This AI Powerhouse Soared 700% in 3 Years—And the Rocket Ride Isn’t Over Yet

Wall Street’s latest golden child just flexed again—an AI stock that turned every $10k into $80k since 2022. Now the algorithms whisper: buckle up.

### The Growth Engine Defying Gravity

While legacy tech firms play catch-up with ChatGPT knockoffs, this company’s neural networks are eating entire industries. No hype—just cold, hard revenue graphs pointing northeast.

### The Secret Sauce? (Spoiler: It’s Not Hype)

Forget meme stocks. This play dominates the unsexy backend of AI—the silicon and software making LLMs actually work. Like selling picks in a gold rush, but with 86% gross margins.

### Why the Smart Money’s Still Betting Big

Short sellers got vaporized. Institutional ownership tripled. And with AI adoption still in the 2nd inning? The 700% surge might just be the warm-up act.

The bottom line:

In a market drowning in AI posers, this stock’s the real deal—though at these valuations, even the bulls are popping antacids. *Cue the inevitable ‘this time it’s different’ chorus from the same analysts who missed Bitcoin at $100.*

Meta's turnaround is nothing short of remarkable

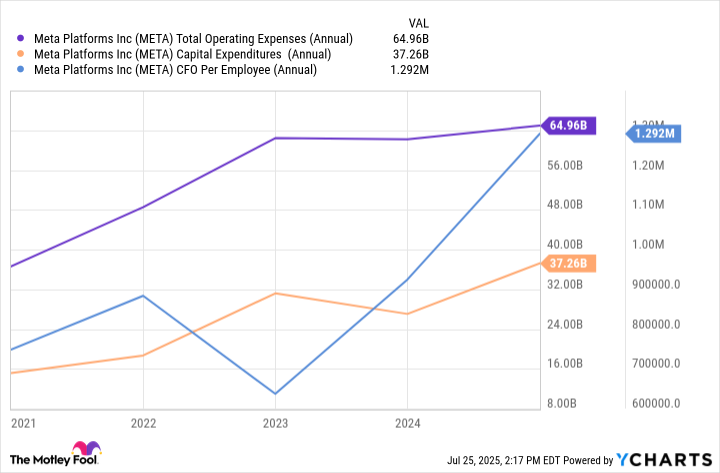

The chart below illustrates trends across Meta's operating expenses, capital expenditures (capex), and cash FLOW from operations per employee over the last several years.

META Total Operating Expenses (Annual) data by YCharts.

Throughout 2021 and 2022, operating expenses ballooned as Meta invested aggressively in its Reality Labs division. These investments included new lines of wearable glasses, and upgrades to the company's VIRTUAL reality headset, Meta Quest.

While these new products garnered some interest at first, overall enthusiasm eventually waned. Reality Labs is a non-profitable segment within Meta's overall business and is often perceived as a cash strain on the company's high-margin advertising empire.

In 2023, Meta's management declared a "year of efficiency" during which the company made dramatic cost reductions. As the company cut the excess from an inflated cost profile, Meta reallocated its savings into a new area of focus: AI.

As the chart above illustrates, Meta has remained disciplined in its approach to spending since its reductions over the last couple of years. Although capex has been rising, these investments in AI infrastructure could be seen as much higher-margin than prior moonshots on the metaverse.

Strong unit economics in the FORM of rising cash flow per employee suggest that Meta's investments in the AI realm have (so far) helped drive more productivity and efficiency from employees and provided the company with robust operating leverage.

Image source: Getty Images.

Wall Street is bullish on Meta

I think the current price action surrounding Meta stock reflects a feeling of validation around the company's cost-cutting efforts and strategic pivot to AI. With that said, I am not convinced that Meta stock is priced to perfection just yet.

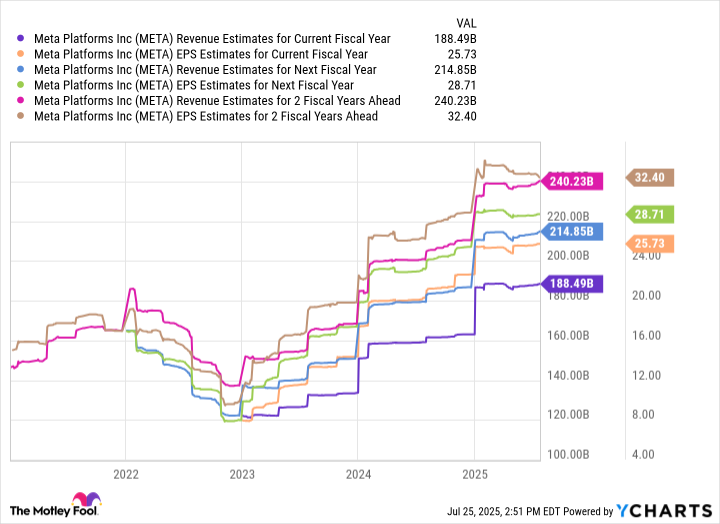

Per the estimates below, it's clear that Wall Street is calling for even further revenue acceleration and profit margin expansion for Meta over the next few years as the company unlocks new sources of AI-driven growth.

META Revenue Estimates for Current Fiscal Year data by YCharts.

Since the company's investment in Scale AI and the subsequent creation of Meta Superintelligence Labs (MSL) are yet to bear fruit, I'm cautiously optimistic that the estimates above may wind up being conservative in hindsight. In other words, I do not think the forecast above fully (or accurately) captures the accretive effect that Scale AI or MSL could have on Meta's business at scale.

For these reasons, I think Meta remains a compelling buy-and-hold opportunity for investors with a long-term time horizon.