Figma’s IPO Exploded Like a Memecoin – Buy the Hype or Wait for the Dip?

Figma just pulled off the tech equivalent of a 100x altcoin pump – its IPO skyrocketed while Wall Street scrambled for buy buttons. But was this a fundamental breakthrough or just another overhyped asset riding FOMO?

The case for jumping in now:

First-movers are already stacking paper gains like DeFi degens during a bull run. The collaboration tool's enterprise adoption gives it more real-world utility than most crypto projects claiming 'disruption.'

Why patience might pay:

Every parabolic move needs a correction – just ask anyone who bought Bitcoin at $69k. Early lock-up expirations could flood the market with shares faster than a VC dumping token vesting periods.

One thing's certain: the bankers underwrote this deal knowing retail would ape in. Maybe they learned something from watching crypto markets after all.

Image source: Getty Images.

Figma's rapid ascent hasn't gone unnoticed by its larger competitors. In Sept. 2022,attempted to acquire Figma for $20 billion, but regulatory concerns scuttled the deal. Now, less than three years later, Figma is worth far more than that.

The stock hit another high of just under $143 per share on its second day of trading, but it rapidly reversed course on day three with a 27.4% decline. Considering Figma is still up 168% from its IPO price, what should investors do now?

Why many investors are chasing Figma stock's surge

According to a 2014 study published in the journal Behavioral Neuroscience, the human brain gets a hit of dopamine when presented with something new. That might explain the general love for IPO stocks from the investing community -- there seems to be an incessant desire for new businesses to go public.

However, the IPO market hasn't satisfied investors' cravings in recent years. After more than 1,000 IPOs in 2021, investors had below-average IPO years in 2022 and 2023. Things picked up slightly in 2024, but they are really heating up now in 2025. There have been over 200 IPOs year to date, and July was the hottest month so far.

Investors like the novelty, but Figma has also captured investors' imaginations because of its impressive business.

First, Figma is growing quickly. Revenue was up 46% year over year in the first quarter. It's not only finding new customers, but existing customers are also spending more money over time, as evidenced by its strong net dollar retention rate of 132%.

The company has a stunning gross profit margin of 91%. For perspective, this is even better than Adobe's gross margin of 89%.

Moreover, Figma co-founder and CEO Dylan Field has a history with Peter Thiel, an investor and entrepreneur who's helped launch many important businesses, including the current 20th most valuable company in the world,.

Between its high growth, strong margins, and valuable ties to Thiel, it's been easy for investors to jump on the Figma bandwagon, especially considering the demand for exciting IPO stocks.

Why it may be smart to wait

While the excitement around Figma stock is understandable, there's good reason for investors to wait patiently on the sidelines for now.

For starters, Figma's initial surge was almost a sure thing because of supply and demand. There are more than 400 million Class A shares of Figma following its IPO, but only about 42.5 million were offered to investors. This means the float for the stock is low, while demand is high, contributing to its stunning gains (and volatility). But the float will increase when the lock-up period expires, allowing insiders to put their shares on the market.

Furthermore, consider that CEO Field has an incentive package of 14.5 million Class B shares that are awarded as certain stock prices are achieved (based on a 60-day volume-weighted average). Despite the Aug. 4 sell-off, Field will qualify for three of the seven performance tranches if the stock price holds at these levels for two months. In such a scenario, Field will receive 45% of his incentive package -- originally intended to cover a 10-year performance period -- which will dilute shareholders.

Moreover, consider that at its current price, Figma stock trades at about 53 times trailing-12-month sales. Even for a business with strong growth and impressive margins, that's steep.

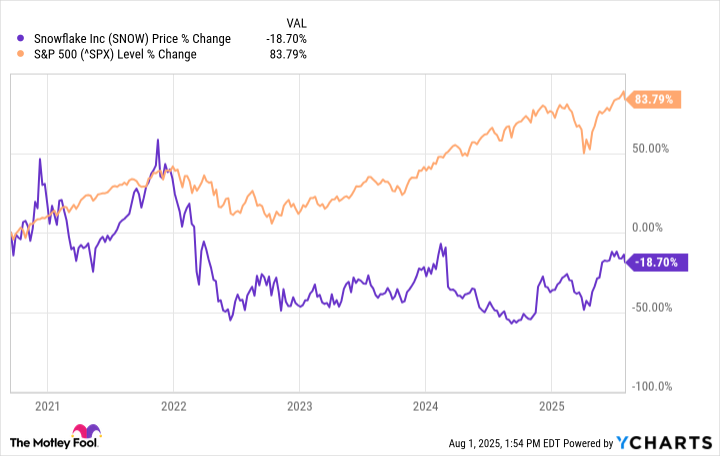

This situation reminds me of's IPO in 2020. It went public and quickly climbed to a valuation of well over 150 times sales. Since then, Snowflake's growth has been other-worldly, but nearly five years later, the stock is still down 18% from where it closed on its first day of trading because of how expensive it was at the time.

Data by YCharts.

As much as investors crave the dopamine rush of an exciting IPO, it may be best to wait for things to cool down for Figma stock. There's good reason to believe the current surge in the share price is only temporary, even if the business executes well.

Fortunately, investors don't need to buy an exciting IPO stock to make money in the stock market. Many well-established businesses are in a good position to generate strong returns for shareholders for years to come.