Take-Two Interactive (TTWO) Stock: Buy Before August 7? History Drops a Clue

Wall Street's favorite casino game—timing the market—gets another spin with Take-Two. Will the dice land in your favor?

The August 7 Phenomenon

Every trader’s guilty pleasure? Hunting patterns in chaos. TTWO’s pre-earnings dance has a backstory—but past performance is just a fancy term for 'luck in hindsight.'

GTA Hype vs. Reality

Rockstar’s parent company rides the GTA VI rumor mill like a bull. Yet quarterly reports cut through hype faster than a speedrunner glitches through textures.

The Cynic’s Take

Remember: 'Historical trends' are what analysts call their educated guesses after three espresso shots. Bonus tip—if history guaranteed profits, we’d all be retired on meme-stock gains.

Image source: The Motley Fool.

Take-Two's business performance has supported big stock gains

Take-Two has seen valuation volatility in conjunction with its earnings reports in the recent past, and performance has been mixed when it comes to immediate near-term stock performance following the company's quarterly updates. On the other hand, taking a buy-and-hold approach to Take-Two stock ahead of a quarterly report from virtually any earnings release dating back to the summer of 2022 would have put shareholders in the green with their investment. That doesn't necessarily guarantee that Take-Two will perform well after its next quarterly report or over the long term, but solid business results and strong positioning in the gaming industry have generally helped support valuation gains for the publisher.

What will be the biggest post-earnings drivers for Take-Two stock?

While the company's sales and earnings performance in fiscal Q1 can be expected to have some impact on where the stock goes after the earnings report, updates on the company's release pipeline could be even bigger catalysts. Most crucially, investors will be looking to see what Take-Two has to say about the release of GTA VI. The video game is by far the most important upcoming release in the company's lineup, and it's the centerpiece when it comes to valuing Take-Two stock right now.

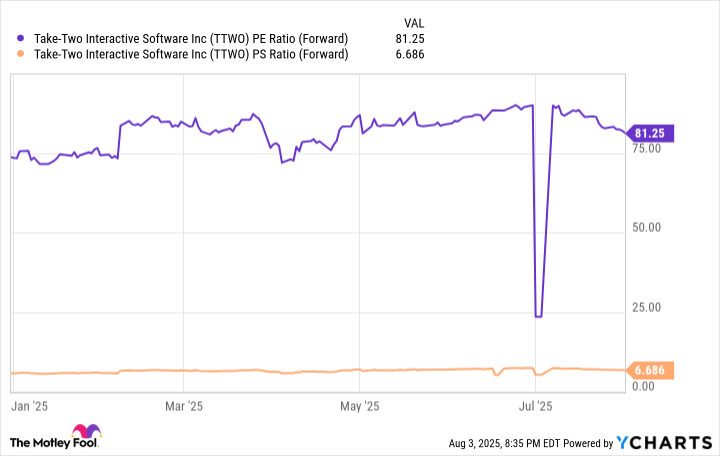

TTWO PE Ratio (Forward) data by YCharts

Trading at roughly 81 times this year's expected earnings and 6.7 times expected sales, Take-Two Interactive could look highly overvalued for a company that saw revenue grow just 5% annually in its last fiscal year and as its net loss expand to $4.48 billion from $3.74 billion in the previous year. On the other hand, the company's business still has a high degree of cyclicality ,and there's a very good chance that nothing will be more important for the stock over the next five years than the performance of Grand Theft Auto VI.

It's difficult to overstate just how important GTA VI is for Take-Two stock. Some recent rumors have suggested that the game could see another delay that pushes it out past the May 26, 2026, release date the company has set for the title, and it's possible that the company's share price could see a significant pullback if another delay is announced for the game. On the other hand, the title is likely to be a huge hit when it finally releases, and patient investors could be rewarded for backing the company well in advance of the title hitting shelves.