If You’d Put $1,000 Into EPR Properties (EPR) 5 Years Ago, Here’s What It’d Be Worth Now

Real estate trusts don’t usually scream 'rocket fuel'—but EPR Properties (EPR) might’ve surprised you.

Five years back, $1,000 parked in EPR would’ve taken a rollercoaster ride through pandemics, rate hikes, and mall apocalypses. Today? Let’s just say it’s not sitting in a savings account.

The Math (No Excel Required)

Commercial real estate got hammered—but EPR’s niche in experiential properties (think theaters, ski resorts) dodged the worst. Reinvested dividends? That’s where the magic happens.

Wall Street’s Amnesia Strikes Again

Analysts called it 'too risky' in 2020. Now? Those same firms are slapping 'outperform' ratings on it—classic rearview-mirror analysis. Meanwhile, retail investors who held on are quietly cashing checks.

Final thought: In a world where hedge funds chase memecoins, sometimes the boring bets age like fine wine. Or at least, better than a bank’s 0.01% APY.

Image source: Getty Images.

As you might have expected, EPR's stock tanked in 2020. At one point, it has fallen more than 80% from its prior high.

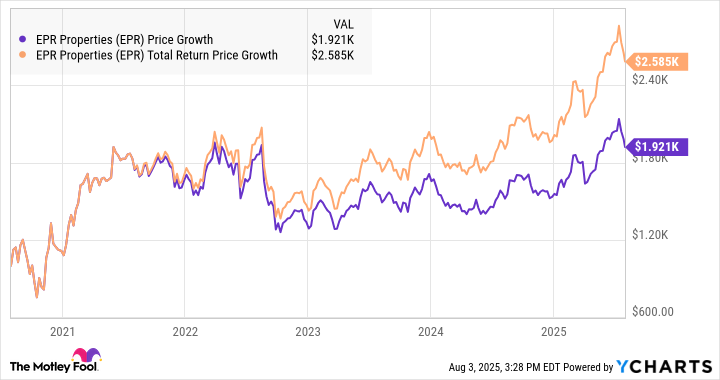

However, there was a major inflection point in late 2020 when vaccines were rolling out and investors saw light at the end of the tunnel. If you had invested $1,000 in EPR Properties five years ago (early August 2020), your investment WOULD have grown to nearly $2,600 today, thanks to a combination of stock-price gains and dividends, which EPR resumed paying in mid-2021.

EPR data by YCharts.

In fact, EPR has outperformed thebenchmark index by more than 50 percentage points over the past five years, and its performance translates to an annualized return of about 21%.

Could EPR Properties still be cheap?

Despite its excellent performance, EPR trades for a relatively cheap valuation of about 10.8 times its full-year guidance for funds from operations (FFO -- the real estate equivalent of earnings). There's still some uncertainty surrounding the future of the movie theater business, but the main reason is the persistent high-interest-rate environment.

If rates fall, it could create a more favorable growth environment for EPR to pursue its massive market opportunity. The stock could still be a bargain, despite its excellent performance.