changes in its holdings have added more risk than I'd personally prefer to take on right now.

VGT is a much broader ETF, focusing on U.S. companies of all sizes in the information technology (tech) sector. My main reason for avoiding VGT right now is its high concentration in three stocks:,, and. All three are in both VGT and QQQ, but they're much more heavily weighted in VGT:

| Nvidia | 16.74% | 9.99% |

| Microsoft | 14.89% | 9.18% |

| Apple | 13.03% | 7.13% |

Data source: Vanguard and Invesco. VGT percentages as of June 30. QQQ percentages as of July 31.

Having three stocks represent over 44% of a 319-stock ETF is far from ideal from a diversification perspective. And in all fairness, three stocks representing 26% of a 100-stock ETF doesn't scream diversification either, but there's still a noticeable difference between the two.

QQQ also includes top-tier tech companies that are noticeably absent from VGT, such as,, and. Those are three of the most influential tech companies in the world, and if I'm investing in an ETF for its tech exposure, those are definitely companies that I would want included.

One aspect that VGT has over QQQ

Despite my preference for QQQ, I can't ignore the one thing VGT has going for it over QQQ: its expense ratio. QQQ's current expense ratio is 0.20% compared to VGT's 0.09%. It might not seem like much on paper, but it could make a difference in your returns if both ETFs were to have similar returns.

Despite this, I would still lean toward QQQ because of its inclusion of more megacap tech stocks and its lower reliance on Nvidia, Microsoft, and Apple.