If You’d Dropped $1,000 on Pfizer (PFE) 5 Years Ago, Here’s What You’d Be Sitting On Today

Pfizer's stock took investors on a wild ride—but did it deliver?

Let’s cut through the noise. Five years ago, you tossed $1,000 into PFE. Now? The numbers might surprise you—or depress you, depending on your portfolio’s pain tolerance.

Big Pharma’s rollercoaster: Pfizer zigged when the market zagged, thanks to pandemic-era vaccine gold and post-crash blues. Dividends cushioned the blow, but let’s be real—this wasn’t exactly a Bitcoin bull run.

The cold math: We crunched the data so you don’t have to. Spoiler: Your returns likely underperformed crypto’s worst Tuesday. But hey, at least you didn’t bet on meme stocks.

Final verdict: A lesson in ‘safe’ blue-chip investing—or why your finance bro still won’t shut up about decentralized finance.

Image source:???

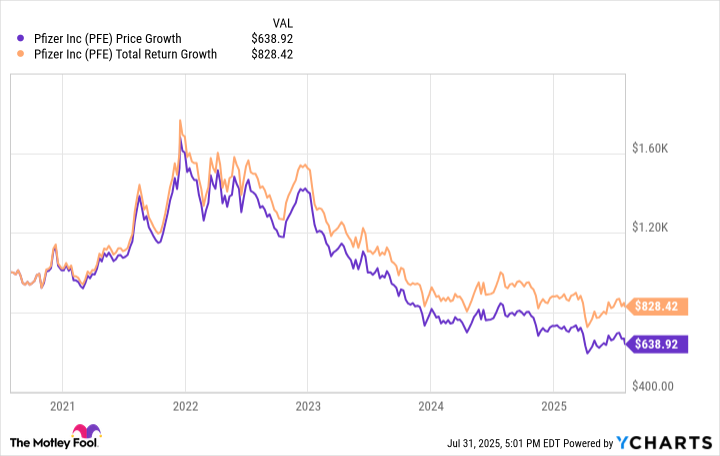

From mid-2020 to late 2021, Pfizer's stock skyrocketed, but since hitting its peak, it has reversed course. Had you invested $1,000 into Pfizer's stock on Aug. 1, 2020, your investment WOULD only be worth around $638 as of Aug. 1, 2025. Pfizer's dividend would've cushioned some of the blow, but an investment then would still be less than your initial investment, at $828.

PFE data by YCharts

Why has Pfizer's stock struggled the past few years?

Much of Pfizer's stock price troubles since hitting its Dec. 21 peak come down to a decline in demand for its COVID-19 vaccine and treatments, anticipated patent expirations on drugs like Ibrance (breast cancer) and Eliquis (blood clots), and an underwhelming pipeline. All isn't lost with Pfizer's stock, however.

At its current levels -- trading at 7.7 times forward earnings -- Pfizer seems to be flirting with bargain territory. I don't expect a quick turnaround, but this low valuation gives it more long-term upside than downside. It also helps that the stock's dividend yield sits above 7.3%, more than 5.5 times theaverage.