The Next $3 Trillion Titan: One Unstoppable Stock Poised to Join Nvidia, Microsoft, and Apple

Move over, tech giants—there's a new contender eyeing the trillion-dollar throne.

Forget 'too big to fail.' This stock isn’t just surviving—it’s rewriting the rules of market dominance. While Wall Street obsesses over Nvidia’s AI chips and Apple’s ecosystem, an under-the-radar player is quietly assembling the pieces for a historic run.

The $3 Trillion Club’s Bouncer Just Lost Its Guest List

No IPOs. No hype cycles. Just relentless execution that leaves analysts scrambling to update their price targets. The numbers don’t lie—this isn’t another meme stock fantasy.

Behind the Scenes: How Fundamentals Became the Ultimate Disruptor

While crypto bros chase the next shitcoin, this company’s doing something radical: printing cash. No blockchain required. (Take notes, 'Web3 visionaries.')

The Final Word: Bet Against This Stock at Your Own Peril

Market veterans know—when the smart money stops debating 'if' and starts arguing 'when,' the game’s already over. The only question left: How many hedge funds will be caught flat-footed?

Image source: Getty Images.

AI is supercharging Meta's business

Almost 3.5 billion people were using at least one of Meta's social media apps every day during the second quarter of 2025. As that figure approaches half of the global population, it will become harder to attract new users, which will have consequences for the company's advertising revenue in the future. However, Meta can also generate more advertising dollars by increasing the amount of time each user spends on its apps, and AI is central to that strategy.

Meta's recommendation engine uses AI to learn what type of content each user enjoys viewing, and then it feeds them more of it. CEO Mark Zuckerberg said this resulted in a 6% increase in the amount of time users spent on Instagram during the second quarter, and a 5% increase on Facebook. Simply put, the longer each user spends online, the more ads they see, and the more money Meta makes.

AI also boosts the efficiency of Meta's ad-recommendation model by targeting users more accurately, which led to a 5% increase in conversions on Instagram during the second quarter and a 3% increase on Facebook. Businesses will normally pay more money per ad when conversions are increasing, which is another big tailwind for Meta.

Higher engagement and more conversions sent Meta's second-quarter revenue soaring 22% year over year to $47.5 billion, which was comfortably above the company's forecast range of $42.5 billion to $45.5 billion. Management also issued bullish guidance for the third quarter (which ends on Sept. 30), telling investors the company's revenue could top $50 billion for the first time ever.

Zuckerberg says AI superintelligence is in sight

Meta launched its Llama family of LLMs in early 2023. They are open source so Meta leans on a community of millions of developers to troubleshoot technical issues, which is why they have caught up to the best closed-source models so quickly. The latest Llama 4 models now rival the most advanced releases from top start-ups like OpenAI and Anthropic.

Meta is using the Llama models to power new features across its social media apps, which is another way it's boosting engagement. The Meta AI chatbot, for instance, already has over 1 billion monthly active users who tap into its capabilities for homework assistance, image generation, and everything in between.

Zuckerberg says AI superintelligence -- which is when AI models surpass human intelligence by every metric -- is now in sight. Whoever reaches this milestone first could have a significant advantage over every other AI developer, which is why Zuckerberg recently established a new division called Meta Superintelligence Labs. Scale AI founder Alexandr Wang will lead the team, after selling 49% of his company to Meta in a $14 billion deal in June.

But achieving superintelligence won't be cheap. Meta allocated $17 billion to capital expenditures (capex) during the second quarter alone, most of which went toward building data center infrastructure and buying chips from suppliers like Nvidia. The company also increased its capex forecast for 2025; it now expects to spend between $66 billion to $72 billion, up from $64 billion to $72 billion previously.

The gigantic capex spending could dent Meta's profitability in the short term, but the company hopes it will lead to accelerated growth over the long run as AI (and potentially superintelligence) improves user engagement and ad conversions even further.

Meta has a clear path to the $3 trillion club

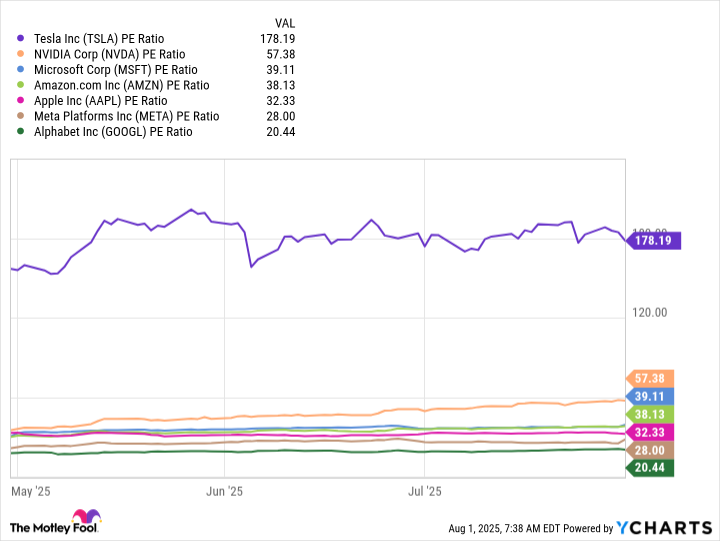

Fortunately, Meta's strong beat at the top line led to a very strong result at the bottom line during the second quarter. Its earnings per share (EPS) soared by 38% year over year to $7.14, crushing Wall Street's estimate of $5.92. It carried the company's trailing-12-month EPS to $27.62, which places its stock at a price-to-earnings (P/E) ratio of just 28.

That's a noteworthy discount to theindex, which is trading at a P/E ratio of 32.7, and it's an even steeper discount to the median P/E ratio of the "Magnificent Seven" stocks, which stands at 38.1. The Magnificent Seven (which includes Meta) is an elite group of technology companies operating on the front lines of the AI industry.

PE Ratio data by YCharts

Therefore, despite logging an eye-popping 200% gain over the last five years alone, Meta stock might still be undervalued. It WOULD have to rise by a further 36.1% just to trade in line with the median P/E ratio of the Magnificent Seven, which would catapult its market cap to almost $2.7 trillion. At that point, Meta's annualized EPS would have to grow by just 11% to push its market cap above $3 trillion.

Meta grew its EPS at a compound annual rate of 36% during the recent decade between 2014 and 2024. That growth rate is unsustainable over the long term for any company, but Meta's EPS soared at an above-trend pace of 37% during the first quarter of 2025, and then 38% in the second quarter, so it should have no trouble mustering 11% growth over the next year or two.

Even if Meta's P/E ratio holds steady at 28 -- which I predict is unlikely because it seems so cheap -- it's only a matter of time before the company's rapid earnings growth carries it into the exclusive $3 trillion club.