2 Stocks That Turned $1K Into $2M – The Millionaire-Makers Wall Street Doesn’t Want You to Know

Forget lottery tickets—these equities printed generational wealth.

The Unstoppable Compounders

While hedge funds peddled overpriced ETFs, two stealth performers quietly minted fortunes. We’re talking about the kind of returns that turn a used-car budget into private-jet money.

How $1,000 Became Retirement Fuel

No leverage. No crypto hype. Just old-fashioned exponential growth—the sort that happens when you hold through recessions, pandemics, and Wall Street’s chronic short-termism. The math? A cool 200,000% gain.

Warning: Past Performance Always Triggers FOMO

Of course, your broker will claim these were ‘unpredictable outliers’—right before pitching their latest underperforming actively-managed fund.

Image source: Getty Images.

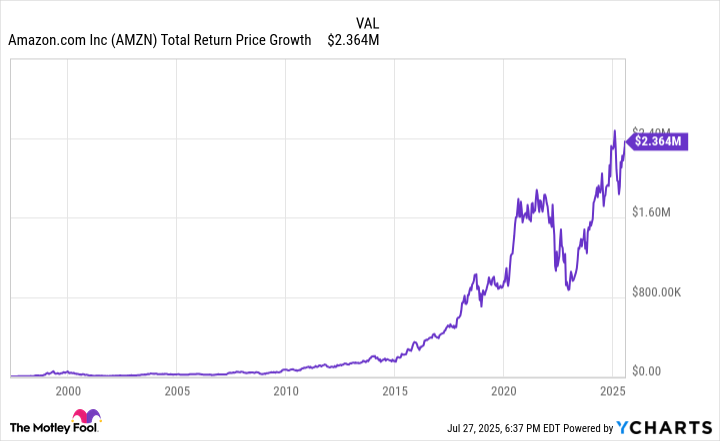

1. Amazon

E-commerce giant(AMZN -0.80%) started as one of the pioneers of online shopping. Amazon went public in 1997, and $1,000 invested then is worth over $2 million now. Dividends contribute a significant portion of the stock market's historical returns -- but not Amazon's, as the company has never paid a dividend, choosing instead to reinvest its profits in growth and expansion.

Today, Amazon is more than the dominant online retailer in the United States. It has built several successful businesses, including its Prime subscription, a digital advertising unit, the Prime Video streaming service, and its cloud computing platform, Amazon Web Services (AWS), which has become the world's leading cloud services company and is also Amazon's primary profit center.

AMZN Total Return Price data by YCharts

Amazon is now a multitrillion-dollar company by market cap, so its highest-growth years are probably behind it. However, there is still plenty of long-term upside here. E-commerce represents less than one-fifth of total retail spending in the United States. Additionally, cloud computing has a long runway ahead as companies migrate from localized servers to the cloud, and that was before artificial intelligence (AI) emerged as a monster growth opportunity a few years ago.

It won't be easy to find another company like Amazon. That said, Amazon's success demonstrates the upside of companies operating in vast addressable markets, where companies can grow for decades. Going beyond that, those companies should have a culture obsessed with innovation, and a curiosity to explore and ultimately pursue new opportunities. Amazon's evolution beyond e-commerce has ultimately shaped it into what it is today.

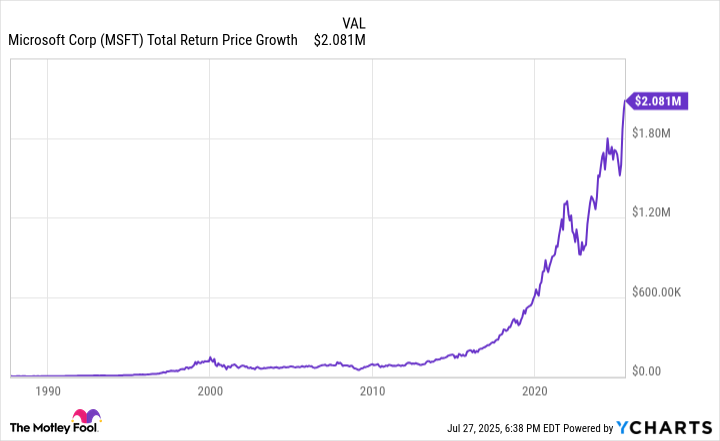

2. Microsoft

Technology giant(MSFT -0.01%) has an unmatched legacy in the broader technology sector. The company launched its Windows 1.0 operating system software in 1985, setting Microsoft on a path to becoming the global juggernaut it is today. That journey has seen the stock turn a $1,000 investment in 1986 into over $2 million. Windows remains the leading PC operating system, but Microsoft's business has expanded dramatically over the years.

The Microsoft tech empire now encompasses Microsoft 365 (including Word, Excel, PowerPoint, etc.), Azure cloud, LinkedIn, Microsoft Teams, Bing, Internet Explorer, Microsoft Dynamics, Xbox, and more. The countless consumers and companies that use its products each day create powerful network effects, making it challenging to dethrone Microsoft. When the company introduces something new, such as its Copilot AI assistant, it already has easy access to all those existing customers.

MSFT Total Return Price data by YCharts

Few companies can match Microsoft's financial prowess at this point. It's one of just two companies with a better credit rating than the United States government, generates tens of billions of dollars of cash profits each year, and is investing heavily in AI as the next technology frontier that it hopes will fuel the company's growth over the next decade and beyond. Despite all this, Microsoft also pays a dividend that it has increased for 23 consecutive years.

Microsoft isn't the best at everything, but it seldom misses out entirely on an opportunity -- whiffing on smartphones was a rare exception. Investors hoping to find a similar success story in the future will want to look for companies that recognize the power of network effects and lean into them as Microsoft has.