Billionaire Bill Ackman’s Top 5 Stock Picks Revealed – Where’s He Betting Big in 2025?

Wall Street's favorite contrarian is doubling down on these market dominators.

Billionaire investor Bill Ackman isn't playing defense—his portfolio screams conviction in these five heavyweight stocks. While most fund managers chase index-hugging returns, Pershing Square's chief is placing billion-dollar bets on companies rewriting the rules of their industries.

From cloud computing titans to pandemic-proof consumer staples, Ackman's picks reveal a razor-sharp focus on cash flow monsters. One thing's clear: he's not wasting time on speculative moonshots when compounders keep printing money.

Funny how these 'active managers' always end up owning the same mega-caps as passive ETFs—just with higher fees.

Image source: Getty Images.

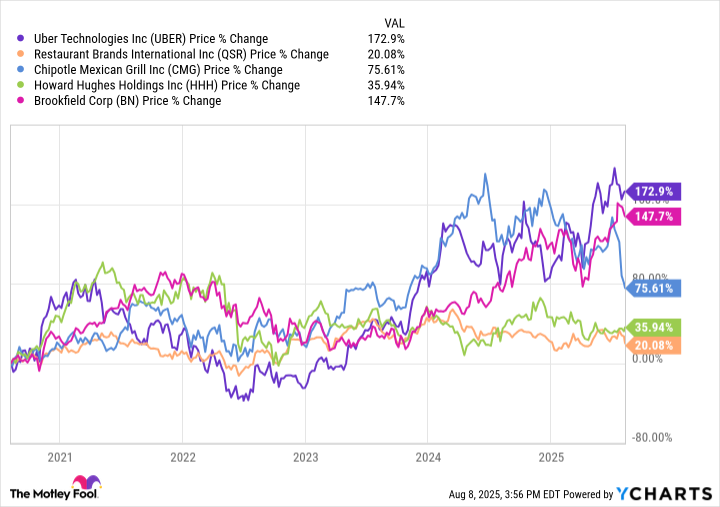

1. Uber Technologies (18.5%)

(UBER -3.30%) is the world's largest ride-sharing company and also offers food delivery and freight transport services. Uber enjoys the benefits of network effects and a large global footprint and sees huge potential in autonomous vehicles. Ackman believes Uber stock could even double over the next three to four years.

2. Brookfield Corp (18.01%)

(BN -0.34%) owns a 73% stake in. The alternative asset manager invests in renewable energy, real estate, infrastructure, and business and industrial services. Ackman is excited about Brookfield's goals to grow annual earnings per share by 20% and generate $47 billion in free cash FLOW over the next five years.

3. Restaurant Brands International (12.85%)

(QSR -0.88%) owns Burger King, Tim Hortons, Popeyes, and Firehouse Subs. It operates over 32,000 restaurants worldwide, primarily through franchisees. Ackman sees strong long-term growth potential in Restaurant Brands, which aims to grow same-store sales and systemwide sales by over 3% and 8%, respectively, between 2024 and 2028.

UBER data by YCharts.

4. Howard Hughes Holdings (11.71%)

Ackman has been involved with(HHH 1.20%) since its formation in 2010 after a spin-off and now owns a 46.9% stake in the real estate developer. Ackman now wants to convert Howard Hughes into a diversified holding company akin to Warren Buffett's.

5. Chipotle Mexican Grill (9.07%)

(CMG -2.87%), known for its burritos and tacos, owns over 3,800 restaurants. Chipotle is now expanding globally and rolling out new technologies. Although Brian Niccol, who was monumental in Chipotle's growth, quit as the CEO in 2024, Ackman believes the present management under new CEO Scott Boatwright will continue to deliver.