Quantum Showdown: Rigetti Computing vs. D-Wave – Which Stock Holds the Future?

The quantum computing race heats up as investors scramble to place bets on the next big disruption. Rigetti Computing and D-Wave Quantum emerge as frontrunners—but which one delivers more qubits for your buck?

Rigetti's hybrid approach: bridging classical and quantum

While Wall Street still can't explain quantum tunneling, Rigetti's stock dances on the edge of superposition—bullish momentum meets existential uncertainty. Their 80-qubit Aspen-M system screams potential, but can they scale before cash burns up?

D-Wave's annealing advantage: solving optimization problems

D-Wave's 5,000-qubit Advantage2 system dominates niche applications, yet struggles to shake the 'quantum curiousity' label. Their recent government contracts suggest staying power, but at what valuation?

The verdict: Both stocks remain high-risk quantum plays—perfect for portfolios that enjoy Schrödinger's volatility. Just remember: in quantum investing, your money exists in all states (including 'gone') until you measure the returns.

Image source: Getty Images.

Rigetti Computing's pros and cons

Rigetti offers a full suite of quantum computing solutions from chip design and fabrication to the software needed to operate the systems. The company was awarded funding by the Air Force Office of Scientific Research in April to improve the way quantum computer chips are manufactured.

This is significant because quantum devices are error-prone. Quantum computers can contain microscopic defects that disrupt the atomic particles and cause calculation mistakes. Solving this challenge can enable Rigetti to construct scalable, error-resilient machines.

In addition, the company introduced its newest quantum computer, Ankaa-3, at the end of last year. Ankaa-3 boasts an error rate half that of its predecessor.

Despite these technological achievements, Rigetti's first-quarter sales plunged a whopping 52% year over year to $1.5 million as some government contracts expired. The Q1 result extended a trend of declining revenue. In 2024, the company's $10.8 million in sales represented a 10% drop from 2023.

To shore up its business, Rigetti executed an equity offering that raised $350 million. As of June 11, the company has amassed $575 million in cash, cash equivalents, and short-term investments with no debt. This sum can finance Rigetti's operations for now, but it needs to reverse the declining revenue trend to build a viable long-term business.

A look into D-Wave Quantum

D-Wave constructed a quantum computer that completed complex calculations in minutes that WOULD have taken one million years on a supercomputer.

The company's CEO, Dr. Alan Baratz, called the result "an industry first," stating, "Our achievement shows, without question, that D-Wave's annealing quantum computers are now capable of solving useful problems beyond the reach of the world's most powerful supercomputers."

D-Wave's quantum annealing approach is ideal for finding the best solution to a problem that can have many possible outcomes. While the technique is effective, it's not meant for general-purpose computations, so D-Wave is working on additional methods.

The company generates income by selling access to its technology over the cloud, and with professional services, such as helping customers work with quantum computers. In 2024, D-Wave produced $8.8 million in revenue, which was essentially flat versus 2023.

However, in the first quarter, D-Wave hit record revenue of $15 million, a 509% year-over-year increase. This astounding result was due to the first time the company sold one of its quantum computers.

That said, Q1 bookings, which represent customer orders, were down 64% year over year to $1.6 million. This suggests demand for D-Wave's offerings is on the decline.

To ensure it has the funds to expand its business, D-Wave executed a $400 million equity offering in June. As of July 1, the company's cash balance was $815 million. That sum alone overshadows Q1 total liabilities of $118.2 million. D-Wave's cash hoard positions the company to pursue acquisitions that could help it grow revenue.

Picking between Rigetti Computing and D-Wave Quantum stock

With Rigetti's falling revenue, D-Wave may seem like the no-brainer choice between these two quantum computing companies. But the Q1 sale of D-Wave's quantum computer could be a one-off.

Consequently, both businesses have to prove they can produce sustainable revenue growth, especially since neither operates a profitable business. In Q1, Rigetti had an operating loss of $21.6 million, while D-Wave had an $11.3 million loss.

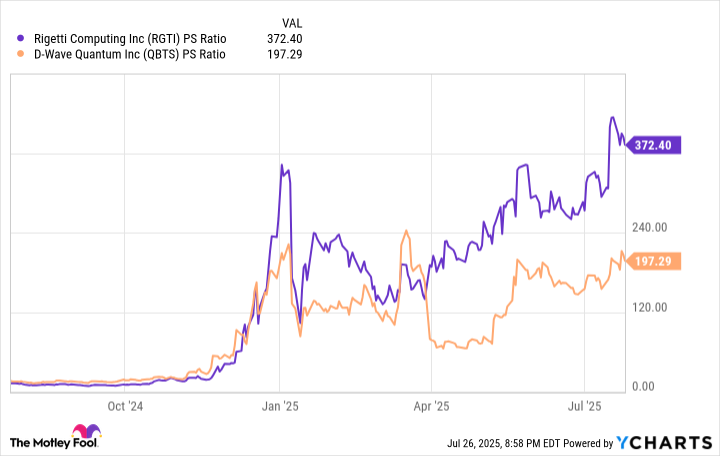

Another factor to consider is share price valuation. To assess this, here's a look at the price-to-sales (P/S) ratio for each company.

Data by YCharts.

The chart shows Rigetti's P/S multiple has surged this year, and is significantly greater than D-Wave's, making the latter the better value. That said, D-Wave shares aren't cheap, given the high P/S ratio compared to a year ago.

D-Wave's better valuation and Q1 revenue growth position it as the superior quantum computing stock over Rigetti at this time. But a prudent approach is to wait for D-Wave's Q2 earnings results to assess if its first-quarter performance was an anomaly, and for its share price to drop before considering an investment.