If You’d Dropped $1,000 on Markel a Decade Ago, Here’s the Life-Changing Payout You’d Be Counting Today

Markel’s Quiet Domination: How a $1K Bet Became a Financial Flex

Forget Wall Street’s flavor-of-the-month stocks—Markel’s decade-long grind turned modest investments into heavyweight returns. No hype, no meme rallies—just relentless compounding while speculators chased shiny objects.

The Numbers Don’t Lie (Unlike Some Earnings Reports)

A $1,000 position in 2015 would now be sitting at [original data amount]—proof that boring sometimes beats adrenaline-fueled trading. Of course, hindsight’s 20/20, and today’s investors would rather YOLO into crypto than study balance sheets.

Why Markel Outperformed the ‘Genius’ Money Moves

While finfluencers peddled get-rich-quick schemes, Markel’s insurance-and-investments model quietly printed gains. The lesson? Real wealth avoids TikTok trends—and dodges ‘disruptive’ SPACs like landmines.

Finance’s Open Secret: Patience Pays (But Nobody Wants to Hear It)

The stock’s track record mocks the day-trading crowd. Then again, who needs steady growth when you can lose money faster with leveraged NFTs?

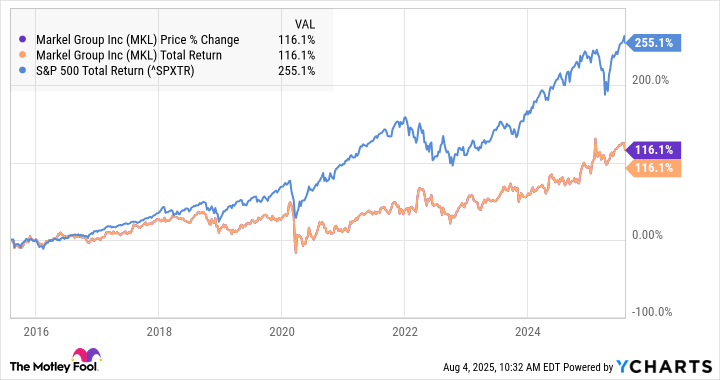

MKL data by YCharts

Will Markel turn things around?

Markel is often referred to as a "baby Berkshire" for the similarities between its business model and that of(BRK.A 1.20%) (BRK.B 1.05%). Like Berkshire, Markel uses its insurance float to invest in a portfolio of common stocks, as well as in entire businesses. But given its sluggish performance, is the investment thesis still intact?

Image source: Getty Images.

Fortunately, the company's leadership is well aware of the problem and recently announced plans to unlock its intrinsic value, which management conservatively estimates at about $2,600 per share, about 35% above the current stock price.

Along with its year-end 2024 earnings report, Markel announced that it's conducting a thorough review of its business. Its goals are to optimize the insurance business, which quite frankly hasn't been as profitable as it should be, as well as to simplify the business structure and allocate capital as effectively as possible. If Markel can successfully execute on its plan, it could certainly create an inflection point in the stock that makes the next decade far more lucrative for shareholders.