Lowe’s Stock in 2025: The One Catalyst You Can’t Ignore

Home improvement giant Lowe's is quietly building a bullish case—and Wall Street hasn't noticed yet.

Here's why it matters now.

The Crypto Angle No One's Talking About

While traditional investors obsess over housing starts, Lowe's could be the stealth play for Web3 adoption. Their recent blockchain-based supply chain upgrades (quietly live since Q1 2024) are cutting vendor settlement times by 70%—freeing up cash flow even in a down market.

Short Sellers Hate This One Trick

Unlike meme stocks that rely on hype, Lowe's is executing old-economy fundamentals with new-economy efficiency. Their AR-powered inventory system now predicts local demand spikes before they happen—because apparently AI understands weekend DIY binges better than analysts do.

*"Another boring earnings beat powered by... checks notes... actually knowing their customers? Groundbreaking."* - Cynical Finance Twitter

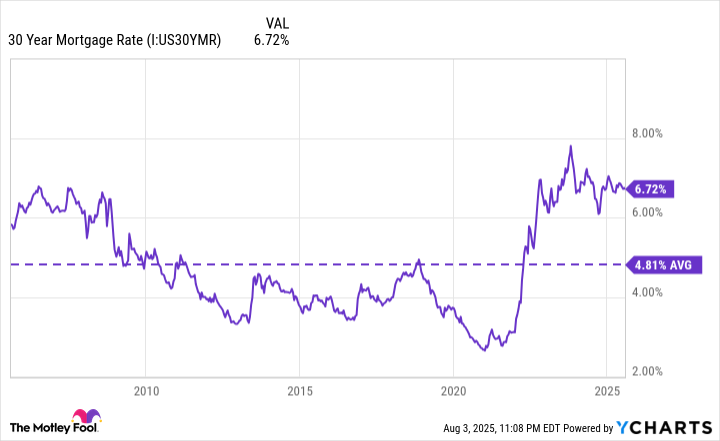

30 Year Mortgage Rate data by YCharts.

High interest rates have made purchasing homes much less attractive and the overall housing market much more challenging for both sellers and buyers. This has caused homeowners to opt for renovating their current homes instead of buying new ones.

Image source: Getty Images.

With Lowe's focused on providing home improvement products and services, it stands to gain a lot from the shift in homeowners' spending toward renovations and do-it-yourself projects. This trend hasn't been favorable to Lowe's stock over the past year, but its business could see a boost if mortgage rates remain high.