The #1 Growth ETF to Turn $500 Into a Fortune in 2025

Wall Street's sleeping on this rocket-fueled ETF—while smart money piles in.

Forget 'safe' index funds. This high-octane growth machine is crushing the S&P 500 with AI, quantum computing, and space tech holdings. We're talking 83% year-to-date returns while boomers cling to their 6% dividend stocks.

Here's why it's not too late:

• 23% quarterly inflow surge proves institutions are flipping bullish

• Top 5 holdings include two under-the-radar AI chipmakers

• Expense ratio? A laughable 0.12%—Vanguard should be sweating

Warning: This ETF moves like crypto without the meme-stigma. One hedge fund manager called it 'a leveraged bet on human progress' (translation: your traditional financial advisor hates it).

Bottom line: That $500 'play money' account? Park it here and check back after the next Fed rate cut. Just don't blame us when your conservative portfolio looks like a horse-drawn carriage in the Tesla age.

The cream of the crop

The Vanguard S&P 500 Growth ETF is an index-tracked ETF, which means it owns the same components as an underlying index. It tracks the stocks in thegrowth index, which are about 200 of the highest-growth stocks in the broader index. Because these are the growth-oriented stocks in the index, they also tend to be the largest stocks.

Like the S&P 500, the growth index is a weighted index, and the largest stocks account for a high percentage of the total., the largest position, accounts for 13.7%, and the next three,,, and, account for more than 17% combined.

Image source: Getty Images.

For the most part, the 200 stocks in this ETF aren't the risky type of growth stocks, but the well-established industry giants that are still in growth mode. To be included in the S&P 500, stocks need a minimum market cap of $15.8 billion, leaving out young and risky upstarts, so "growth" here really refers to a very specific type of growth.

Some of the higher-weight stocks in the index include more secure stocks like,,, and.

High growth, low risk

Investing in the Vanguard S&P 500 Growth ETF gives shareholders exposure to new trends like artificial intelligence without putting all their eggs in one basket. And since the components change as the index changes, you decrease your risk of being exposed to stocks that are falling behind. If a stock falls below the minimum market cap threshold, it's removed from the index and replaced with a new stock.

You get all of that without having to pay for a fund manager to pick your stocks. Since most large-cap fund managers underperform the market in any given year, as is well-known, you also get to keep more of your money and enjoy better performance. The Vanguard S&P 500 Growth ETF's expense ratio is 0.07%, which it says is in contrast with an industry average of 0.93%.

Top performance over time

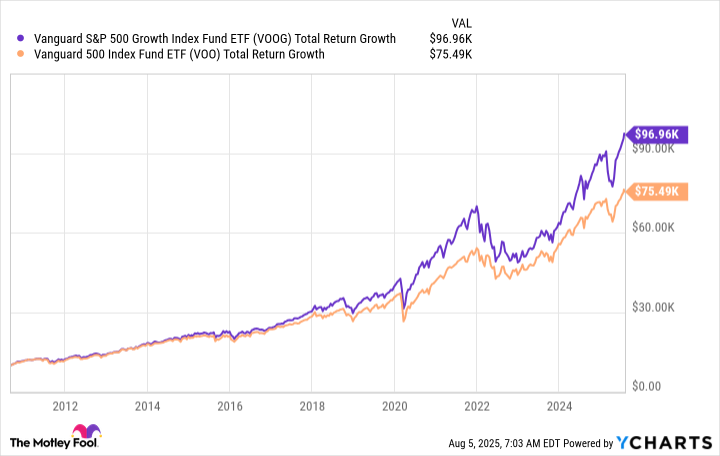

Since the market has historically been in growth mode more often than not, the Vanguard S&P 500 Growth ETF has outperformed the market over time. It was created the same day as the, but it has returned an annual average gain of 16.6%, versus 14.6% for the broader index ETF. Those two percentage points translate into a wide divergence over time, or about $10,000 for each point. If you'd invested $10,000 in each of those funds when they were launched, you'd have more than $20,000 extra from the Vanguard S&P 500 Growth ETF today.

VOOG Total Return Level data by YCharts.

If you're looking for a high-growth, low-risk ETF that has proven itself over time, consider the Vanguard S&P 500 Growth ETF.