Microsoft vs. Nvidia: The $5 Trillion Showdown – Who Takes the Crown?

The tech titans are locked in a high-stakes sprint to a $5 trillion valuation—but only one can cross the line first. Here’s the brutal breakdown.

### The AI Arms Race Heats Up

Nvidia’s chips power the AI revolution, but Microsoft’s cloud empire hoards the data. Both are printing money—just differently.

### Valuation Vertigo

$5 trillion isn’t just a number—it’s a gravitational pull distorting Wall Street’s reality. Analysts whisper ‘bubble’ but keep buying.

### The Cynic’s Corner

Let’s be real: whoever ‘wins’ will just trigger another round of stock splits—because nothing says ‘moonshot’ like retail investors chasing crumbs.

Image source: Getty Images.

Microsoft and Nvidia are succeeding thanks to a few shared tailwinds

Microsoft has become one of the most prominent tech giants, and offers a wide variety of products ranging from business software to cloud computing to gaming devices. However, the show's focus is clearly on its Intelligent Cloud division, led by Azure, its cloud computing service.

Azure is seeing massive growth as Microsoft has become the top platform for building cloud workloads. Cloud computing can run traditional business workloads like data processing, information storage, or website hosting, but it's also useful for running AI workloads. The dual tailwind that cloud computing is receiving is impressive and will likely be around for many more years.

When a company like Microsoft builds new cloud servers to meet demand, they're often filled with computing hardware from Nvidia. Nvidia's graphics processing units (GPUs) are best in class and are extremely flexible for running various workloads. This flexibility makes them ideal for data centers, as the same computing units can run various workloads when needed.

Nvidia has GPUs for multiple use cases, but its biggest by far is data centers. Thanks to the same tailwinds that are increasing demand for cloud computing and AI, Nvidia expects data center capital expenditures to rise from $400 billion in 2024 to $1 trillion by 2028. This bodes well for Nvidia's growth story and shows that it can continue rising at its rapid pace.

Both Nvidia and Microsoft have solid growth stories, but what do the numbers say?

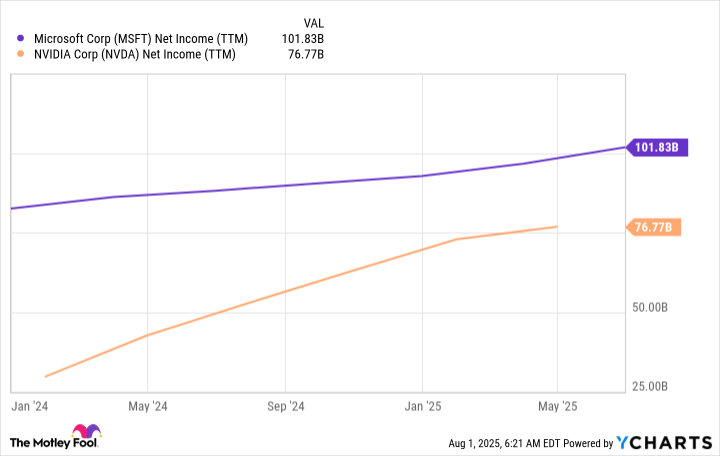

Microsoft appears to produce more profits than Nvidia

If you look at how much income each company is generating, it's clear that Microsoft has a head start over Nvidia.

MSFT Net Income (TTM) data by YCharts

However, a few factors are holding Nvidia back. First, Q1 had poor net income numbers because the U.S. revoked its export license to China. Nvidia has reapplied for that license with assurances that it will be approved. Still, the lost sales of Nvidia's H20 chips will harm its net income figures in both Q1 and Q2. Second, Nvidia hasn't reported Q2 results yet (it's due to report them later this month), so Microsoft has a bit of a head start that way.

Last, and likely the most important, Nvidia is growing much faster than Microsoft. In Q4 of fiscal 2025 (ending June 30), Microsoft's net income ROSE 24%. Considering Microsoft's size and maturity, that's impressive growth, and investors shouldn't have any qualms with the results Microsoft delivered. However, Nvidia's net income increased by 26% in Q1 fiscal year 2025 (ending April 27), despite being severely hampered by a write-off of H20 chips.

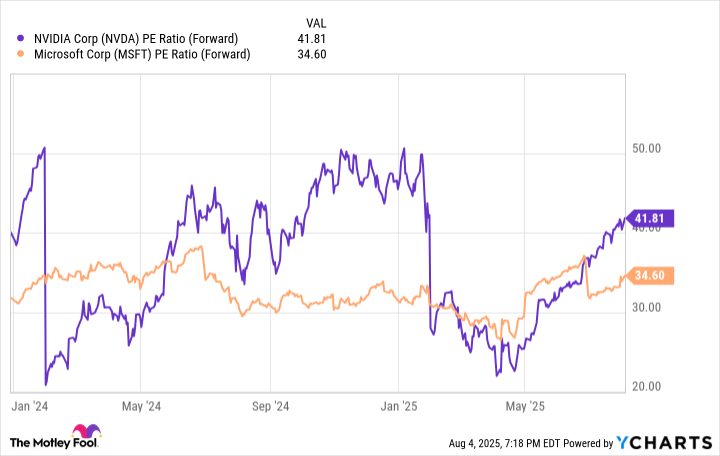

With Nvidia expected to grow earnings faster than Microsoft, it has a slight premium to Microsoft.

NVDA PE Ratio (Forward) data by YCharts

This premium is why Nvidia is worth more than Microsoft despite having a smaller net income.

Because of Nvidia's faster growth rate and premium valuation, I think it will likely beat Microsoft to the $5 trillion mark. While Microsoft's growth is impressive, it's still slower than Nvidia's, despite Nvidia's results being hampered. I think both stocks are excellent companies to own at these points, but Nvidia still has the edge.