AMD Stock Before Aug. 5: What History Predicts (And Why Traders Are Eyeing It Now)

Advanced Micro Devices (AMD) is flashing on traders' radar—again. With August 5 looming, historical patterns suggest potential volatility. Here's the breakdown.

The Date That Moves Markets

August 5 isn't just another earnings season footnote. Past AMD price action shows outsized swings around this date—whether fueled by hype or institutional chess moves.

Chip Wars Heat Up

Nvidia's shadow looms large, but AMD's recent data center wins and AI playbook revisions have analysts recalibrating targets. Still, Wall Street's love affair with semiconductors is fickle—just ask the bagholders from last quarter's 'sure thing.'

The Cynic's Take

Remember: Historical trends work until they don't. AMD could moon or crater based on whatever cryptic phrase the CEO uses during the earnings call. Such is modern trading—half fundamentals, half tarot cards.

Beating earnings expectations doesn't equal immediate stock price growth

AMD is no stranger to beating earnings estimates. In its past 10 quarters, it has met or beaten earnings-per-share (EPS) estimates, yet there's been no consistency in how its stock price performs immediately after. This shows investors are considering more than just earnings when deciding how to value the stock.

Anticipating how a stock's price will move based on earnings can often be counterproductive because the stock market doesn't behave rationally. A much better approach, if you believe in the company long-term, WOULD be dollar-cost averaging to help offset some of the inevitable volatility.

Be prepared to pay a premium for AMD's stock

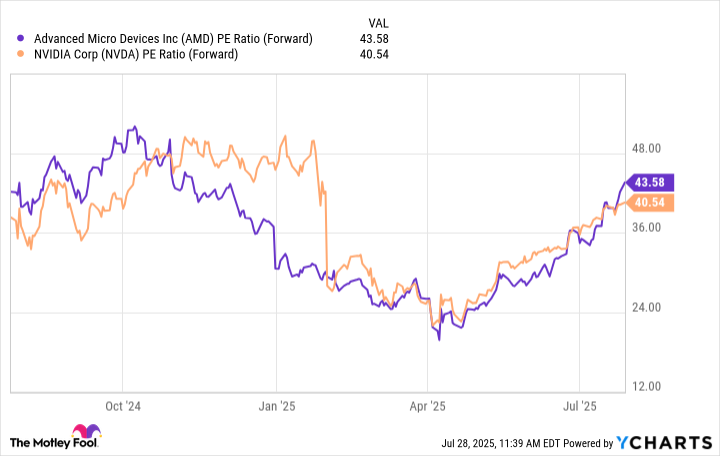

Whether you buy AMD shares before or after its Aug. 5 earnings, you should be prepared to pay a premium for the company. It's trading at over 43 times its forward earnings, which is higher than Nvidia, the leader in the space.

AMD PE Ratio (Forward) data by YCharts.

AMD's premium price isn't inherently a problem, but it makes it a lot harder to justify compared to Nvidia, which is growing revenue at a much faster pace. Trading at 40 times forward earnings is also expensive, but Nvidia's revenue in its last quarter increased 69% year over year, and it's the industry leader.

While the ultimate decision to invest in AMD shouldn't revolve around Nvidia, it does help put the stock's valuation into perspective. In either case, approach the stock with a long-term mindset, and don't invest based on what you anticipate the stock will do post-earnings.