2 Explosive Growth Stocks to Buy Now and Hold Until 2035

The crypto winter thawed—now these picks are primed to run.

Disruptors doubling as cash printers

Forget blue chips. The real wealth-building plays hide in sectors Wall Street still misprices—where adoption curves outpace legacy valuation models. We’re talking protocols scaling like AWS in 2010 and tokens eating traditional settlement rails.

Why hodl beats trading

Day traders get rekt chasing 10% swings. The 100x gains go to degenerates who diamond-hand through volatility—just ask the Bitcoin pizza guy. (That $40 order? Worth $400M at ATH.)

The cynical kicker

Your financial advisor still thinks blockchain means ‘Scam 2.0’ while quietly buying GBTC in their Roth IRA. Don’t be the bagholder stuck with their 2% yield bonds when hyperbitcoinization hits.

Image source: Getty Images.

1. Amazon

(AMZN 3.97%) is a company that doesn't need much of an introduction. The online bookstore-turned-Swiss Army knife of businesses has long been one of the top growth stocks in the stock market -- and it still has room to go.

Amazon's e-commerce continues to be a cash cow, with its North America and international segments (which also include advertising, subscriptions, and third-party sellers) bringing in $100.1 billion (up 11% year over year) and $36.8 billion (up 16% year over year) in the second quarter, respectively.

E-commerce will continue to be Amazon's foundation, but the microscope has been and will continue to be on its cloud business, Amazon Web Services (AWS). Let's start with the positives of AWS. Although it was only 18% of Amazon's Q2 revenue, it continues to be the bulk of its profits (53% of its operating income).

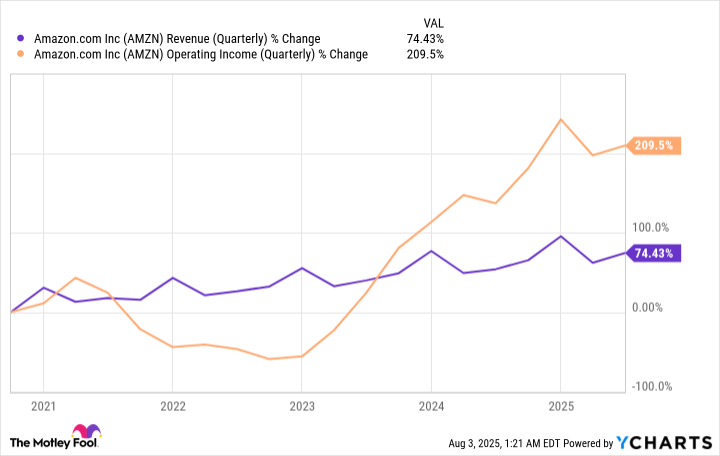

AMZN Revenue (Quarterly) data by YCharts.

The could-be-better news is that AWS is beginning to grow at a slower pace than smaller rivals like Microsoft's Azure and Alphabet's Google Cloud. AWS revenue grew 17.5% year over year to $30.9 billion, while Azure and Google Cloud increased revenue by 34% and 32% in their latest quarters, respectively.

AWS' modest growth seemed to disappoint investors, causing the stock to drop by over 8% in a single day. However, this dramatic reaction seems overdone, in my opinion. Although AWS is still the market leader, its size meant a slowdown was always likely.

If you're looking for a growth stock to hold on to for the long term, this recent drop in Amazon's stock gives it a much more attractive entry point, trading at 32.6 times forward earnings versus the 35.6 it was pre-drop. AWS is undoubtedly an important business for Amazon, but it has been actively (and effectively) expanding its business ventures.

2. CrowdStrike

Cybersecurity company(CRWD 2.20%) was in the news for all the wrong reasons last year after it was responsible for the worst IT outage in modern history. However, the company has remained resilient, and in July, the U.S. District Court of Western Texas dismissed a class action lawsuit against the company regarding the incident.

The reason to be excited about CrowdStrike over the next decade is twofold. First, CrowdStrike's cybersecurity solutions have proven they're some of the best in the industry. At the end of its fiscal first quarter, 48% of its customers used at least six of its modules (tools), 32% used at least seven, and 22% used at least eight.

This not only shows strong engagement, but it also helps CrowdStrike with retention because it's not easy for corporations to switch cybersecurity providers due to the logistical and financial costs involved in doing so. CrowdStrike ended the quarter with $4.4 billion in annual recurring revenue, up from $3.6 billion in the previous fiscal year's Q1.

Its operating income declined by $12 million year over year, but that can be attributed to higher sales and marketing costs to recover from the impact of the July 2024 IT outage. I don't see this as a continuing trend for the company.

The other reason is the overall growth and importance of the cybersecurity industry. Cybersecurity has become a necessity for virtually any business connected to the internet. CrowdStrike estimates its total addressable market for AI-native security solutions at $116 billion this year and reaching $250 billion in 2029.

CrowdStrike is fairly expensive, trading at 23.6 times its forward sales, but if you're planning to hold it for at least a decade, this alone shouldn't be a deterrent. If anything, I recommend taking the dollar-cost averaging approach, slowly but surely buying shares.