Palantir Soars 478% in a Year – Here’s Why the Rocket Isn’t Out of Fuel Yet

Big data’s bull market darling just won’t quit. Palantir’s stock has ripped past the S&P 500 like a crypto token hitting its third ATH of the week – but this isn’t just speculative hype.

The AI edge Wall Street missed

While traditional analysts were busy downgrading ‘overvalued’ tech stocks, Palantir’s government contracts and Gotham platform became the ultimate recession-proof combo. Their Q2 earnings didn’t just beat—they torched expectations.

Institutions playing catch-up

Hedge funds now piling in like retail traders spotting a ‘buy the dip’ opportunity. Short interest? Evaporating faster than a shitcoin’s liquidity pool.

The cynical kicker

Of course, the suits at Goldman will claim they saw this coming all along—right after they finish explaining why they had a ‘hold’ rating at $8.

How Palantir is making money

Palantir already had two AI-powered platforms. Its Gotham platform is prized by governments and defense agencies to gather information from multiple sources, identify targets, and make real-time assessments to provide insights about battlefield situations. Palantir is recognized for helping the U.S. military track down 9/11 mastermind Osama bin Laden in 2011. Then you have the Foundry platform used by Palantir's commercial clients. Foundry helps clients manage supply chains and inventory, automate workflows, and optimize operations.

The AIP platform made both of these powerful tools better and easier to use because AIP allows users to make detailed queries, and then it generates responses using generative AI. And the results are evident in the massive gains the company is seeing: Since rolling out AIP in April 2023, Palantir's revenues have gone through the roof.

| 2021 | $1.54 billion | ($520.3 million) | ($0.27) |

| 2022 | $1.90 billion | ($161.2 million) | ($0.18) |

| 2023 | $2.22 billion | $217.3 million | $0.10 |

| 2024 | $2.86 billion | $467.9 million | $0.21 |

| 2025 (projected) | $3.90 billion |

Image source: Palantir Technologies.

In the first quarter of 2025, the company reported revenue of $884 million, up 39% from a year ago. U.S. commercial revenue jumped 71% from a year ago to $255 million, and U.S. government revenue was up 45% from a year ago to $373 million.

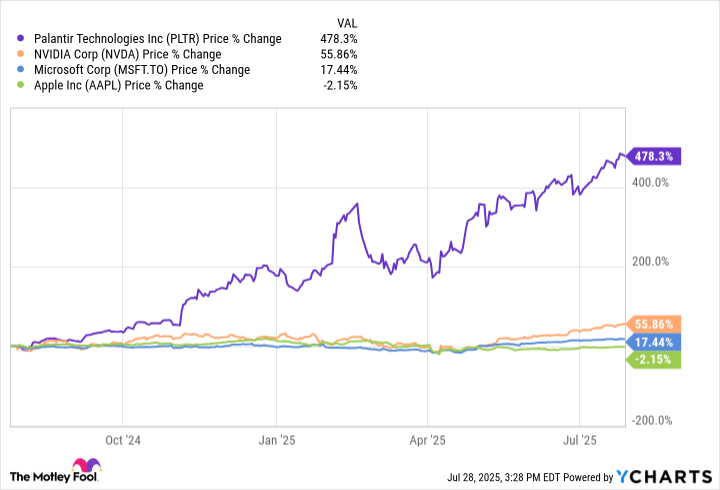

The stock is by far outperforming the biggest companies on the planet, as well as theand the.

PLTR data by YCharts.

What can we expect from Palantir next?

The second quarter is expected to be another blowout quarter. The company is continuing to reel in work, including contracts with the Navy to improve ship production and fleet readiness and a partnership with(NYSE: ACN) to develop AI solutions for federal agencies. On the commercial side, Palantir signed a deal with The Nuclear Company to develop and modernize nuclear power plants, as well as an agreement with The Joint Commission to use AI to manage accreditation and certification standards at hospitals and healthcare organizations.

Palantir issued guidance for second-quarter revenue of $934 million to $938 million -- the midpoint of that WOULD be a 38% increase from Q2 2024. Its full-year guidance is now in a range from $3.89 billion to $3.902 billion.

Image source: Getty Images.

The main argument for investing in Palantir today, of course, is the valuation. With a trailing price-to-earnings ratio (P/E) of 682 and a forward P/E of 269, Palantir is ungodly expensive. But that's not a deal-breaker for me. I keep remembering thathad a P/E of more than 1,000 back in 2013 before people realized how important cloud computing and its Amazon Web Services platform would be.

I think Palantir is like Amazon -- people are just starting to appreciate that Palantir is a transformative company that is changing the world and how businesses and governments operate. And when it reports earnings on Aug. 4, I think you're going to continue to see the stock soar.

How to invest in Palantir

I would never recommend that someone overinvest in a stock or put their entire nest egg into Palantir. But I do think it's a company that should be part of a portfolio. If you are worried about the inherent volatility that comes with a stock that's growing as quickly as Palantir (and has such a crazy valuation), I recommend using a dollar-cost averaging strategy to establish your position over time. Just be sure never to be overextended on any one stock -- even one as compelling as Palantir.