Palantir Stock Is Soaring—But Here’s the Glaring Red Flag Keeping Investors Away

Palantir’s stock rockets while skeptics whisper 'overvalued'—again.

Bulls cheer the AI hype, but the fundamentals? Not so shiny.

Here’s why smart money might be sidestepping this tech darling.

Volatility alert: When the algos stop buying, who’s left holding the bag?

Bonus jab: Another 'disruptive' tech stock trading like a meme coin. Surprise.

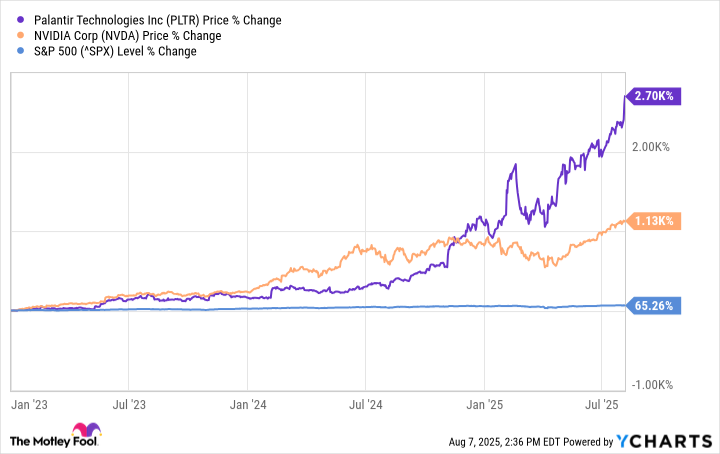

Data by YCharts.

Where Palantir's financials stand

Palantir's Artificial Intelligence Platform (AIP) has been a major reason for its recent financial success. AIP is a platform that allows organizations to run generative AI and large language models (LLMs) within their own operations, and it's been a hit for Palantir's commercial business.

In the second quarter (Q2), Palantir's U.S. revenue increased 68% year over year to $733 million, with U.S. commercial revenue being the fastest-growing segment, increasing 93% year over year to $306 million. Palantir's commercial segment still trails behind its U.S. government segment, which grew 53% to $426 million last quarter, but it's catching up with hundreds of new deals. In Q2, the company achieved its highest-ever quarter of U.S commercial total contract value of $843 million, up 222% year over year.

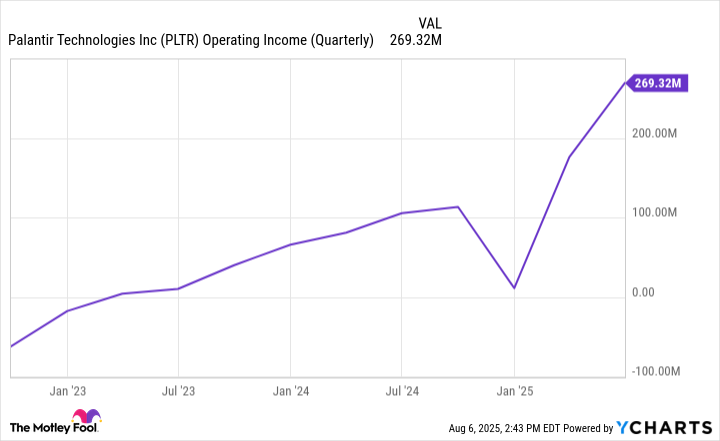

Arguably more impressive, however, is the growth in Palantir's operating income, which reached $269 million last quarter. Just two years ago, in Q1 2023, the company achieved its first quarter of operating profits with $4.1 million.

Data by YCharts.

On the top line, Palantir achieved its first $1 billion quarter in Q2 and has seemingly locked in consistent profitability. That's an incredible amount of financial progress in such a short period of time.

Here's why I would avoid Palantir stock right now

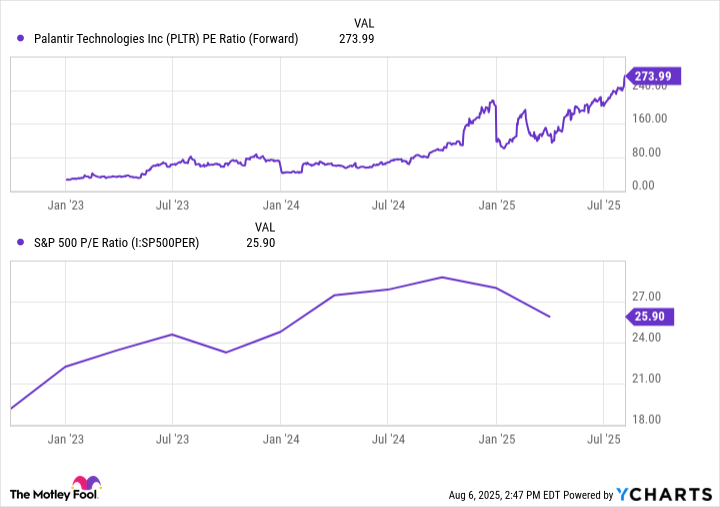

The biggest issue I have with Palantir is its absurdly high valuation. As of Aug. 6, the stock is trading at close to 274 times forward earnings.

To put that into perspective, the current forward price-to-earnings (P/E) ratio of theis around 26, and the P/E ratio of the S&P 500 tech sector is just above 38. Even Nvidia, which is growing earnings at a faster pace than Palantir, is trading at 41 times forward earnings, and that's already expensive by most standards.

Data by YCharts.

If the company's rapid revenue growth has you focused on the top line, Palantir's price-to-sales (P/S) ratio is similarly problematic. Trading at 132 times sales, the stock is 47 times more expensive than the S&P 500, and it's by far the most expensive company in the index.

Even with Palantir's recent success, there's no way to logically justify its valuation. It has become increasingly disconnected from reality, even by tech growth stock standards, which are known for stretched valuations as investors anticipate rapid earnings growth.

The high valuation doesn't make Palantir a bad stock to have in your portfolio; it just makes it a bad time to start a position in the stock. Anything less than perfect execution going forward could cause a sharp and sudden sell-off. Investors saw it happen earlier this year with the stock losing nearly a quarter of its value from Feb. 18 to Feb. 25.

It's impossible to predict how the stock will perform in the NEAR term, so I won't recommend waiting until the stock pulls back so you can buy on the dip. But I would recommend dollar-cost averaging and gradually acquiring shares if you're a believer in Palantir's long-term potential. This could help hedge your position against any sudden drops in the stock price.