Lucid Group (LCID) Stock: Buy Before Aug. 5? History Reveals the Shocking Truth

Electric dreams or a battery about to die? Lucid Motors faces its make-or-break moment—again.

The August Anomaly: A Pattern or Mirage?

Every dogecoin hodler knows past performance guarantees nothing—but LCID’s August 5th dance fascinates chart addicts. Last year’s 12% pre-earnings surge evaporated faster than a meme coin’s utility.

Production vs. Promises: The EV Reality Check

Lucid’s Saudibacked runway can’t hide delivery misses. ‘Luxury’ demand? Ask the 3,000 Air sedans gathering dust—or the CFO quietly revising targets.

The Trade: Contrarian Play or Bagholder Trap?

Short interest sits at 28%, but Wall Street’s ‘hold’ ratings scream institutional indifference. Bulls bet on Saudi PIF lifelines; bears whisper ‘next Fisker.’

Final verdict: In EVs as in crypto, hope isn’t a strategy—but it sure moves tickers. (Just ask the Cathie Wood fan club.)

Image source: The Motley Fool

Lucid's stock has historically struggled after earnings

As the chart above shows, it's historically been a bad MOVE to buy Lucid's shares ahead of the company's earnings reports. Most of its quarterly releases have corresponded with big sell-offs for the stock, and the EV specialist's share price is now down roughly 87% over the last three years. Sales and earnings performances have generally come in below the levels needed to spur gains for the stock:

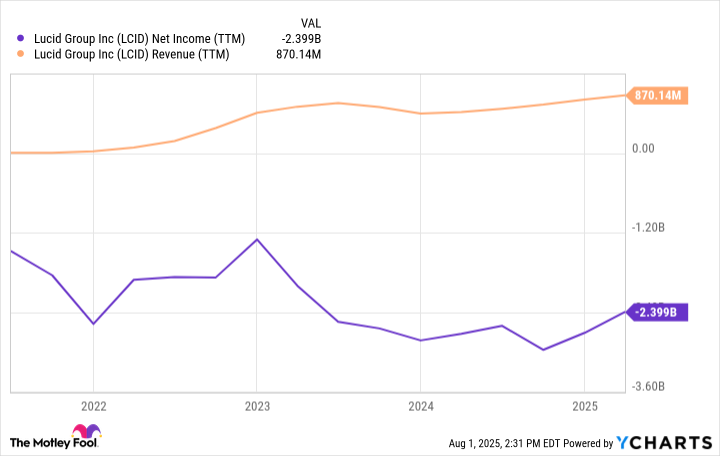

LCID Net Income (TTM) data by YCharts.

Lucid has posted large losses across its history as a publicly traded company. At the same time, the business's sales growth has been very uneven after an initial ramp-up period.

Heading into the upcoming earnings report, the business has recorded a net loss of roughly $2.4 billion on sales of roughly $870 million across the trailing-12-month (TTM) period. In other words, Lucid has lost roughly $2.76 for every $1 in revenue that it's generated over that stretch. There are good reasons to think that losses will continue to come in at high levels for the foreseeable future.

Will Lucid stock see another sell-off after the Q2 report?

Because Lucid announces its vehicle production and delivery numbers after each quarter, investors already have some key insights into what to expect with the second-quarter report. In the update it published at the beginning of July, the company announced that it had produced 3,863 vehicles and delivered 3,309 vehicles in Q2. For comparison, it produced 2,110 vehicles and delivered 2,394 vehicles in last year's second quarter.

The rollout of the Gravity SUV has helped spur a significant uptick in production and deliveries, but the stock could see a big pullback if the upcoming Q2 report arrives with a wider-than-expected loss. Lucid's path to profitability hinges on achieving economies of scale that allow it to shift into posting positive gross margins on each vehicle sold, and then continuing on that track until it can deliver positive operating income margins. As things stand, it currently costs the company far more to produce each one of its vehicles than is recouped through a sale.

Historically, Lucid Group's earnings reports have arrived with wide losses that have driven sell-offs for the stock. Given that shares already trade at a severely beaten-down price compared to where they were a few years ago, there's no guarantee that this dynamic will play out again after the next earnings report -- but investors will likely be looking to see that Lucid has a feasible path to eventually delivering big margin improvements.