The Smartest Dividend ETF to Buy With $2,000 Right Now (August 2025)

Dividend ETFs are having a moment—but this one stands out from the herd.

Why settle for mediocre yields when you can deploy $2,000 strategically?

Forget the hype around meme stocks and overpriced tech plays. This ETF delivers consistent cash flow without the volatility—something Wall Street's algo-traders still can't seem to grasp.

How it works: By focusing on companies with sustainable payout ratios and growth trajectories, this fund bypasses the dividend traps that sink retail investors. No flashy promises—just cold, hard compounding.

The kicker: It’s quietly outperformed the S&P 500’s dividend aristocrats for three straight years. But don’t expect your broker to mention it—they’re too busy pushing high-fee actively managed funds.

Time to put that $2,000 to work. Before the herd catches on.

Not all dividend ETFs are the same

Contrary to an easy-to-make assumption, not all dividend ETFs are the same. Indeed, they're surprisingly different. Take the(VYM 0.55%) and the(SDY 0.03%) as an example.

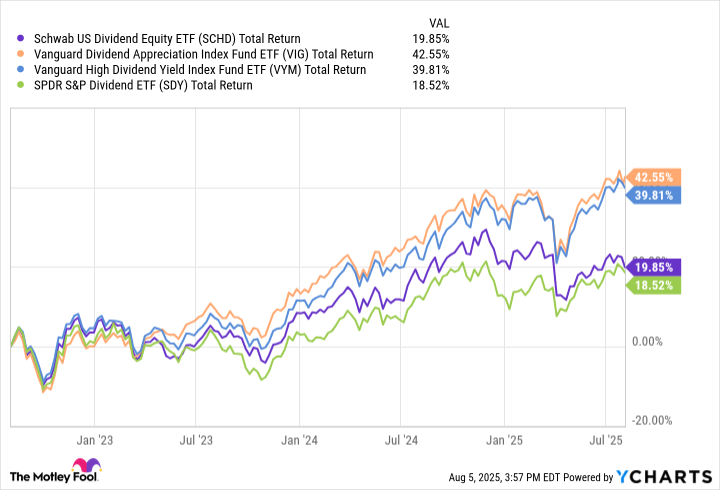

The Vanguard fund is meant to mirror the performance of the FTSE® High Dividend Yield Index, while the SPDR fund is based on the similar S&P® High Yield Dividend Aristocrats™ Index. (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC.) And both sport yields of just under 2.6% right now. Over the course of the past five years, however, the Vanguard fund has performed about 40% better than SDY whether or not you factor in these funds' respective dividends.

The(SCHD 0.49%) is similar in that its underlying Dow Jones U.S. Dividend 100™ consists of dividend stocks that have no particular dividend-growth requirement, but are high-yielding names of good quality all the same. Its trailing yield stands at a markedly higher 3.9% in fact. But it's lagged SDY as well as VYM for a while now, again with or without its dividends being counted in its performance.

SCHD Total Return Level data by YCharts

The best all-around performer for the past five years has actually been the(VIG 0.54%), based on the S&P U.S. Dividend Growers Index. This index prioritizes consistent dividend growth, requiring a minimum of 10 years' worth of rising annual payouts.

In fact, yields aren't part of its selection methodology, other than to exclude the market's highest-yielding names from this index. Why? Standard & Poor's rightfully worries that high yields are often an indication of trouble for a company, reflected by that company's stock's poor performance. To this end, VIG's trailing dividend yield currently stands at a mere 1.65%, lowered by the fund's market-leading gains since 2023.

But the question remains, which of these exchange-traded funds would be the smartest dividend ETF to buy with a couple thousand bucks right now? It's the Schwab U.S. Dividend Equity ETF. Here's why.

The pick of the litter for what's waiting on the horizon

Don't panic if you already own one of the other three funds, or a different dividend ETF altogether. You're hardly doomed. If you've got room and reason to add a new income investment to your portfolio at this time though, Schwab's SCHD is a top choice. And not necessarily for the reason you might think.

Yes, its yield of nearly 4% is better than you'll find with most other dividend stocks and ETFs. That's not the crux of the bullish argument though. That's just a side effect of this fund's subpar performance since 2023. The Schwab U.S. Dividend Equity ETF is a top prospect right now because the big reason for its recent underperformance may be about to reverse. That's a shift from an environment that favors growth stocks to one that favors value stocks, and dividend stocks in particular.

All four of these funds are more value funds than not, to be clear. Even among these four value-oriented funds though, SCHD is by far the most value-oriented. The average price-to-earnings ratio of its holdings is a mere 16.3, which is well under the P/E ratios of VYM, SDY, and VIG's sky-high average earnings multiple of 25.5.

And this has mattered of late -- a lot. Value stocks like the Schwab U.S. Dividend Equity ETF's,,, andhave struggled specifically because investors have been so enamored with growth for the past couple of years, at the expense of value stocks.

Many of the factors that favored growth names over value are starting to unravel though, chief among them being the waning euphoria surrounding artificial intelligence stocks. Investors still love them, but they're at least starting to ask questions about profitability, and at least questioning outrageous valuations.

Meanwhile, economic lethargy, lingering inflation (especially as it relates to housing), and tepid job growth all work against growth, which works in favor of value stocks.

Image source: Getty Images.

Then there's the far bigger reason taking on new positions in dividend-paying value investments makes good sense at this time. That's the possibility of a prolonged period of poor performance from the overall market.

Vanguard's most recent long-term outlook puts things in alarming perspective, suggesting the U.S. stock market is only APT to see average annual growth of between 3.3% and 5.3% for the next 10 years, with growth stocks likely to see even weaker returns than that.puts the figure at a slightly better 5.6%, aligning with brokerage firm's expectation for an average yearly return of only 6% for the coming decade. But that's still weak.

The underlying bearish arguments hold water though. Most of these troubling predictions cite inflation, trade uncertainties, and labor woes as reasons for the below-average returns, along with the unusually high valuations of most growth stocks right now. If these outlooks are anywhere close to being on target, cash dividends (and the stocks capable of paying them) will become very valuable indeed.

No rush, but don't tarry either

Don't read too much into the message too quickly. While we may see a shift from an environment that favors growth stocks to an environment that favors dividends and value stocks, it will likely be a gradual shift that plenty of tickers will be able to defy -- at least, for a while. There's no need to dump your entire portfolio here and go all-in on a single ETF, or even several different dividend-paying exchange-traded funds.

But, it also wouldn't be crazy to start proactively moving your portfolio in this direction, even without knowing exactly when -- or even if -- this change is brewing. If you wait until it's crystal clear that you should, you've arguably waited too long.