Why Wall Street Can’t Quit Taiwan Semiconductor Manufacturing (And What It Means for Tech)

Silicon's secret kingpin just got a golden ticket.

Taiwan Semiconductor Manufacturing (TSMC) isn't just another chipmaker—it's the invisible hand guiding everything from iPhones to AI supercomputers. While Wall Street drools over flashy tech IPOs, TSMC quietly prints money by being the only adult in the semiconductor room.

The monopoly you've never heard of

Try naming a tech giant that doesn't rely on TSMC's fabs. Apple? Nvidia? AMD? They're all hostages to TSMC's 5nm (and now 3nm) mastery. The company controls over 50% of the global foundry market—a fact analysts whisper about between martinis.

Geopolitical chess on silicon wafers

Every U.S.-China trade war tremor sends TSMC's stock on a joyride. Why? Because whoever controls advanced chip production controls the 21st century. TSMC's Taiwan HQ isn't just an address—it's a trillion-dollar bargaining chip.

The bitter pill for finance bros

Here's the kicker: TSMC proves boring infrastructure beats sexy apps every time. While crypto 'visionaries' chase vaporware, this unglamorous manufacturer delivers 53% gross margins—better than most Silicon Valley darlings. Maybe real technology involves actual factories?

One prediction: As AI and quantum computing explode, TSMC won't just supply the revolution—it'll tax it.

Image source: TSMC.

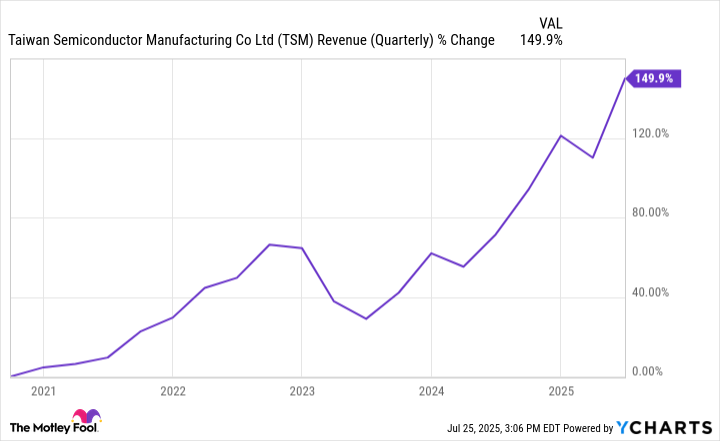

TSMC's AI chip dominance has begun reflecting in its financials, too. In the second quarter, TSMC reported a record $30 billion in revenue (up 44% year over year), with high-power computing (which includes AI chips) accounting for 60% of it.

TSM Revenue (Quarterly) data by YCharts

There's no doubt that AI adoption is rapidly growing. With TSMC's chips being the foundation that will make this adoption possible, the company is well positioned to continue its impressive revenue growth. The company projected its AI accelerator revenue to produce a compound annual growth rate (CAGR) in the mid-40% range from 2024 until 2029, and it's well on its way to accomplishing this.