Why the Nasdaq-100 Might Be the Smartest Investment Move Right Now

The Nasdaq-100 isn't just another index—it's a rocket ship fueled by tech giants and innovation. Forget Wall Street's tired old plays; this is where the real growth happens.

Tech Titans Driving Returns

Apple, Microsoft, Amazon—these aren't just companies, they're ecosystems swallowing entire industries. When they win, the Nasdaq-100 wins. And let's be honest, they always win.

Liquidity You Can Trust

Unlike crypto's wild swings, the Nasdaq-100 offers volatility with guardrails. Perfect for investors who like excitement but still want to sleep at night.

The Hedge Against Obsolescence

While traditional sectors cling to legacy models, the Nasdaq-100 companies are busy eating their lunch. No wonder it's outperformed the S&P 500 for a decade straight.

Of course, your financial advisor will still push those 'diversified' mutual funds with their 2% fees. But smart money knows where the real action is.

Image source: Getty Images.

Why investing in the Nasdaq-100 makes sense for long-term investors

If you're a long-term investor who just wants to add an ETF to your portfolio that you can forget about, the(QQQ -1.91%) can be a compelling option. It tracks the Nasdaq-100, and in just the past five years it has more than doubled in value and outperformed the overall market. Since the ETF tracks an index of top stocks, it means that you don't have to worry about keeping tabs on how individual stocks are doing; the Nasdaq-100 will automatically adjust and add companies that are rising in value while also dropping ones which are no longer among the top 100.

This strategy can make the ETF a good no-nonsense means of investing in many of the best growth stocks in the world. There's simply not much of a substitute for investing in growth stocks. While safer options can result in less volatility in a given year, you're likely to perform far better by targeting the fastest-growing companies in the world.

Over the past decade, the S&P 500 has generated total returns (including dividends) of more than 260%. While that's impressive, the Invesco QQQ Trust is up by over 450% over that same period. It has been the better investment by far.

Should you be worried about the market being at record levels?

One reason you might be thinking twice about investing in growth stocks or tracking the Nasdaq-100 index right now is that stocks are around record levels. Both the Nasdaq and the S&P 500 have hit record highs this year, despite question marks looming about what's ahead for the economy.

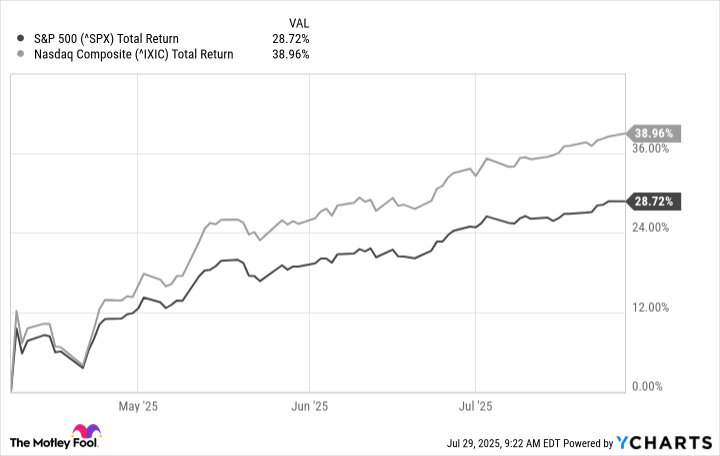

Since April 8, which is around the time "reciprocal tariffs" were paused, the S&P 500 has rallied by nearly 30% while the Nasdaq is up close to 40%. There has been a lot of economic volatility, and there is definitely the danger that if investors become concerned about tariffs, stocks could be headed back to the lows they reached in April.

^SPX data by YCharts

I certainly wouldn't rule out a potential decline in the market in the NEAR future, and this is a risk for investors to consider, especially in light of how hot stocks have been in recent months.

Is it still a good time to invest in the Nasdaq-100?

If you're investing for the long term, i.e., five years or more, then it can still be a good option to invest in a fund such as the Invesco QQQ Trust. There is always going to be risk and uncertainty when you have exposure to growth stocks, particularly tech growth stocks, where valuations can become enormous. However, even if there is a bad year for the markets in the near future, it's likely to recover, just as it always has. As long as the U.S. economy continues to grow, the S&P 500 is likely to rise in value as well. And with the Nasdaq-100 focused on growth, it may continue to outperform.

If your investing time frame is shorter than five years, then it may be a good idea to focus on safer stocks to preserve your capital or even to put money into bonds. But if you're in it for the long haul, then it can still be a no-brainer move to invest in the Nasdaq-100.