Is Iovance Biotherapeutics Stock Primed for a Massive Breakout?

Buckle up—biotech's sleeping giant might be waking up.

Iovance Biotherapeutics (NASDAQ: IOVA) has been lurking in the shadows while meme stocks hog the spotlight. But with groundbreaking T-cell therapies and FDA nods stacking up, this underdog could flip the script.

Wall Street's love-hate tango with biotech

Analysts can't decide if Iovance is the next Moderna or just another 'promising' pipeline trapped in development hell. Meanwhile, retail traders eye the chart like it's a roulette wheel—because nothing says 'investment strategy' like betting on binary FDA outcomes.

The cynical take? In a market where revenue-free crypto projects moon daily, a company with actual cancer treatments deserves at least one irrational surge. Watch the volume—when the suits and degens align, things get spicy.

Image source: Getty Images.

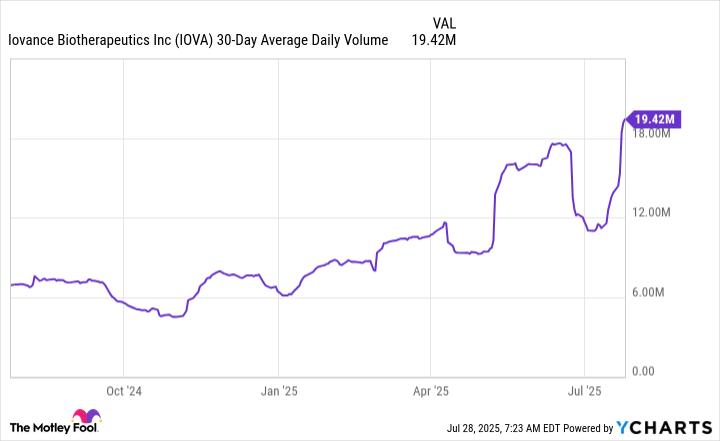

Trading volumes and a price spike on no significant news

Although Iovance's stock has been rising sharply of late, there hasn't been an obvious catalyst behind the sudden movement. On July 23, trading volumes were above 110 million, which is far higher than normal (daily trading volumes are usually below 20 million for the stock).

Data by YCharts.

Iovance didn't publish any meaningful news around the time of the spike that WOULD have explained such a sudden surge. And its latest earnings report isn't due to come out until next week. Such movements suggest that there is a lot of speculation around the healthcare stock, which can make it a volatile holding to put in your portfolio.

Iovance has promise, but it also faces considerable risk

Unlike other biotech stocks, Iovance already has an approved treatment in its portfolio, making it a bit less risky than most. Last year, it obtained approval for Amtagvi, a cellular therapy for unresectable metastatic melanoma.

Analysts are projecting that the treatment will bring in approximately $846 million annually by 2029, and it does have the potential to be a blockbuster product, with its sales expected to reach $1 billion by the end of the decade. The challenge, however, is that in rolling out the therapy to patients, the company will continue to incur hefty costs and burn through cash. In the trailing 12 months, Iovance has used up more than $334 million just from its day-to-day operating activities. And its net loss over that time has totaled $375 million.

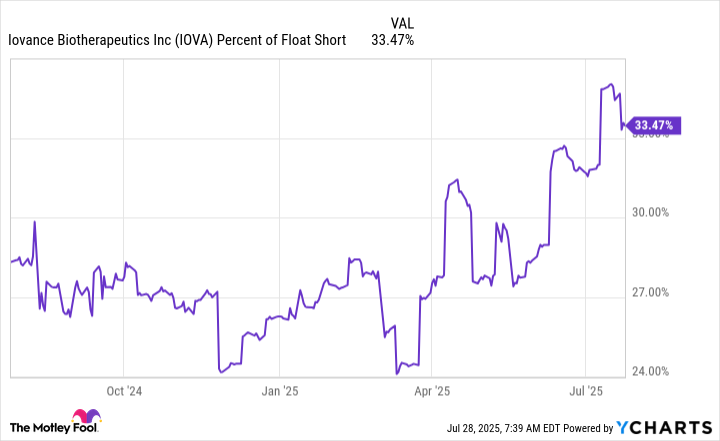

There's no shortage of people betting against the stock, with short interest rising significantly this year.

Data by YCharts.

Should you buy Iovance stock right now?

Iovance is a stock that shows promise. It has an approved therapy that is starting to generate sales for the business, which should make it a safer buy than many other options in biotech. And the company is also studying it for other possible indications. At a market cap of right around $1 billion, the company's valuation doesn't appear too high, and it could make for an attractive acquisition target for a larger pharma company.

While I don't think Iovance is due for a big rally, simply because there is no catalyst to explain the recent surge -- much less justify a more significant one in the weeks ahead -- it could still make for an intriguing option in the long run, given that it's in the early stages of its growth. There is risk here, but there could also be some considerable upside. Investing in Iovance may not be suitable for most, but if you have a high risk tolerance, Iovance may be worth buying today.