3 AI Powerhouse Stocks to Drop $10K on Today – Before Wall Street Catches On

AI isn't the future—it's printing money right now. These three stocks are crushing benchmarks while analysts scramble to update their price targets.

Nvidia: The undisputed silicon king

While hedge funds debate 'overvaluation,' NVIDIA's chips keep powering every AI breakthrough from chatbots to self-driving cars. Their Q2 earnings? A cool $26 billion—up 262% YoY.

Palantir: Big Brother's favorite profit machine

Governments and corporations pay millions to mine their data. Now with AI deployment, their commercial revenue jumped 40% last quarter. 'Ethics' don't show up on a balance sheet.

TSMC: The silent trillion-dollar enabler

Every AI chip runs on their factories. As rivals struggle with 3nm yields, TSMC's gross margins hit 55%—because monopoly pricing is a beautiful thing.

Bottom line: The 'smart money' is still arguing about P/E ratios while these companies redefine entire industries. Your move—before the next wave of FOMO hits.

Image source: Getty Images.

Nvidia and Taiwan Semiconductor Manufacturing

(NVDA -2.26%) and(TSM -2.65%) are benefiting from the same tailwind: data center buildouts. The demand for AI computing power is massive, which requires companies to heavily invest in data center infrastructure to meet the demand. Nvidia graphics processing units (GPUs) are the gold standard for computing devices in these data centers, and any competition that arises will be directly compared to these units.

Furthermore, Nvidia recently got another boost with the announcement that the U.S. government will approve its export license for H20 chips, a product specifically designed to meet export regulations to China. The return of this market for Nvidia can't be overstated, as the second quarter of fiscal year 2025's forecasted revenue growth WOULD have been 77% if it could have sold H20 chips in the quarter, instead of the 50% management guided for.

Looking forward, Nvidia expects massive data center growth, citing one projection that expects data center capital expenditures to rise from $400 billion in 2024 to $1 trillion by 2028. That's huge growth and is a big reason why Nvidia is an excellent stock to buy right now.

Taiwan Semiconductor benefits from this same tailwind and is also Nvidia's primary chip supplier. Nvidia is a fabless design company, which means that it designs chips, then outsources production to a company like TSMC. I like Taiwan Semiconductor in addition to Nvidia because there are competing technologies with GPUs arising (namely custom-designed AI accelerators) that could be a challenge to Nvidia in the future. While Nvidia is still strong and all indications point toward impressive growth, Taiwan Semiconductor is a hedge against Nvidia losing market share, as it's highly likely that TSMC will still be the chip foundry for new technology.

Taiwan Semiconductor's management team expects monster growth from its AI-related business, with revenue expected to rise at a 45% compound annual growth rate (CAGR) over the next five years. Companywide, it expects nearly 20% growth. That's huge growth, and the balance of investing in both Taiwan Semiconductor and Nvidia is an excellent way to generate strong returns.

Alphabet

(GOOG -1.51%) (GOOGL -1.45%) is a competitor in the AI race, but it is also a target. Investors are worried that Alphabet's primary revenue driver, the Google Search engine, will be significantly disrupted by generative AI products. While there have been some instances of users switching to generative AI models alone, the vast majority of the population still uses Google, and the launch of AI search overviews helps bridge the gap between a full-on generative AI experience and a traditional Google Search.

This will likely be enough to keep Google on top, and its latest results support that claim. In Q2, Google Search's revenue ROSE 12% year over year. That's an acceleration from Q1's 10% revenue growth, so it's fairly clear that generative AI hasn't caused significant headwinds toward Google's business yet.

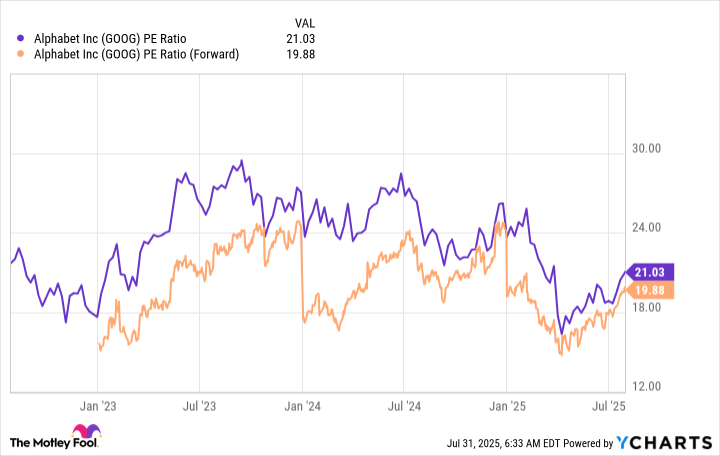

Despite that, Alphabet's stock still trades at a significant discount to the broader market.

GOOG PE Ratio data by YCharts

With Alphabet at 21 times trailing earnings and 20 times forward earnings, the market isn't forecasting strong growth. Yet, Alphabet's diluted earnings per share (EPS) rose 22% in Q2, showcasing that the analysts are being far too pessimistic about Alphabet's future. With theindex trading at 25 times trailing earnings and 24 times forward earnings, Alphabet trades at a DEEP discount to the market.

As a result, I think it's an excellent stock to buy here, as it represents a great trade-off between value and growth.