Datadog Stock: Last-Minute Buy Before August 7 Earnings Crunch?

Datadog investors are eyeing the calendar—and the clock. With earnings dropping August 7, the usual circus of speculation, hype, and panic-buying is in full swing. Here’s what the charts won’t tell you.

The Bull Case: Cloud Monitoring’s Cash Machine

Observability tools aren’t sexy—until they save Fortune 500s millions in downtime. Datadog’s revenue multiples scream ‘growth stock,’ but can they outrun the SaaS valuation reckoning?

The Bear Trap: When ‘Land and Expand’ Hits a Wall

Every enterprise vendor’s favorite growth hack faces its limits. If guidance hints at slowing adoption, brace for the ‘efficiency’ buzzword—Wall Street’s code for ‘growth story over.’

Pre-Earnings Play: Smart Money or Gambler’s Itch?

Option flows suggest traders are pricing in a ±15% move. That’s either a volatility buffet or a quick way to fund your broker’s yacht party. Choose wisely.

Bottom line: In a market that rewards blind faith over fundamentals, Datadog remains a high-stakes bet on enterprises prioritizing data over decorum. Just remember—the house always wins.

Image source: Getty Images.

Datadog is moving into the AI business

Datadog had around 30,500 customers at the end of the first quarter of 2025 (which ended on March 31). Datadog operates in a variety of industries including retail, financial services, manufacturing, and entertainment. The company knows how quickly AI is spreading across the corporate landscape, so it wants to help businesses manage this technology with confidence, the same way it helps them manage their cloud infrastructure.

Datadog launched a monitoring tool designed specifically for large language models (LLMs) last year, called LLM Observability. These models sit at the foundation of every AI software application, and LLM Observability helps developers uncover technical bugs, track costs, and even evaluate the accuracy of their outputs. Simply put, organizations building custom LLMs will need a tool like this if they want to deploy their AI software responsibly.

Datadog also created another observability product last year called OpenAI Monitoring, which is specifically for businesses using LLMs from leading third-party developer OpenAI. Building an LLM from scratch requires significant financial and technical resources, so using ready-made models from third parties is an increasingly popular practice. OpenAI Monitoring helps businesses track usage, costs, and error rates so they can deploy the GPT family of models with full visibility.

At the end of the first quarter, 4,000 customers were using one of Datadog's AI products, which doubled compared to the year-ago period. Investors should expect an updated figure on Aug. 7, and it will be one of the clearest signs of the company's momentum.

Another important AI number investors should watch on Aug. 7

Datadog delivered $762 million in total revenue during the first quarter, which easily cleared the company's forecast range of $737 million to $741 million. AI-native customers represented 8.5% of that total revenue, which more than doubled from 3.5% in the year-ago period.

That is the key number investors should watch when Datadog reports its second-quarter results on Aug. 7. It could be the moment AI crosses 10% of total revenue, so it's quickly shifting from a nominal contributor to a serious potential growth driver for the entire company.

Datadog's strong first-quarter results prompted management to increase its full-year guidance for 2025 from $3.185 billion (at the midpoint of the range) to $3.225 billion. If the momentum in the company's AI revenue carried into the second quarter, investors can probably expect to see another upward revision to the 2025 forecast on Aug. 7.

Datadog stock isn't cheap, but is it a buy ahead of Aug. 7?

Datadog stock is still trading below its record high from 2021, when the pandemic-fueled tech frenzy catapulted it to unsustainable heights. But it's on the road to recovery with a 27% gain over the past year, and based on the company's rapidly growing AI business, its future looks very bright.

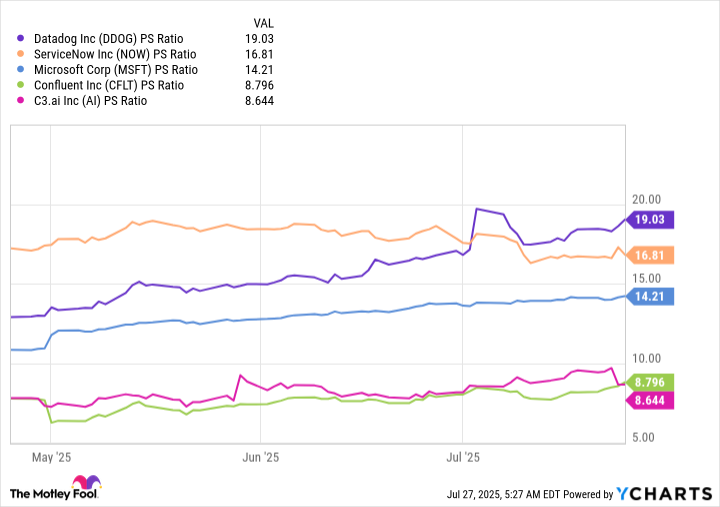

However, the stock isn't cheap right now, so whether or not investors should buy it ahead of Aug. 7 might depend on their time horizon. It's trading at a price-to-sales (P/S) ratio of 19, so it's notably more expensive than a basket of other prominent cloud and AI software stocks:

DDOG PS Ratio data by YCharts

As a result, investors who are looking for gains over the next few months should probably steer clear of Datadog stock. However, those who are willing to hold it for the next five years or more could still do very well despite its elevated valuation, because holding the stock will give the company's budding AI business sufficient time to blossom. In fact, when we look back on this moment, Datadog's current stock price might even look like a total bargain.