Move Over ’Magnificent Seven’—The ’Ten Titans’ Are Dominating 2025’s Tech Revolution

The era of the 'Magnificent Seven' is over. Welcome to the age of the 'Ten Titans'—the unstoppable forces reshaping tech, finance, and everything in between.

These giants aren’t just leading; they’re rewriting the rules. From AI to blockchain, their influence is everywhere—whether Wall Street likes it or not.

And let’s be honest: if your portfolio isn’t paying attention yet, it’s already behind. (But hey, traditional finance always needs a few stragglers to make the rest of us look good.)

Image source: Getty Images.

The Broadcom blunder

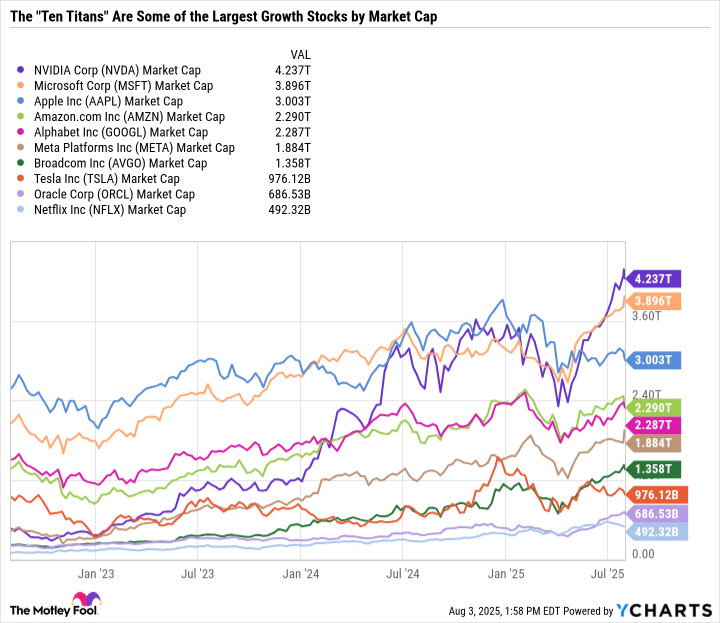

The biggest flaw of the Magnificent Seven is that it doesn't include Broadcom. It's up about 450% in the last three years, which has pole-vaulted its market cap well over $1 trillion.

Data by YCharts.

Based on market cap, it deserves to be included in the Magnificent Seven over Tesla. However, some folks may prefer the diversification that Tesla brings to the table with electric vehicles, renewable energy, robotics, and artificial intelligence (AI). And some may argue that it's redundant to include both Nvidia and Broadcom since they're both chip giants, but Broadcom has a much different business than Nvidia.

Nvidia generates the vast majority of its profits by selling graphics processing units and associated hardware and software to data centers. Like Nvidia, Broadcom makes AI chips, and AI is its fastest-growing segment, making up around 30% of total revenue in its latest quarter. But the bulk of Broadcom's business is not directly tied to AI.

End markets include networking, cybersecurity, storage, broadband, wireless, infrastructure software, and more. In fact, Broadcom was considered a dividend-paying value stock before its recent boom -- similar to another high-yield semiconductor stalwart,.

Another "value" stock turned growth stock

Not long ago, Oracle was seen more as a mature tech stock with an entrenched legacy business and limited upside potential. Investors were more excited about hotter software stocks like,,, and. However, Oracle has completely transformed its business, integrating cloud infrastructure as a complement to its foothold in database software and enterprise applications.

Oracle has carved out a growing role in the cloud that is uniquely different from Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Oracle's hybrid and multicloud strategy integrates with the major cloud players, which allows customers to use Oracle's database advantages even if they're with another cloud provider.

Oracle Cloud Infrastructure (OCI) offers some advantages over AWS, Azure, and Google Cloud, including lower prices in some cases, more AI tools, and vertical integration with the company's other database services.

Some drawbacks of OCI are that it has a smaller ecosystem with fewer preset tools for developers. However, Oracle is growing faster than the major players with a 27% year-over-year cloud revenue increase in its most recent quarter, including a 52% rise in cloud infrastructure revenue.

Like Broadcom, Oracle is a great addition to the Ten Titans because it's a highly diversified company that's playing a growing role in AI.

FAANG's anchor is a worthy addition to the Ten Titans

Netflix was an integral part of FANG and FAANG, but it fell out of favor for a while as it underperformed the broad market. The streaming company is now worth around half a trillion dollars, which has catapulted it to the top 20 S&P 500 companies by market cap.

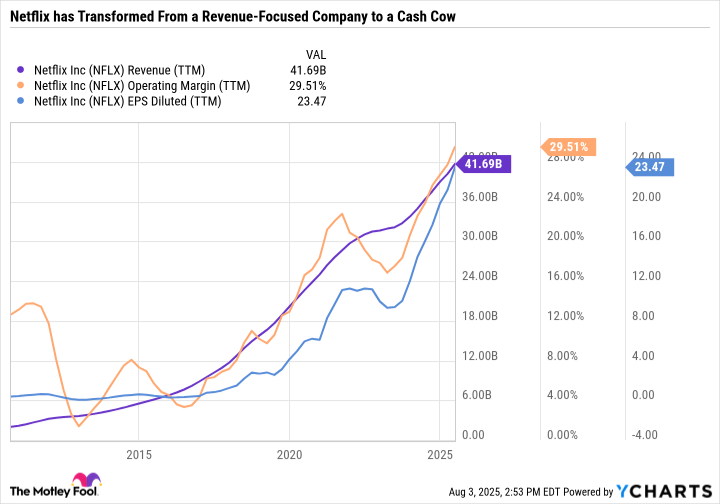

Netflix has pulled back from its recent highs, but the stock has still crushed the S&P 500 year to date. A big reason for its rebound in recent years is its improved cost management and more purposeful spending.

A major problem with the business in the past was the boom-and-bust nature of its earnings. The company WOULD steadily grow subscribers, but it would overspend on content and have dry spells without major success.

As you can see in the following chart, Netflix spent most of the 2010s being inconsistently profitable. But over the last five years, profits have skyrocketed and its operating margin continues to climb in lockstep with revenue.

Data by YCharts; TTM = trailing 12 months.

The company has revolutionized entertainment and remains the Gold standard in streaming, despite tons of new competition. A lot of that success comes down to its ability to balance the quantity and quality of content it produces.

It's time to add some all-stars to the team

Expanding the Magnificent Seven to the Ten Titans corrects for the blatant error of Broadcom's omission and includes massively important growth stocks in Oracle and Netflix. Over the next three to five years, it wouldn't be surprising if all of the Titans were worth over $1 trillion due to their industry leadership and runways for growth.

With a combined weighting of 37.7% of the S&P 500, the Ten Titans offer investors a useful way to track the top growth stocks that can really MOVE the major indexes and keep tabs on prevailing themes that are driving the market.